C-FPV

This company is in the pipeline of America 2030, IPO CLUB’s $50M, actively managed secondary fund focused on U.S. defense, energy, security, and AI.

Updated in January 2026

Headquarter: Aabenraa, Denmark

Year Founded: 2024

Leadership: Major Jørgen Leif Svane

Industry Sectors: Defense technology; battlefield solutions; counter-UAS (counter-drone) systems

Funding Round: Pre-Seed

Valuation: n/a

Is C-FPV A Public Company? No, it is privately held

What is C-FPV?

C‑FPV is a U.S.-based defense technology company focused on developing and supplying first-person view (FPV) unmanned aerial systems for military and national security applications. Founded in 2023, C-FPV was created in response to modern battlefield requirements for low-cost, rapidly deployable, and mission-flexible aerial systems, particularly in contested and electronic-warfare-heavy environments. The company positions itself as a defense-focused supplier purpose-built to meet emerging operational needs rather than adapting consumer drone platforms.

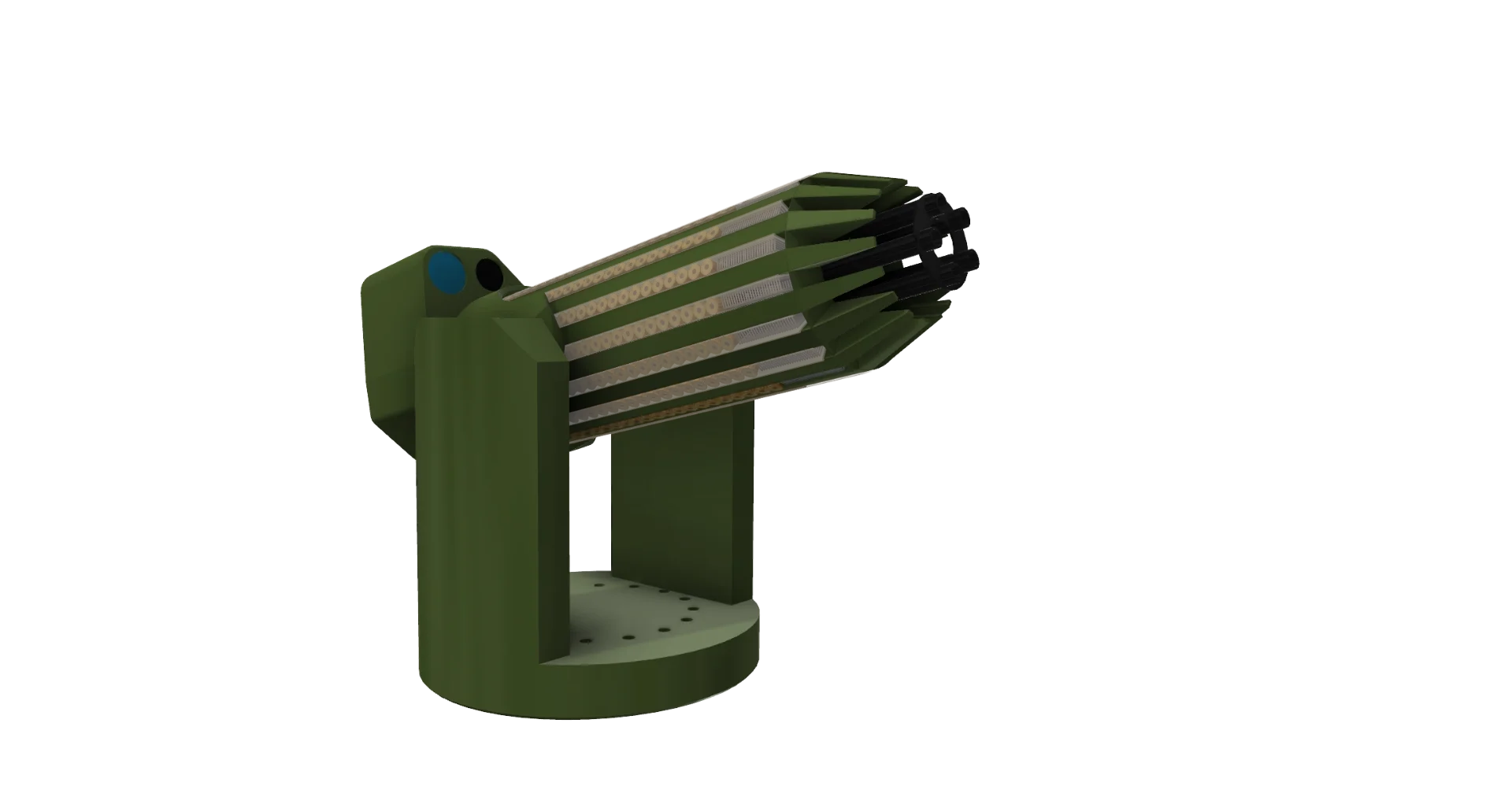

Technology & Products

C-FPV develops military-grade FPV drone systems optimized for speed, maneuverability, and resilience under combat conditions. Its platforms emphasize modular architectures, swappable payloads, and hardened communications links, enabling use across reconnaissance, training, and kinetic mission profiles depending on configuration. The company focuses on rapid iteration, manufacturability, and operator-centric design, aiming to deliver systems that are simple to deploy, easy to maintain, and effective in high-threat environments where traditional UAVs may be cost-prohibitive or vulnerable.

Market Opportunity

C-FPV operates within the fast-growing market for attritable unmanned aerial systems, driven by lessons from recent conflicts that have highlighted the effectiveness of FPV drones for tactical missions at scale. Defense organizations increasingly seek affordable, mass-producible drones that can be deployed in large numbers without the financial and logistical burden of traditional UAV platforms. This shift toward quantity, speed, and adaptability creates strong demand for specialized FPV suppliers aligned with military procurement and operational requirements.

Competitive Landscape

C-FPV competes in the defense drone and FPV UAS segment, alongside both emerging defense startups and non-traditional suppliers adapting commercial FPV technology for military use. Its differentiation lies in a defense-first design philosophy, focus on operational resilience, and alignment with U.S. and allied military standards rather than consumer or hobbyist markets. By emphasizing rapid manufacturing, modularity, and battlefield relevance, C-FPV positions itself as a specialized provider in a segment that is becoming strategically important to modern defense forces.

How To Buy C-FPV Stock?

C-FPV is currently a private company and is not publicly traded on major stock exchanges like the NASDAQ or NYSE. This means you can buy shares through a pre-IPO platform or brokerage like IPO CLUB.

This company is in the pipeline of America 2030, IPO CLUB’s $50M, actively managed secondary fund focused on U.S. defense, energy, security, and AI.

C-FPV and America 2030 Latest News

Stay up-to-date with all the latest news pertaining to this company’s stock, IPO, and investment opportunity. By clicking here, you'll gain access to real-time updates and in-depth analysis from market experts, empowering you to make informed decisions about your investment journey. Whether you're a seasoned investor or just getting started, our platform is tailored to provide you with all the crucial information you need to navigate the thrilling world of the stock market and IPOs. Dive in and keep your finger on the pulse of the financial markets.

You can imagine America 2030 as a polished metal capsule sitting in the palm of your hand.

A compact, precision-engineered instrument.

Every piece designed to do exactly one thing: turn the next decade of American hard-tech into real, liquid returns.