Latest Trends on Pre IPO Companies

Follow the news on the most interesting Pre-IPO companies

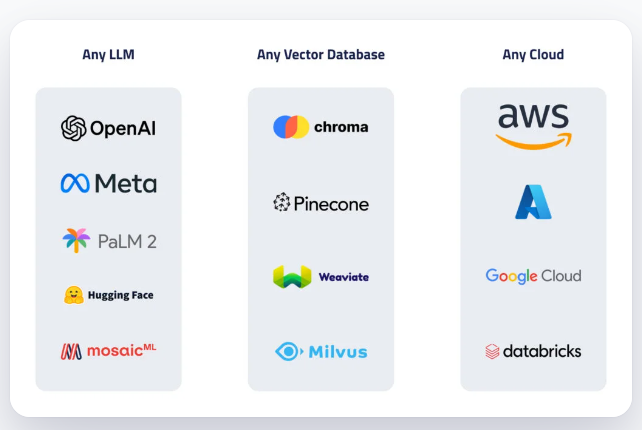

Anthropic, OpenAI, and Datarobot

In the wake of Google's $2B investment in Anthropic and Microsoft's significant stake in OpenAI, our focus shifts to DataRobot's unique position in the AI sector. With a diversified focus on AI, DataRobot is a compelling potential target for M&A. As AI industry consolidation accelerates, understanding these key players is crucial. Subscribe to our club letter for exclusive DataRobot IPO insights.

Former Expedia CFO joins Plaid

Plaid, the fintech firm, appoints former Expedia CFO Eric Hart as its first CFO. Speculation on IPO plans while diversifying revenue streams and emphasizing security in payments.

OpenAI Seeks $86 billion valuation

OpenAI's valuation soars to $86 billion, driven by AI advancements. Employee stock sale in discussion. ChatGPT's rapid growth fuels OpenAI's success in the chatbot industry.

Newcleo signs MOU with Nuclear AMRC

The NewCleo-Nuclear AMRC partnership aims to drive nuclear innovation, enhancing supply chain readiness, modularization, and manufacturability. It supports NewCleo's plan-to-market strategy for advanced modular reactors, contributing to decarbonizing electricity generation. With collaborations and acquisitions, NewCleo strengthens its position in the nuclear industry, poised for global impact.

Flexport cuts staff to gain profitability

Flexport, the digital freight forwarder, announces a 20% staff reduction, aiming to regain profitability amid industry challenges. Learn more about this strategic move and its impact on Flexport stock price.

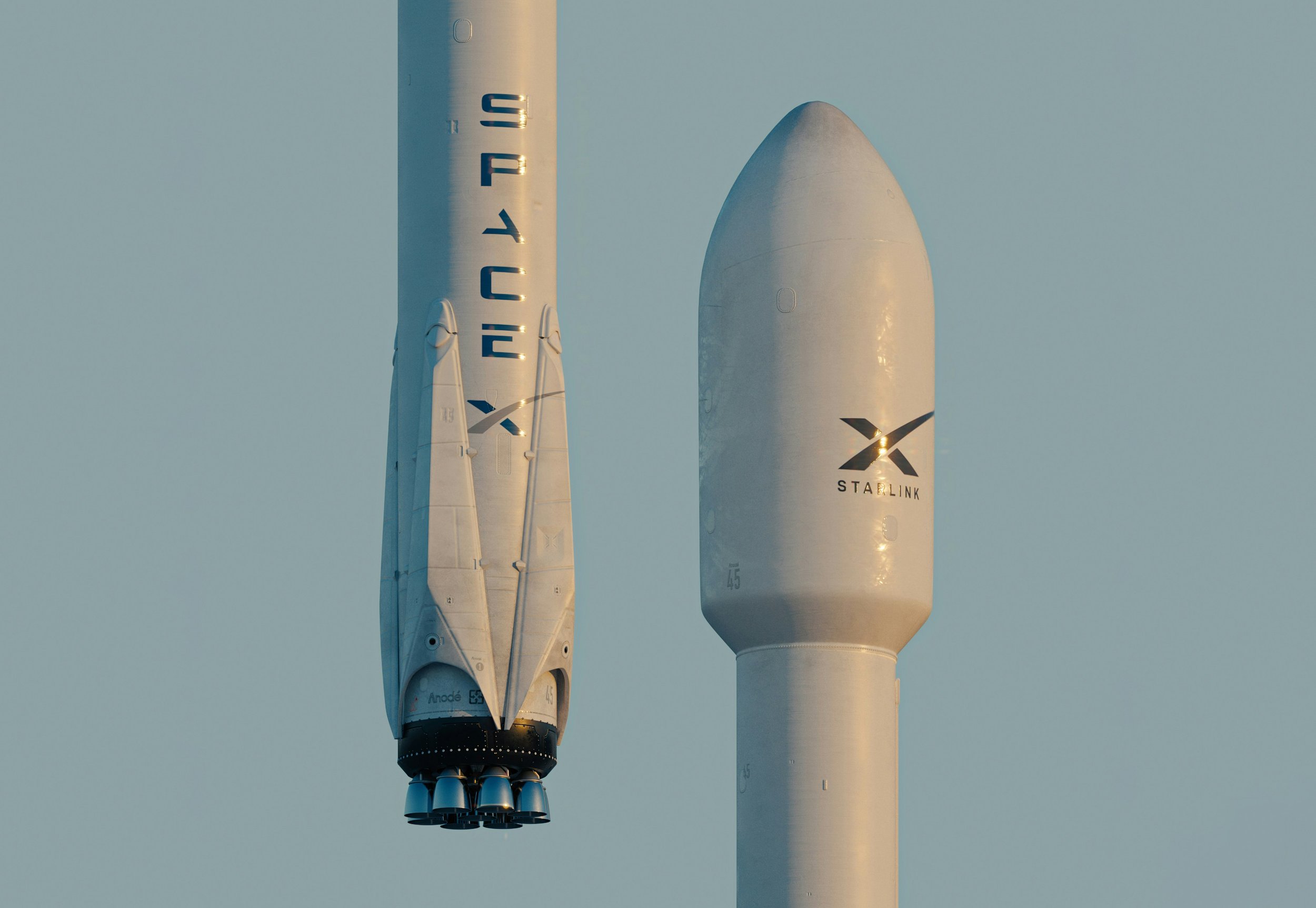

Maersk adds SpaceX Starlink systems on 330 ships

Danish logistics leader Maersk partners with SpaceX's Starlink for high-speed internet on 330+ container ships. Boosting connectivity at sea and digitalizing vessel operations.

Epic Games' Strategic Restructuring: A short Analysis

Epic Games' stock price stabilization hints at strategic restructuring and potential IPO considerations. The company's moves to enhance financial health and CEO Tim Sweeney's transparent statements could pave the way for a public listing. Dive deeper into our analysis and learn about the implications of Epic's recent actions. Note: Always consult with a financial advisor before making investment decisions.

#EpicGames #IPOAnalysis #StockTrends

Natilus Blended-Wing-Body Aircraft for defense

Natilus is transforming the aviation and defense sectors with its next-gen blended-wing-body (BWB) aircraft, promising heightened aerodynamic efficiency and payload capacity. Tailored for the commercial freight sector, this innovation promises to overhaul outdated transport methods, positioning air freight as a prime commodity. Leveraging its prowess, Natilus targets defense contracts, notably the USAF's $40B Next Generation Air-refueling System. Plus, with a 40% cut in CO2 emissions, the BWB design redefines sustainability in aviation.

Q3 Selected stock prices according to “Valuation at Market©”

The rules for “Valuation at Market©” are based on the PRE IPO CLUB LLC proprietary methodology: price inputs are derived from the 10 most active secondary brokers during the quarter, as well as publicly available information, such as federal filings (e.g., Form D), state filings (e.g., amendments to Certificates of Incorporation, Limited Offering Exemption Notices, Employee Plan Exemption Notices), and company disclosures (e.g., press releases, other public statements). The calculation model is based on actual or derived prices of preferred stock and common stock, which are validated by the fund manager. Corporate actions, such as bankruptcies, stock splits, reorganizations, mergers and acquisitions, and spinoffs, are monitored on a daily basis. Index values are calculated for each calendar month but distributed on a quarterly basis, before the last day of each January, April, July, and October.

Taleb on Instacart's IPO pricing

Considering Taleb's insights, it's evident why understanding risk and reward in venture capital is pivotal. A venture capitalist might anticipate that many investments will fail, but they're worthwhile if just one becomes a Black Swan success. By appreciating the asymmetric nature of investments, investors can navigate venture capital more effectively. It's essential to internalize Taleb's principles to maintain a strategic perspective.