Latest Trends on Pre IPO Companies

Follow the news on the most interesting Pre-IPO companies

18 Uprounds, 1 Listing, over $7 billion of fresh capital: Why AMERICA 2030’s Strategy Is Delivering Results

In just over a quarter into 2025, AMERICA 2030 has witnessed a remarkable confirmation of its investment thesis: 18 companies in our deal pipeline have already raised follow-on rounds at higher valuations, and Kodiak Robotics just announced a public listing via SPAC. This rapid validation highlights that we are picking the right companies at the right time—positioned at the intersection of defense, energy, security, and AI—at attractive secondary prices before broader capital catches up.

Boxabl 2024 Form 10-K Summary: A Crossroads Between Innovation and Execution

In 2024, Boxabl invested over $40 million to generate $3.4 million in revenue, selling 51 Casitas and making operational and regulatory advancements across several states. Key operational milestones include the certification of 83 installers, regulatory approvals in New Mexico, Nevada, and California, and continued R&D to expand the product line both up-market and down-market.

Groq’s $2.8B Valuation

Groq raises $640M in Series D funding and secures a $1.5B Saudi commitment to build global AI infrastructure, challenging Nvidia with energy-efficient AI chips.

7 opportunities for investors interested in dual-use defense.

Instead of picking individual bets across defense, AI, energy, and cybersecurity, investors can gain diversified exposure through a single, actively managed fund—like America 2030.

By investing in a portfolio built across these critical sectors, with disciplined entry points and real-time market responsiveness, investors can access the upside of national interest technologies while mitigating the risk of sector concentration or timing missteps.

Crusoe Energy’s big AI Pivot

Crusoe Energy is making a bold pivot to AI infrastructure, developing a 4 million sq. ft. hyperscale data center campus in Texas and securing collaborations with OpenAI, Oracle, and Google. As AI overtakes energy as its primary revenue stream, Crusoe is emerging as a critical enabler of sustainable, high-performance compute.

Castelion: Hypersonic Defense Disruptor Gaining Speed in the Secondary VC Market

Castelion, a hypersonic weapons startup founded by ex-SpaceX engineers, raised $100M in January 2025 to mass-produce affordable long-range strike systems. Backed by Lightspeed, a16z, and others, the company is poised to reshape defense tech with rapid testing and scalable manufacturing.

Google’s $32B Wiz Acquisition Sparks Momentum in AI-Driven Cybersecurity

Google’s $32B acquisition of Wiz signals strong investor confidence in AI-driven cybersecurity, boosting valuations and M&A activity. This creates a positive climate for secondary market investors, especially in high-growth cybersecurity startups. America 2030’s pipeline includes top firms like Orca Security, Cybereason, and Dragos—positioned for potential exits. Explore pre-IPO opportunities now.

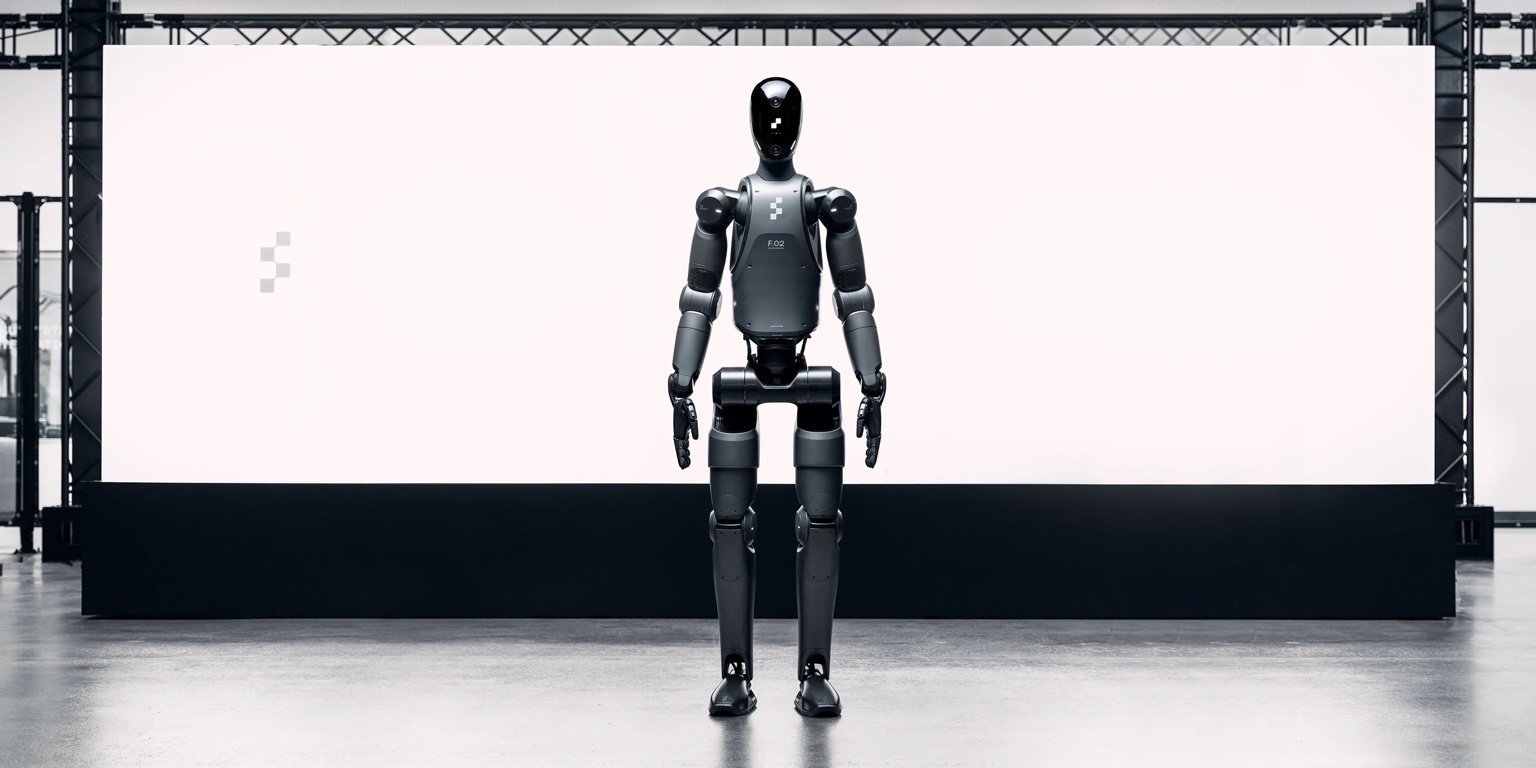

Figure AI’s $39.5 Billion Valuation: A Game-Changer in Humanoid Robotics?

Figure AI is reportedly raising $1.5 billion at a staggering $39.5 billion valuation—15x its February 2024 value. With commercial deals secured and production scaling, it now ranks among the world’s top robotics companies. Is this the future of AI-driven automation?

The AI Arms Race: How China tries to Overtake the U.S. by 2030

China is racing to surpass the U.S. in AI dominance by 2030, leveraging state subsidies, aggressive data collection, and alleged IP theft. With companies like DeepSeek and Huawei leading the charge, how can America maintain its edge?

The U.S.-China AI Race: An Ecosystem Problem, Not Just a Technology Gap

We discuss two key sectors of the America 2030 fund that are connected with China.

China’s rapid industrialization is not just about manufacturing dominance—it’s about building an entire ecosystem that supports AI, from infrastructure to energy. With six times the U.S.‘s electrical grid expansion in 2023 alone, China is laying the foundation to dominate AI. This isn’t just a technology race; it’s a systemic shift.