America 2030

A 5-year, short-term fund investing in late-stage U.S. defense, energy resilience, and artificial intelligence.

Available to accredited investors only.

KEY FACTS

Minimum investment: $50,000

Management fee: 1.5% per year (charged upfront)

Performance fee: 15% carried interest, European-style after an 8% compounded hurdle

Target duration: 5 years (to 2030)

Accepting investments via self-directed IRAs.

Review the Investment Memo

Why America 2030

America 2030 is designed to provide exposure to late-stage private companies operating in sectors critical to U.S. resilience and long-term competitiveness.

The fund emphasizes secondary transactions, seeking access to companies with established traction while reducing early-stage and blind-pool risk.

Focused Mandate

U.S.-centric investments across defense, energy resilience, and AI infrastructure.

Short Maturity

A five-year target duration to align underwriting discipline and exit expectations.

Secondary Liquidity

Later-stage entry through secondary opportunities, with selective follow-on participation.

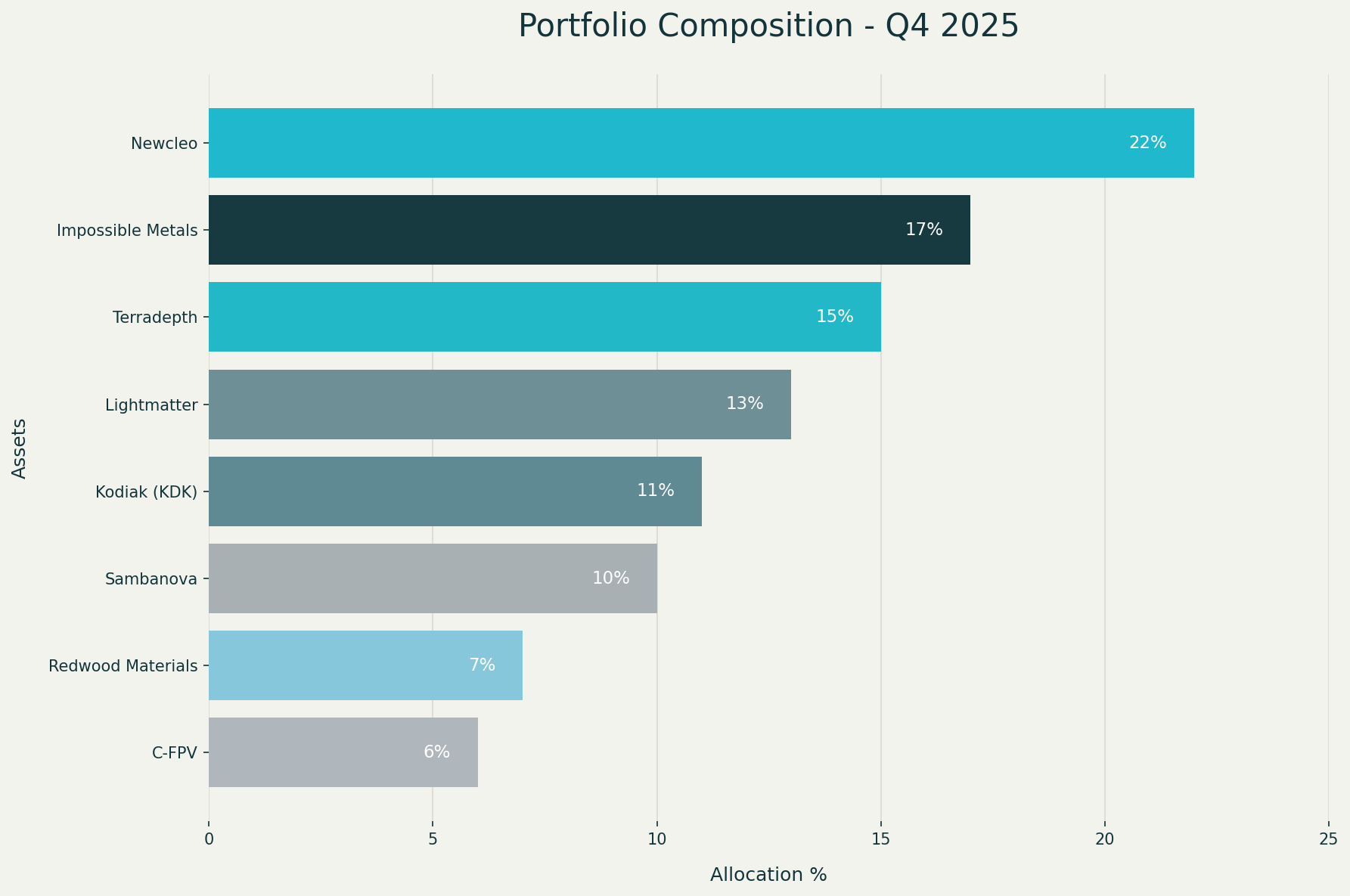

Selected Portfolio Examples

How it Works

1. Book a Call

Schedule a short introductory call to confirm eligibility, walk through the fund structure, and determine whether America 2030 is an appropriate fit for your portfolio.

2. Review the Investment Memo

Receive access to the investment memo and supporting materials detailing strategy, fees, risks, and fund mechanics.

3. Subscribe Online

Complete accredited investor verification and review subscription documents if you decide to proceed.

4. Capital Deployed until December 2027

Capital is deployed throughout the life of the fund as secondary and follow-on opportunities are identified.

5. Capital Returned at Exits on or before December 2030

Short-term pre-IPO Fund, distributes exists.

What Happens After You Become a Member

After becoming a Member, you’ll: