Energy Hub

We provide accredited investors with curated access to the Energy tech ecosystem via two core formats:

Portfolio Companies

Single-Name SPVs (Selective Access)

For investors who want direct exposure to companies like NewCleo, or Redwood Materials, we occasionally offer deal-by-deal allocations through SPVs. These are invitation-only and capacity-limited.

See what’s available: NewCleo, Redwood Materials, Impossible Metals, Aalo

America 2030

America 2030 Fund (Flagship Fund)

A short-maturity fund capturing late-stage U.S. companies across AI, defense, and critical infrastructure. Designed for investors seeking exposure to national security trends without picking individual names.

See what’s available: Aalo, Base Power, Bedrock Energy, Commonwealth Fusion, Energy Dome, Form Energy, Heron Power, Impossible Metals, Last Energy, Lilac Solutions, NewCleo, Radiant Nuclear, Redwood Materials, TAE Technologies, Terrapower, X-Energy

Maksim Sonin

Energy Expert

SMR Sector Outlook 2025: Key Drivers of Growth

The global small modular reactor (SMR) market is entering a phase of unprecedented growth, projected to double from US $6.9 billion in 2025 to US $13.8 billion by 2032. This acceleration is being driven by AI infrastructure’s surging energy demand, energy security imperatives, and decarbonization goals — with tech giants like Amazon, Google, Microsoft, and Meta committing multi-gigawatt nuclear capacity agreements through the 2030s.

Capital inflows into SMR developers have reached record levels in 2024–2025, with private funding rounds of US $700 million (X-Energy), US $225 million (Radiant), and €135 million (Newcleo), alongside large public-private partnerships. The sector is now positioned to become a primary clean-power backbone for data centers, defense, and industrial operations.

Emerging private market opportunities — Dominated by Last Energy, Radiant Industries, and Newcleo, with additional momentum from X-Energy, Kairos Power, TerraPower, and Oklo. Commercial pipelines include Last Energy’s 80+ reactor unit agreements worth over US $32 billion, Radiant’s DOE-backed microreactor program, and Newcleo’s €1 billion European build-out.

The evolving geopolitical landscape — U.S. DOE’s Advanced Reactor Demonstration Program, France’s Bpifrance SMR funding strategy, and the UK’s first commercial nuclear site licensing since 1978.

Flagship infrastructure projects — Amazon’s 1.9 GW nuclear PPA with Talen Energy, Google’s Kairos SMR program targeting 500 MW by 2030, Microsoft’s Three Mile Island restart, and Meta’s 1.1 GW Constellation Energy agreement.

👉 Download the 2025 SMR Market Brief

Includes top companies, sector outlook, and IPO Club’s allocation calendar, all in a 3-minute executive summary.

NewCleo

SMR developer pioneering lead-cooled fast reactors that recycle nuclear waste

Redwood Materials

Battery recycling and materials company building a closed-loop supply chain for lithium-ion batteries

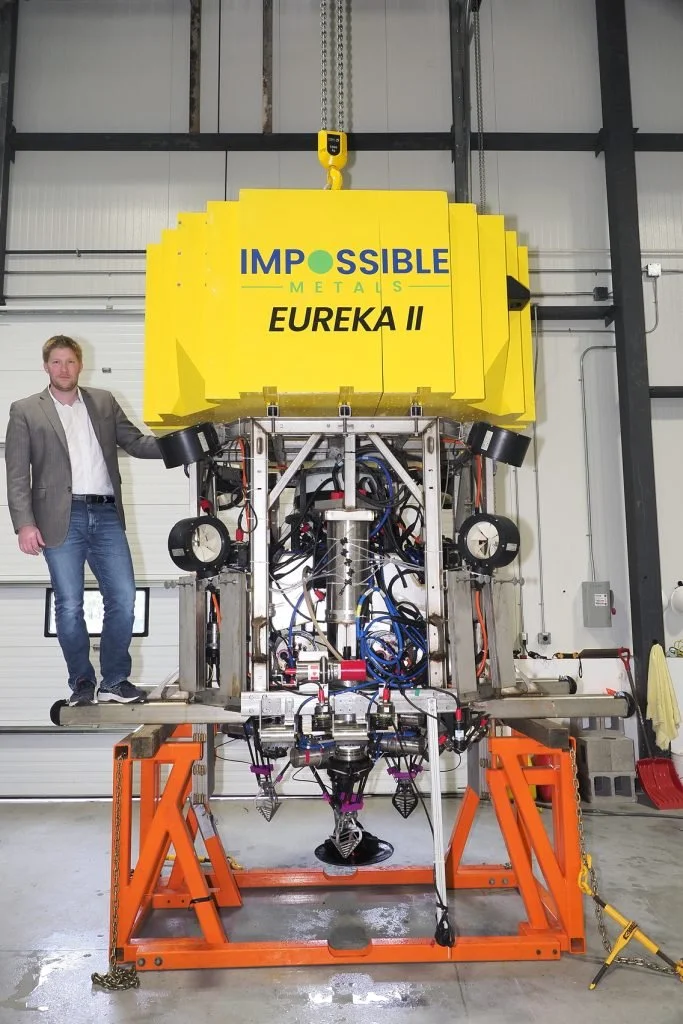

Impossible Metals

Deep-sea mining startup deploying autonomous underwater robotic vehicles to harvest battery‑grade metals

AMERICA 2030

One Fund, 30 Startups

A Short-maturity Fund in Defense, Energy, Robotics, AI-Infra

Next allocation window closes soon. Secure your seat now