Space Hub

We provide accredited investors with curated access to the Space tech ecosystem via two core formats:

Portfolio Companies

Single-Name SPVs (Selective Access)

For investors who want direct exposure to companies like Loft Orbital, Varda, or SpaceX, we occasionally offer deal-by-deal allocations through SPVs. These are invitation-only and capacity-limited.

See what’s available: Varda, Loft Orbital, Archimede, SpaceX

America 2030

America 2030 Fund (Flagship Fund)

A short-maturity fund capturing late-stage U.S. companies across AI, defense, and critical infrastructure. Designed for investors seeking exposure to national security trends without picking individual names.

See what’s available: D-Orbit, Firefly Aerospace, Firehawk Aerospace, Hawkeye 360, Kepler Communications, Loft Orbital, SpaceX, Star Catcher, Varda

Secure your allocation in IPO CLUB Series SpaceX

Accredited investors only

Backed by over 150 accredited investors | $50M+ curated dealflow | 300+ investments| $25M+ invested | 7 Unicorn IPOs

Zaheer Ali

Space Expert

Space Sector Outlook 2025: Key Drivers of Growth

The global space economy reached $613 billion in 2024 (Source: BryceTech Global Space Economy Report, 2024), growing 7.8% year-over-year. Commercial activity represents 78% of total market value. Government spending across NASA, ESA, and emerging agencies reached $132 billion (Source: OECD Space Budget Review, 2024). VC/PE investment in space tech totaled $8.6 billion in 2024 (Source: PitchBook, Feb 2025).

This rapid scaling is being fueled by low-cost access to orbit, major government infrastructure programs, and private market deal flow, positioning both traditional aerospace contractors and next-generation space-tech startups for sustained growth.

Key technological shifts — including cislunar infrastructure, orbital manufacturing, and AI-powered space systems.

Emerging private market opportunities — $8.6 billion in 2024 VC/PE funding, with the U.S. capturing 52% of global capital.

The evolving geopolitical landscape — U.S. lunar nuclear power program, Europe’s €10.5 billion IRIS² constellation, and Africa’s new continental space agency.

Flagship infrastructure projects — Artemis missions, Lunar Gateway, and DARPA NOM4D orbital manufacturing.

High-profile market catalysts — including Firefly Aerospace’s $8.5 billion post-IPO valuation and a $1.1 billion contract backlog.

Projected financial outcomes through 2035 — U.S. maintaining lead, EU targeting €1.5 trillion space economy, and rapid growth from emerging markets.

👉 Download the 2025 Space Market Brief

Includes top companies, sector outlook, and IPO Club’s allocation calendar, all in a 3-minute executive summary.

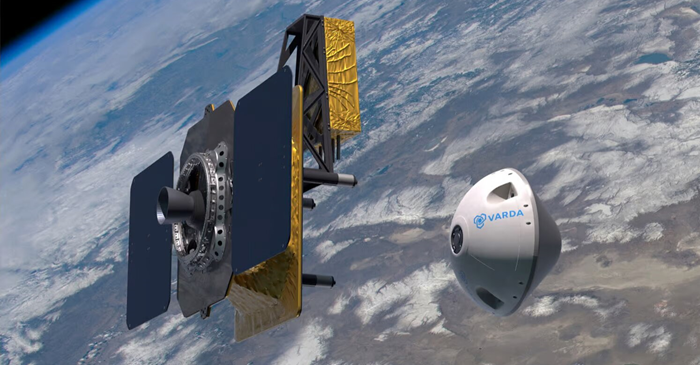

Varda

Manufactures high-value materials in microgravity, returning them to Earth for commercial use

SpaceX

Operates reusable rockets and the Starlink satellite network, lowering launch costs and expanding global broadband coverage

Loft

Provides shared satellite missions, hosting multiple payloads to offer fast, low-cost access to orbit

AMERICA 2030

One Fund, 30 Startups

Defense, Energy, Robotics, AI-Infra

Next allocation window closes soon. Secure your seat now