Latest Trends on Pre IPO Companies

News on portfolio companies and sectors we cover

October Update on Live Investments, Covering the Previous 90 Days

October Update on Live Investments, Covering the Previous 90 Days

Kraken’s Market Resurgence: Secondary Activity and Growth Signals in 2025

Kraken is demonstrating a strong recovery, marked by a resurgence in secondary market trading, growing revenue, and strategic expansion efforts. While regulatory pressures persist, the exchange’s security-first approach and institutional focus position it well for sustained growth. For investors, Kraken remains a compelling pre-IPO opportunity with improving market sentiment.

U.S. government exploration of blockchain technology

In January 2025, the Trump administration issued an executive order emphasizing support for digital assets and blockchain technology. The order promotes the development of lawful dollar-backed stablecoins and prohibits the establishment of Central Bank Digital Currencies (CBDCs) within the U.S. These developments show a transformation in capital formation, with digital assets becoming integral to next-generation investment portfolios. Investors are focusing on strategic positioning ahead of mass adoption, considering key trends and regulatory developments in pre-IPO digital asset investing.

Think Outside the Boxes: Rethinking the VC Playbook for AI Investment

Most VC firms invest in the same well-trodden paths of the AI value chain, from applications to hardware. But IPO CLUB sees opportunity in the overlooked fundamentals — electricity, data, communication infrastructure, and more. Learn why thinking outside the boxes drives better returns.

Trump’s Policies Impact on selected US growth companies

Donald's Honeymoon.

With Donald Trump’s election as President of the United States, there is significant anticipation about how his proposed policies—spanning #deregulation, #tax#reforms, and international #trade—might reshape certain industries and the #leading#growth#startups in #America.

We have divided selected portfolio companies into three groups: Strongly Positive, Positive and Somewhat Positive.

Record $6 Billion Weekly Inflow into Crypto Funds

Crypto funds have recorded a historic $6 billion weekly inflow, according to BofA Global Research. This milestone reflects growing institutional interest in the crypto space, signaling confidence in IPO CLUB’s portfolio companies Ripple and Kraken.

US tech wins the elections

Donald Trump’s recent re-election promises a favorable climate for U.S. late-stage tech startups, with policies on deregulation, tax incentives, reshoring, and emerging technologies driving potential growth. Enhanced government partnerships, particularly in AI and aerospace, are expected to bolster opportunities for venture-backed companies poised for expansion.

AI and the Railway Mania: Lessons from History’s Investment Bubbles

The AI investment frenzy, exemplified by OpenAI's recent $157 billion valuation, mirrors past bubbles like the 19th-century railway boom. Investors are drawn in by revolutionary potential, but history teaches us that overestimating demand, speculative behavior, and lack of regulation can lead to failure. To succeed, investors must focus on fundamentals and long-term viability.

Mario Draghi’s report And Unlocking Europe’s Venture Capital Potential

Europe’s venture capital market faces critical challenges, from fragmented markets to underdeveloped capital ecosystems. With only 5% of global VC funding, European startups often relocate to the U.S. for better access to capital. IPO Club’s experience reflects these dynamics, highlighting the need for market reforms to retain innovation, talent, and funding within Europe.

#VentureCapital #EuropeanStartups #TechInnovation #CapitalMarkets #InvestmentStrategy #ScalingInnovation #MarioDraghi #StartupEcosystem #PrivateEquity #USInvestments #GlobalEconomy #Entrepreneurship #FinancialMarkets

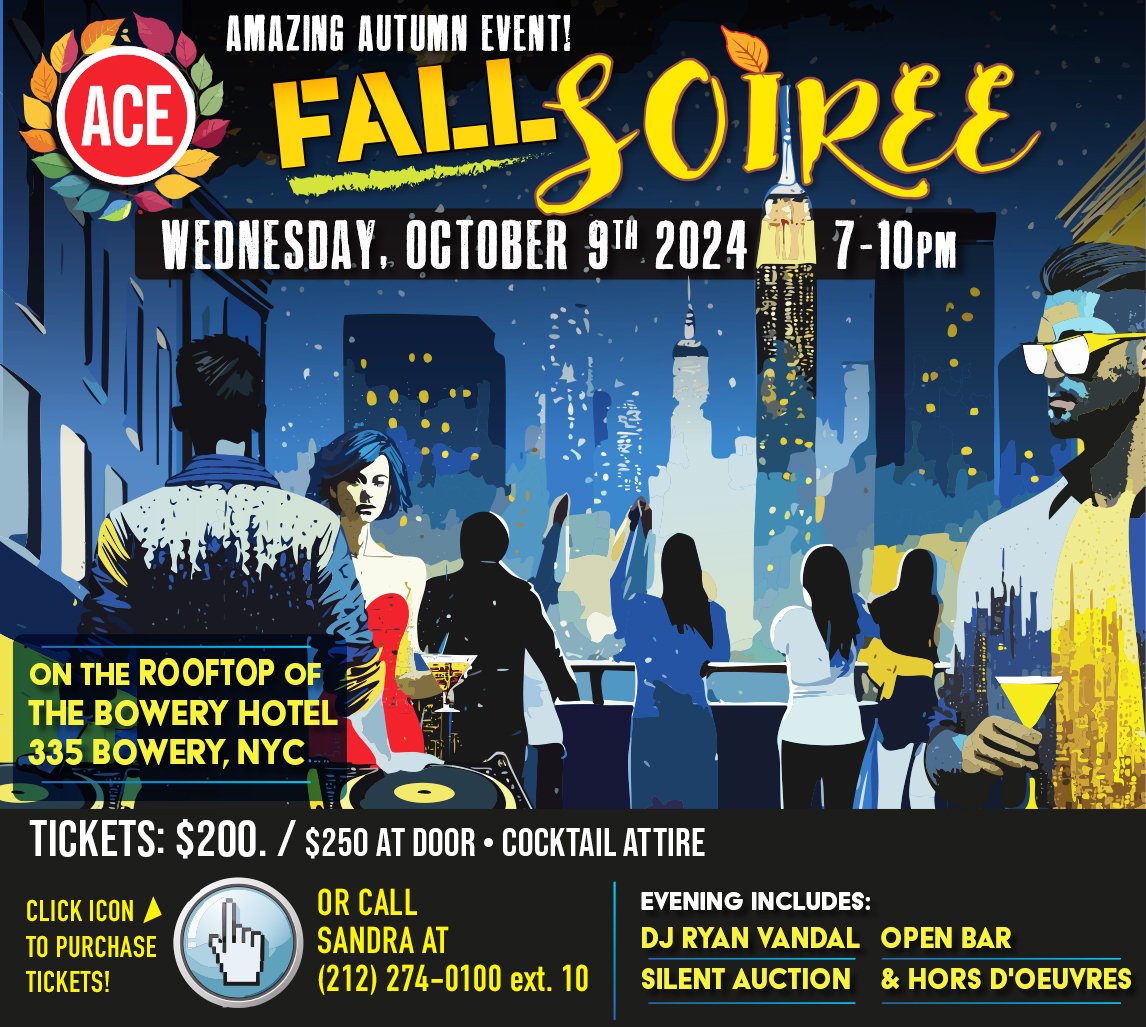

ACE fall event in NEW YORK

Join ACE’s Fall Soirée on October 9, 2024, for a chic night on The Bowery Hotel Rooftop in NYC, featuring live music, an open bar, hors d’oeuvres, and a silent auction.

#ACEFallSoirée #NYCEvents #TheBoweryHotel #Fall2024 #RooftopParty #NYCNightlife #OpenBar #DJRyanVandal #CocktailAttire