IPO CLUB Humanoids Investment Analysis

How to make money and not lose money in robotics, with analysis of the "Picks & Shovels" of the supply chain and the shift to the RaaS (Robots-as-a-Service) financing model.

November 2025. Our opinions are in blue.

“It’s a lousy business. We’re earning sub-standard returns…’ And he knew that … a better machine … would all go to the benefit of the buyers … Nothing was going to stick to our ribs as owners.” Charlie Munger, SoCal Business School, 1984.

Humanoids are a big investment opportunity in venture investing.

Recent humanoid robot market studies project growth from roughly USD 2.9B in 2025 to around USD 15B by 2030 at ~39% CAGR, with demand from healthcare, personal assistance, manufacturing, logistics, and retail. (Source:MarketsandMarkets)

Independent analysis focuses on where profit actually accrues—arguing that today’s obviousness of the theme makes stock‑picking treacherous and that value may concentrate in specific layers (AI, hardware modules, and key application niches) rather than generalized platforms. (Source: Delphi Intelligence’s “Humanoids: Sizing the Profit Pools”)

iCapital’s humanoid note tracks private‑deal momentum and points out that “humanoids” funding in 1H 2025 already exceeded the entire 2010–2024 period, with $3.1B across 60+ deals, highlighting clear acceleration and crowding risk.

Crunchbase and similar data providers have done 2024 “Year of the Humanoid Robot” retrospectives that summarize deal volumes and showcase flagship raises (e.g., Figure’s large Series B, Physical Intelligence, Collaborative Robotics, etc.)

Regional Insights

The current ecosystem is Asia-dominated, especially China, with ~73% of involved companies and 77% of integrators based in Asia.

Chinese firms benefit from supply chain depth, supportive local adoption, and government policies, raising questions about future Western market positioning.

1. Business case: Reshoring, Demographics, Falling unit costs are the key drivers of the industry.

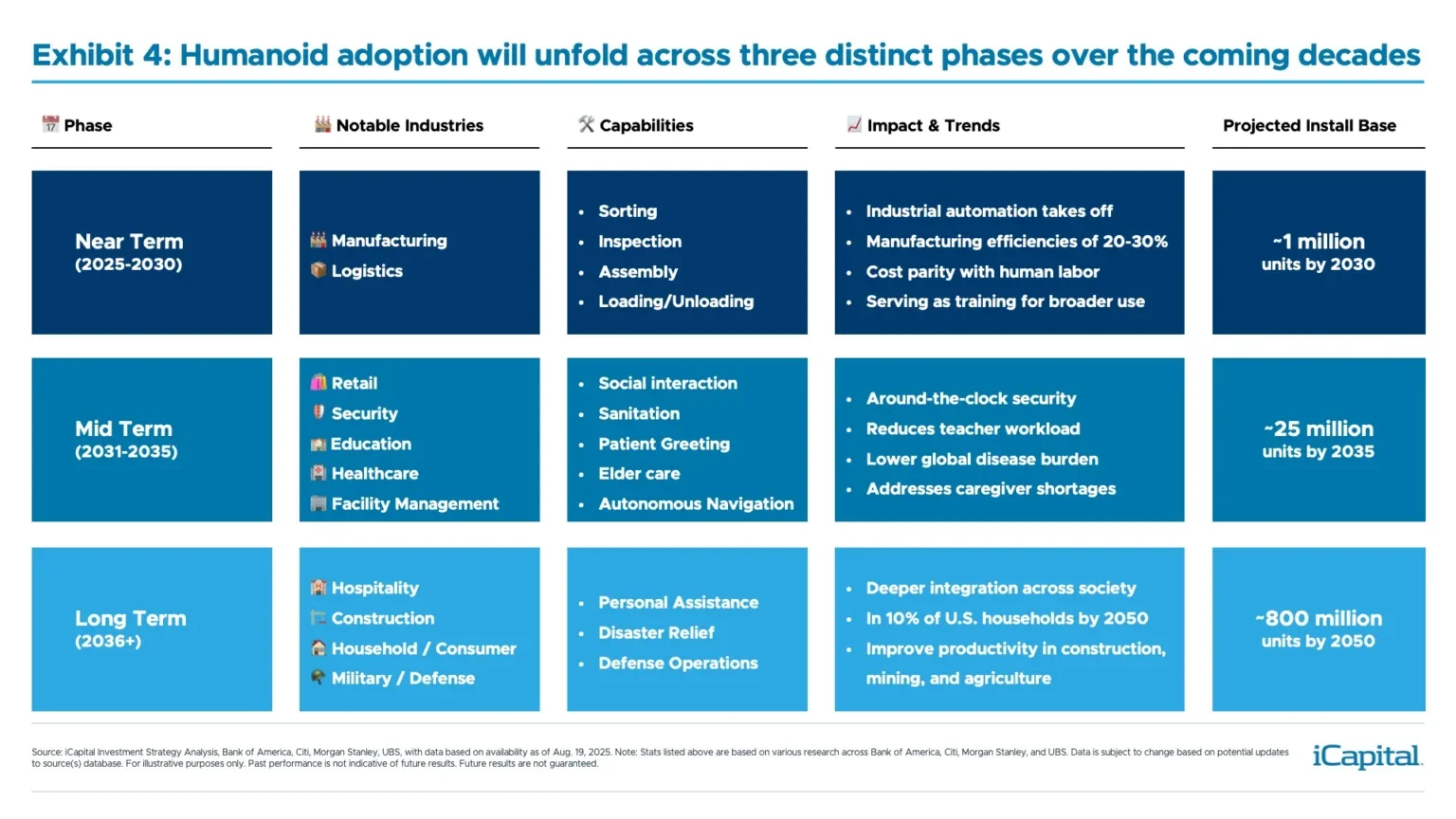

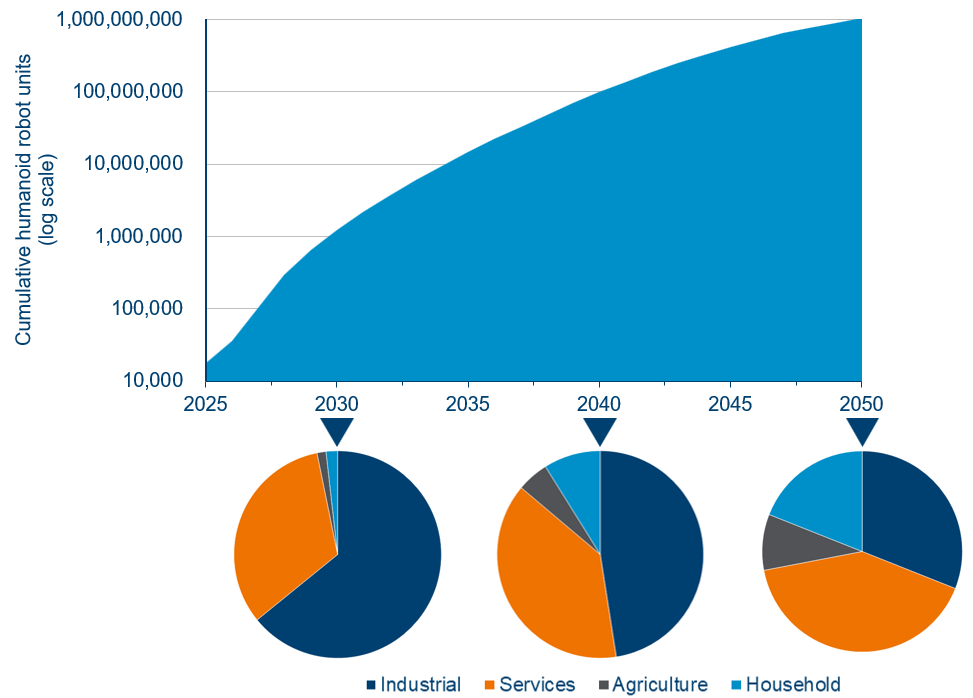

While still nascent today with fewer than 10,000 humanoids globally, these robots are already being tested and deployed in factories. From this small base, adoption is expected to scale materially, with the global install base projected to reach as many as 800 million humanoids by 2050.

Aging demographics, tightening labor markets, and the push to reshore manufacturing are driving demand, while advances in hardware, software, and falling unit costs are setting the stage for wider adoption.

The sales estimates range between the 800 million (Picture 1 - Source: iCapital Market Pulse Aug 2025), to 1 billion below, by 2050 (Picture 2 - Source: Polar Capital Investment Insights October 2025)

In our opinion these projections are too optimistic, if you consider that based on the UN projection, a reasonable estimate for the population of developed countries in 2050 is ~1.2 billion people. We strongly believe that in the next 25 years this technology will be limited to adoption in developed countries due to financing constraints. (Source: IPO CLUB Research. We cover the robotics market for America 2030)

So we take the combined total population of U.S., China and Europe ≈ 2.36–2.46 billion people in 2050, respecticely 0.43+1.3+0.7 billion. (Source: Wikipedia)

An estimate of 800-1,000 million globally seems high in comparison We expect the market to be between 200 and 500 million units globally by 2050. (Source: IPO CLUB Research. We cover the robotics market for America 2030)

Our numbers are also lower than the Morgan Stanley Humanoid 100 Report, which estimates the global installed base of humanoid robots will reach as high as 1 billion units by 2050, assuming their upper projection scenario. (Source: Morgan Stanley)

1.1 IPO CLUB Research Coverage

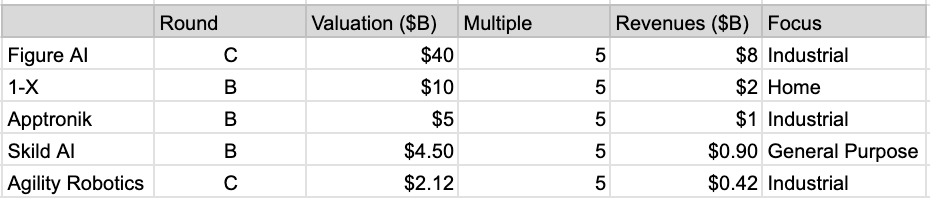

Revenues represent the hypothetical sales level required to justify the stated valuation at a 5× revenue multiple; they are not actual reported revenues. (Source: IPO CLUB Research. We cover the robotics market for America 2030)

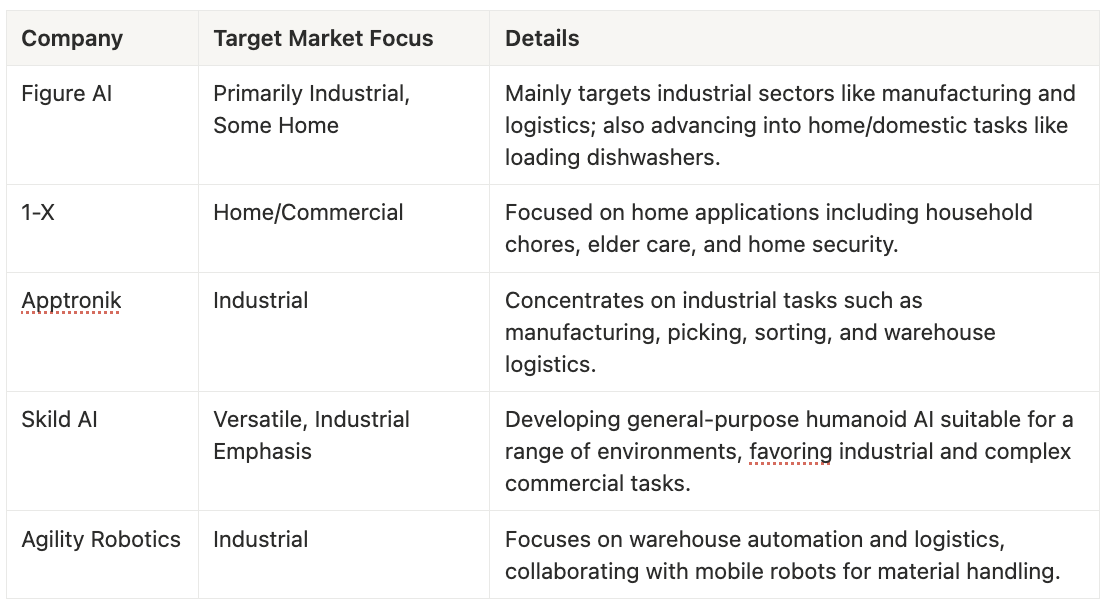

This table highlights that while most companies including Figure AI, Apptronik, Skild AI, and Agility Robotics predominantly serve industrial markets, 1-X is distinctively home- and consumer-oriented. Skild AI blends versatility with an industrial tilt.

2. Issues with investing

2.1 Falling prices and margins

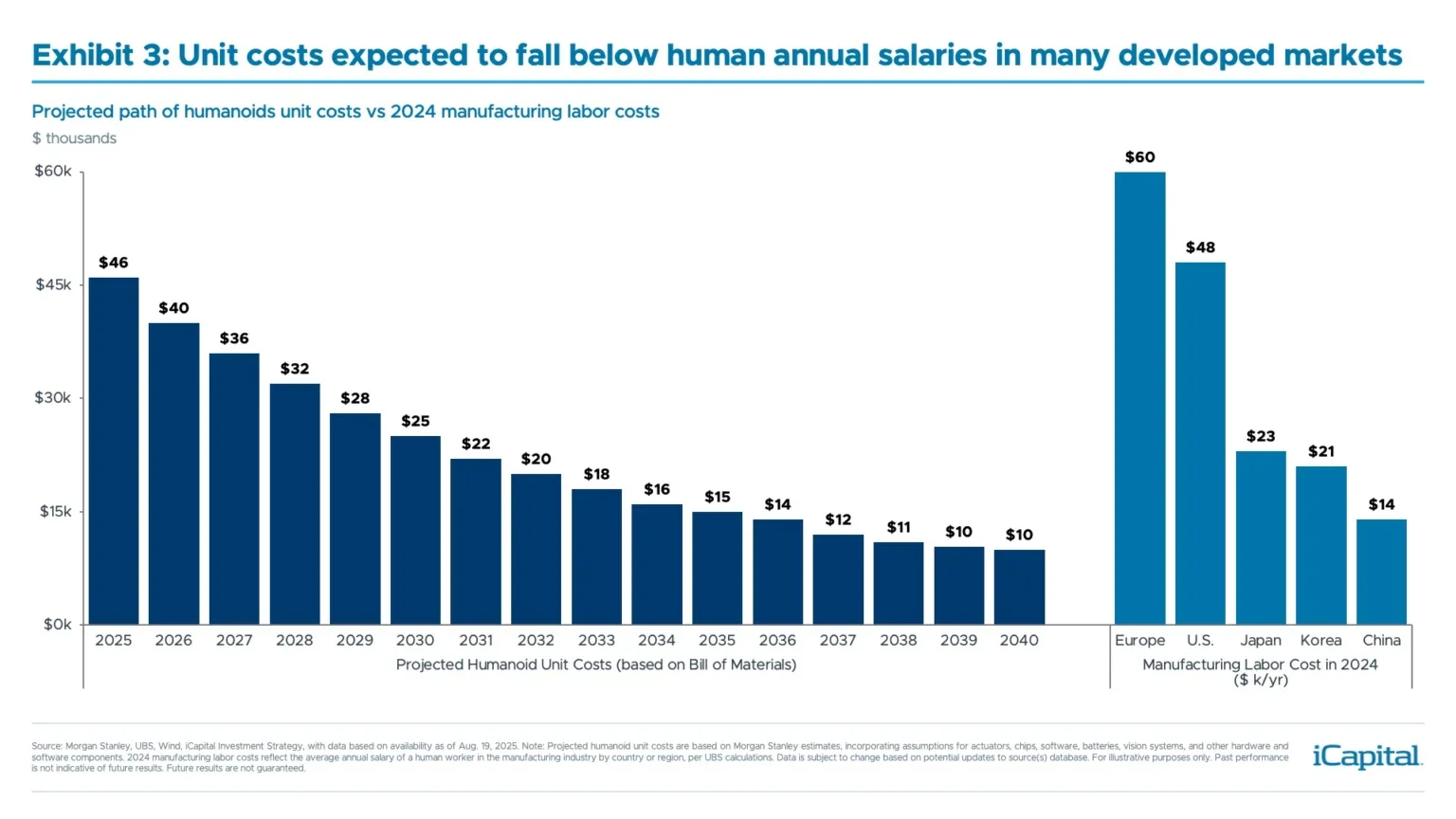

Because of the steep growth, in a hardware business, cost curves expected to drop sharply as volumes rise: rapid improvements in actuators, power density, and AI (vision, control, foundation models) moving humanoids from demos to pilots, will drastically reduce prices and margins in such components. (Source: IPO CLUB Research. We cover the robotics market for America 2030)

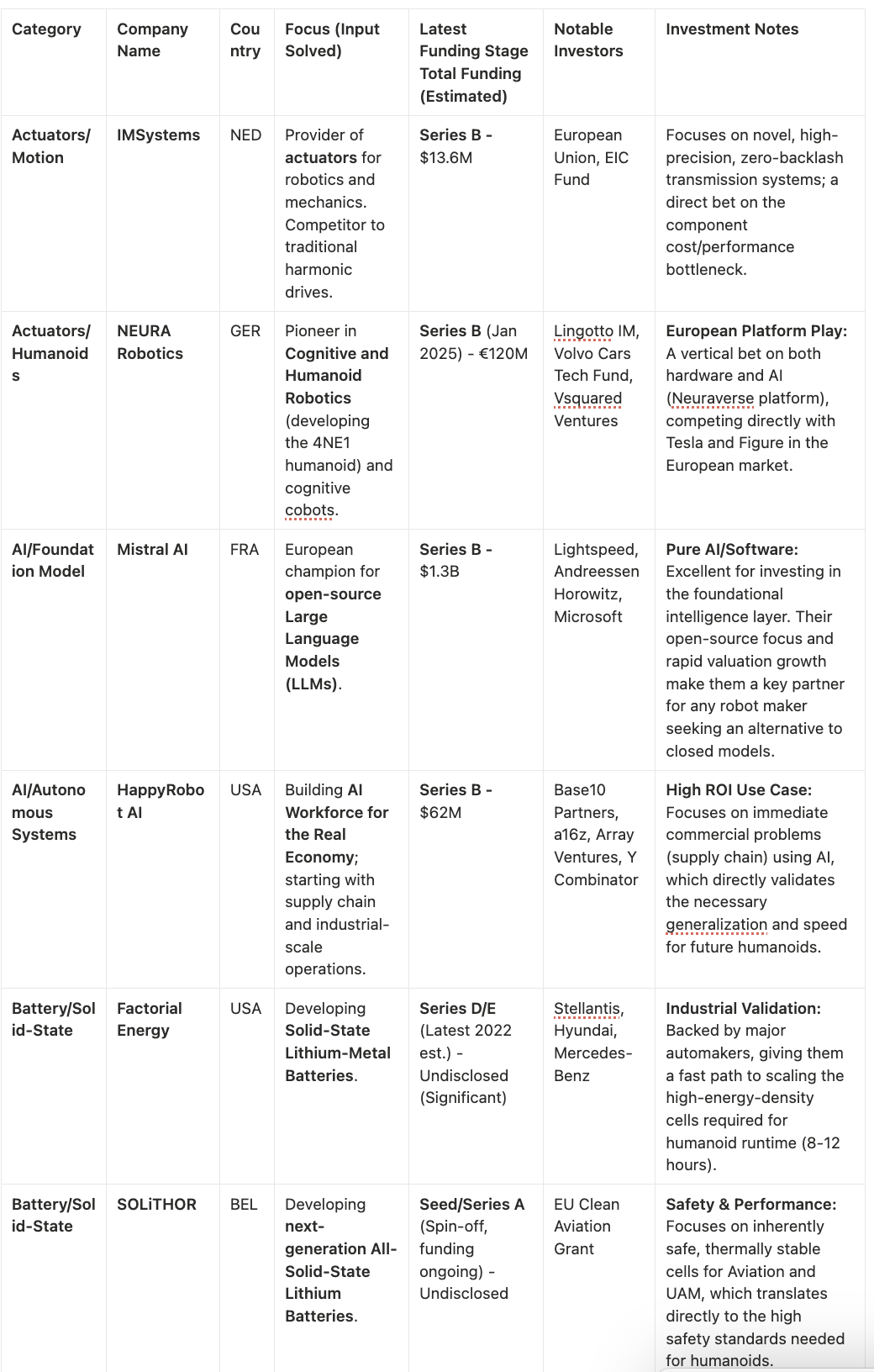

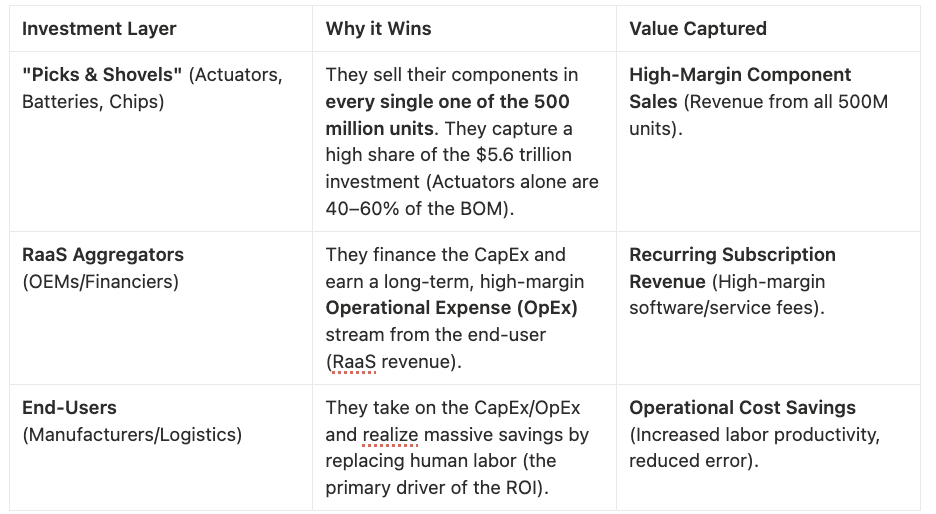

This means that while investment will go into humanoids, the real money will be made by investing in suppliers to manufacturers of humanoids or heavy users of humanoids.

It seems us that this is a typical case where the user will benefit more than the investor.

The argument about falling prices needs to be nuanced to protect the "picks and shovels" thesis:

While cost curves for humanoid platforms are expected to drop sharply (following Wright's Law with a 15-20% decline for each doubling of volume), the real money will be made by investing in specialized suppliers to manufacturers or heavy users.

IPO CLUB Insight: Margins will fall on commoditized components, but high margins will persist for firms that deliver step-change innovation in power density (batteries) or force control (actuators), as these technologies remain the most complex and mission-critical components.

It will be hard for private investors to find winners in humanoids manufacturers in the west and make money, due to direct competition with incumbent tech giants such as Tesla, Amazon and Google. (Source: IPO CLUB Research. We cover the robotics market for America 2030)

2.2 Tesla's potential vertical integration advantage.

Tesla is uniquely positioned due to its vertical integration in AI and scale, but they are far from having the whole sector secured.

Here is a breakdown of Tesla's strengths and the areas where competitors are focusing on an open, non-vertically integrated market:

2.3 What is Amazon doing in Robotics?

2.3.1. Amazon's Current Robotics Scale and Scope

Amazon is the world's largest operator of mobile robotics, giving them an unmatched scale advantage.

A. The Robot Army is Massive

Total Robots: Amazon has deployed more than 1 million robots across its global fulfilment network. This is a massive leap from the 750,000 figure often cited recently.

Key Robots: Their fleet includes various specialized robots, such as:

Autonomous Mobile Robots (AMRs): Kiva-style drive units (like Hercules and Titan) that move entire shelves or pods of inventory to human workers.

Autonomous Mobile Robots (New Generation): Proteus, an AMR that can navigate freely and safely around human employees without being confined to separate cages.

Robotic Arms: Sparrow and Cardinal use advanced computer vision and AI to pick, sort, and place individual packages. Vulcan is noted as their first robot with a sense of touch (using force sensors) to plan and execute motions.

Impact: Approximately 75% of all customer orders globally are now assisted in some way by Amazon's robotics.

B. Strategic Acquisitions

Amazon has strategically acquired key robotics firms over the past decade, including:

Kiva Systems (2012): The acquisition that kickstarted their entire warehouse robotics strategy.

iRobot (Roomba): Expanding their consumer robotics portfolio (though this deal has faced regulatory scrutiny).

Zoox: An autonomous vehicle developer, vital for their last-mile delivery and autonomous transportation strategy.

Covariant: Recently licensed technology and hired key talent from this leading AI robotics startup to strengthen their foundational robot models and generalization capabilities.

2.3.2. Amazon's Core Business Strengths (The "Winner" Inputs)

Amazon doesn't just buy robots; they control the inputs necessary for a robotics revolution, giving them a significant systemic advantage:

2.3 Electricity constraints

Constraint issues remain with electricity, and to a lower extent batteries.

The Electricity Bottleneck: The scale of energy needs of humanoid robots will be significant, adding a new layer of electricity consumption on top of the surge already driven by AI data centres. A current industrial humanoid consumes 2kW at operation, depending on design and task complexity, and can operate 2-3 hours per charge at maximum. This might not be enough for the robot to complete a task, adding complexity and costs to the operations. While a humanoid robot’s peak power draw is lower than an EV, its average daily energy use is expected to be higher due to continuous operation. (Source: Polar Capital estimates. Assumptions include: 203 million units annual and average selling price of $25,000 by 2050)

The Battery Bottleneck (Uptime): Current humanoids run for only 2 to 4 hours on a charge, far short of the 8- to 12-hour operational shift required for real-world industrial and commercial viability. This low uptime means robots spend too much time idle and cannot deliver productivity comparable to human labor.

Investment Implication: The market needs a step-change in power density. Advanced chemistries like Solid-State Batteries (targeting 10-12 hours of operation) or new battery chemistries achieving 430 Wh/kg (enabling 8+ hours) are crucial. This makes specialized battery innovators a high-priority investment. (Source: IPO CLUB Research, We cover the robotics market for America 2030)

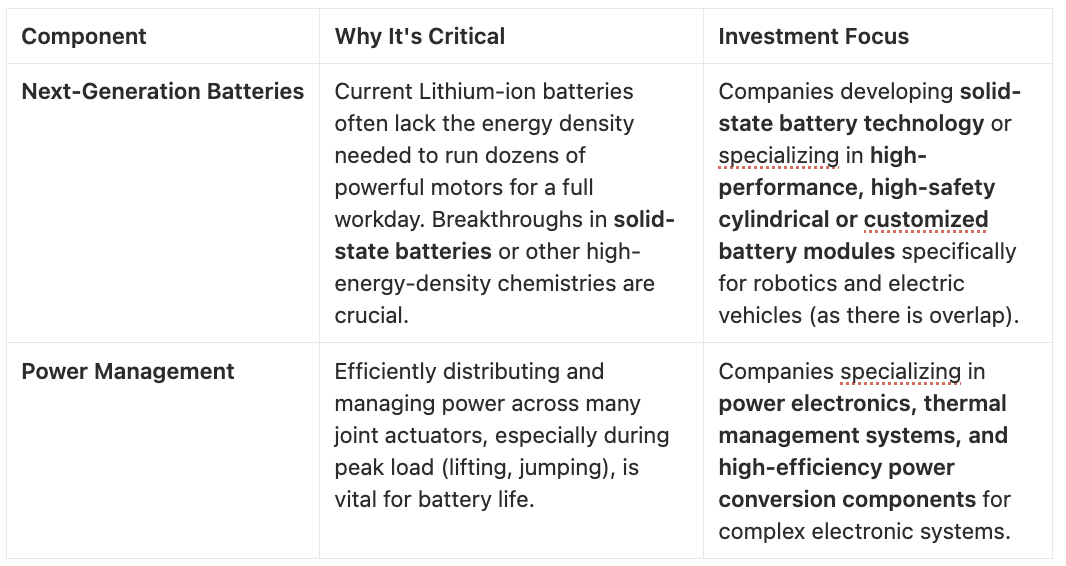

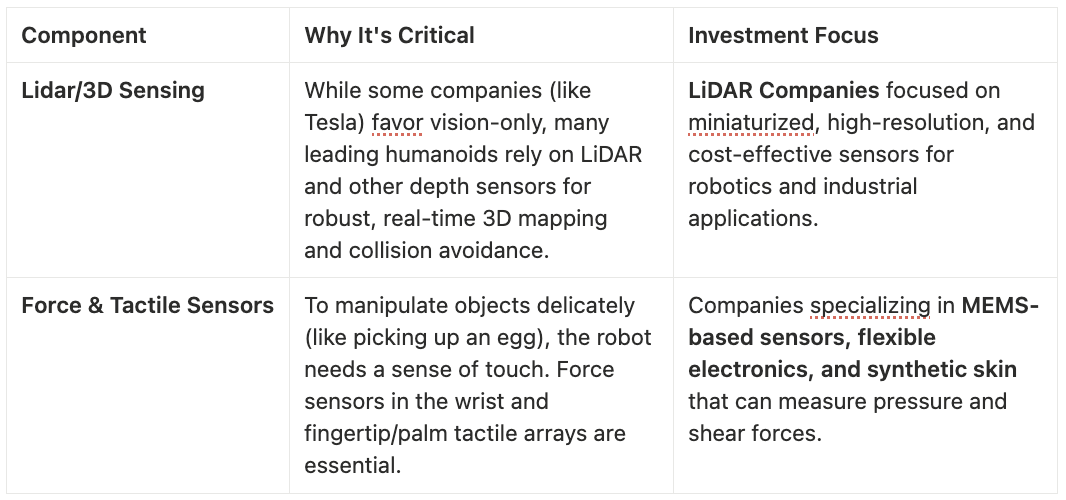

2.4 Component constraints

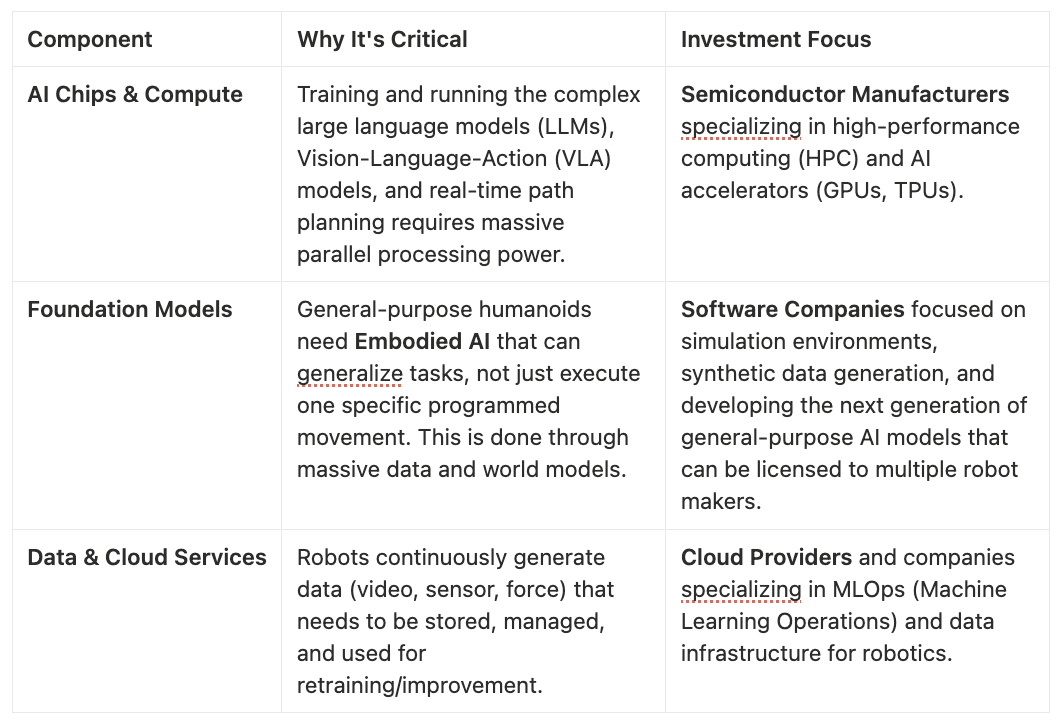

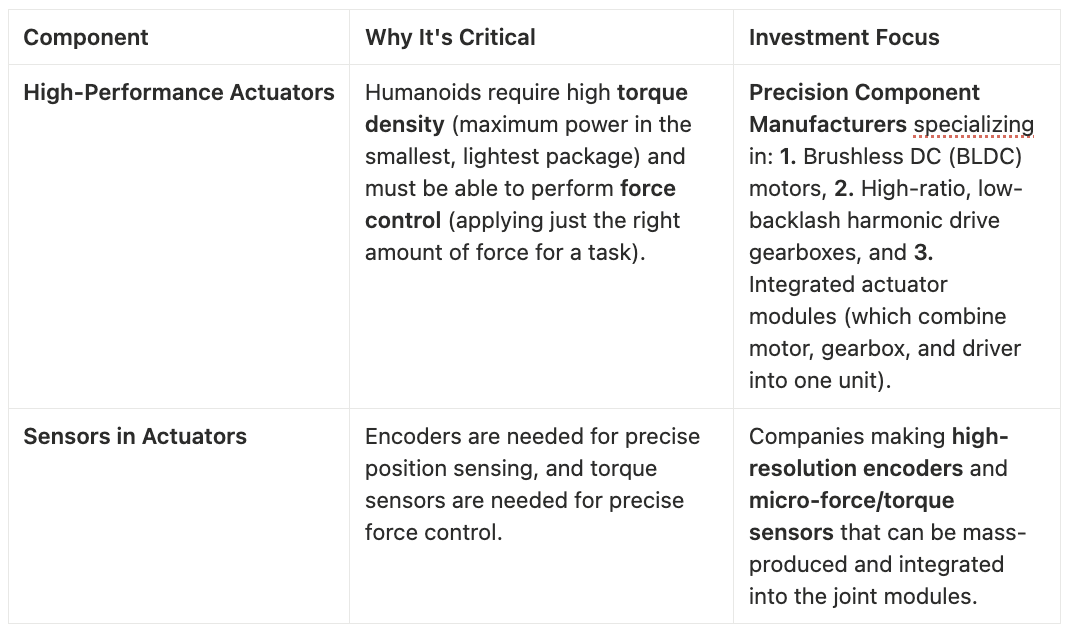

IPO CLUB’s core insight: All successful humanoids, regardless of the brand (Tesla, Figure, Apptronik, Agility Robotics), will rely on the same critical components and software infrastructure. (Source: IPO CLUB Research)

This means that the vertically integrated manufacturer with existing supply chain for chips, models, cloud, sensors, actuators will dominate the supply and cost structure of the market and will be more likely to win the race.

3. Investment Analysis

3.1 🧠 Embodied AI and Software Infrastructure

3.2 💪 Actuation and Motors

3.3 🔋 Power and Energy Density

3.4 👁️ Perception and Sensing

4. Pick and Shovel Investment Ideas

4.1 The Case for Platform Neutrality: National Champions

While the vertically integrated giants—Tesla, Amazon, and Google—have undeniable advantages in internal data scale and component cost, their success creates a clear, urgent market opportunity for independent platform companies like Figure AI and Apptronik.

Many of the world’s largest companies—particularly in sectors where Tesla (Auto) or Amazon (Logistics/Retail) are direct competitors—will refuse to integrate a competitor's core labor technology. This "competitive avoidance" is the strongest argument for investing in independent national champions.

The Leading US National Champions

The existing partnerships of U.S. independents demonstrate this strategy in action:

Figure AI (USA): Secured a partnership with BMW to deploy its Figure 01 robot in automotive manufacturing.

Apptronik (USA): Partnered with Mercedes-Benz to use its Apollo robot for transporting components on the production line.

These partnerships are evidence that non-Tesla automakers are actively seeking independent, non-competitor solutions to automate their factories. Investing in Figure and Apptronik, or their specialized component suppliers, provides the highest leverage on this competitive market dynamic.

5. Who will pay for Humanoids?

5.1💰 Estimated Total CapEx: $5.6 Trillion USD

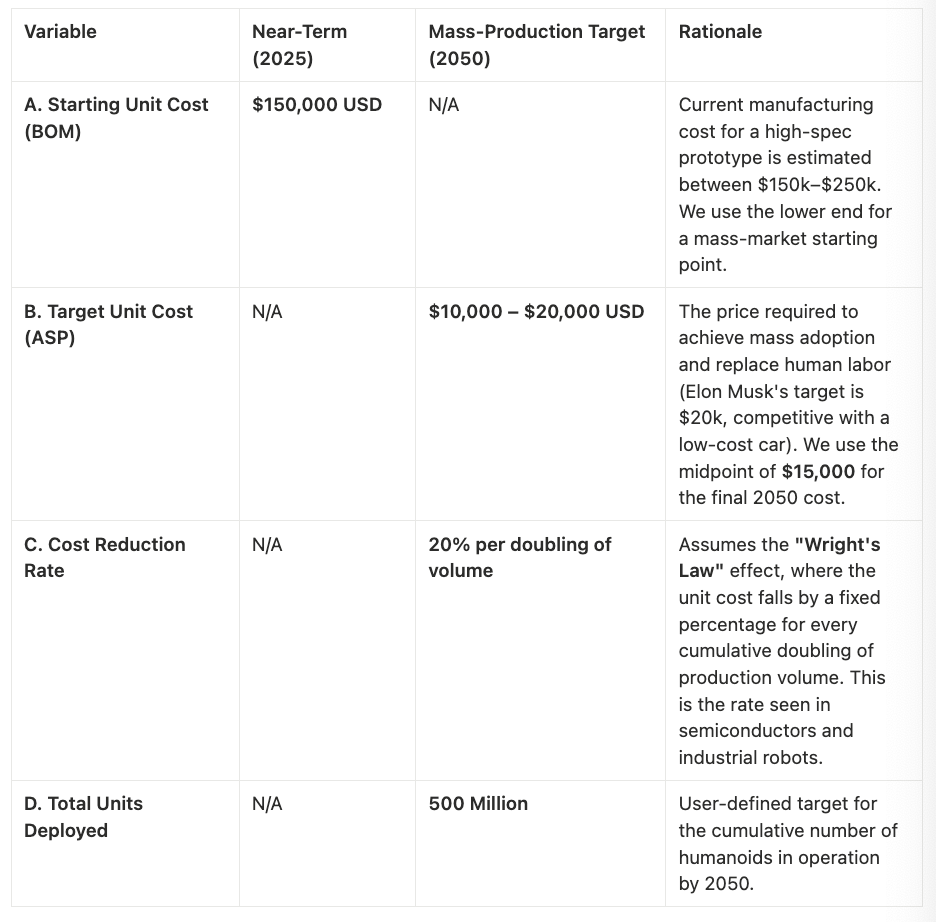

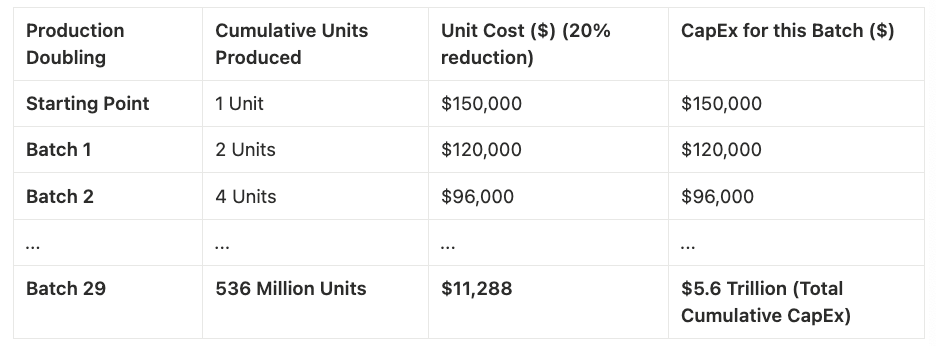

Based on the assumptions below, the cumulative global investment required to deploy 500 million humanoids by 2050 is estimated to be approximately $5.6 trillion USD. (Source: IPO CLUB Research. We cover the robotics market for America 2030)

This estimate represents the total hardware purchase price (the Bill of Materials + manufacturing margin) paid by end-users (manufacturers, logistics firms, consumers) to the robotics platforms (Tesla, Figure, etc.).

5.2 Key Assumptions & Inputs

The calculation relies on three main variables, informed by industry analysis (Goldman Sachs, McKinsey, Morgan Stanley):

5.3 Calculation Methodology: Wright's Law Model

We use the Wright's Law model to project the unit cost across the entire production history (2025–2050) and then sum the CapEx for each batch of units.

The model shows that to reach a cumulative total of 500 million units, the industry will have gone through roughly 29 doublings of cumulative production. This continuous drop in price, from $150,000 down to a final average cost of approximately $15,000, results in a total cumulative investment of $5.6 Trillion USD. (Source: IPO CLUB Research. We cover the robotics market for America 2030)

5.4 Investment Interpretation

This massive CapEx creates distinct opportunities for investors:

6. The Wage Impact

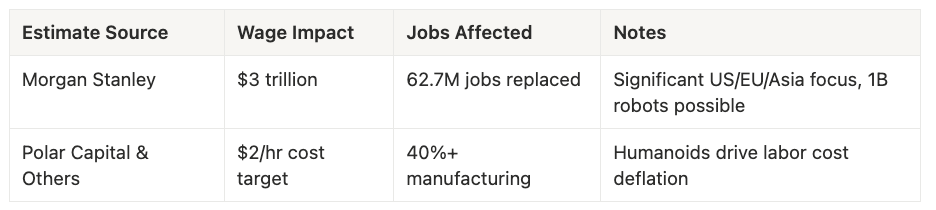

A comprehensive review of recent financial and market estimates suggests that humanoid robots could have a multi-trillion dollar impact on global wages by 2050:

Morgan Stanley and other major financial analysts estimate a $3 trillion global wage impact by 2050 resulting specifically from the adoption of humanoid robots. This figure is connected to displacement or transformation of existing labor, especially in sectors such as manufacturing, logistics, healthcare, and services. (Source: Morgan Stanley Humanoid 100 Report)

Wage Impact Mechanism: The wage effect arises from increased automation, cost savings (up to $500,000–$1 million per worker over 20 years), and productivity improvements. This could put downward pressure on lower-skilled wages globally while also potentially creating upward wage effects in new creative, technical, and supervisory roles. (Source: Polar Capital)

7. The True Cost of Humanoid Labor: An Obsolescence-Driven Cost Model

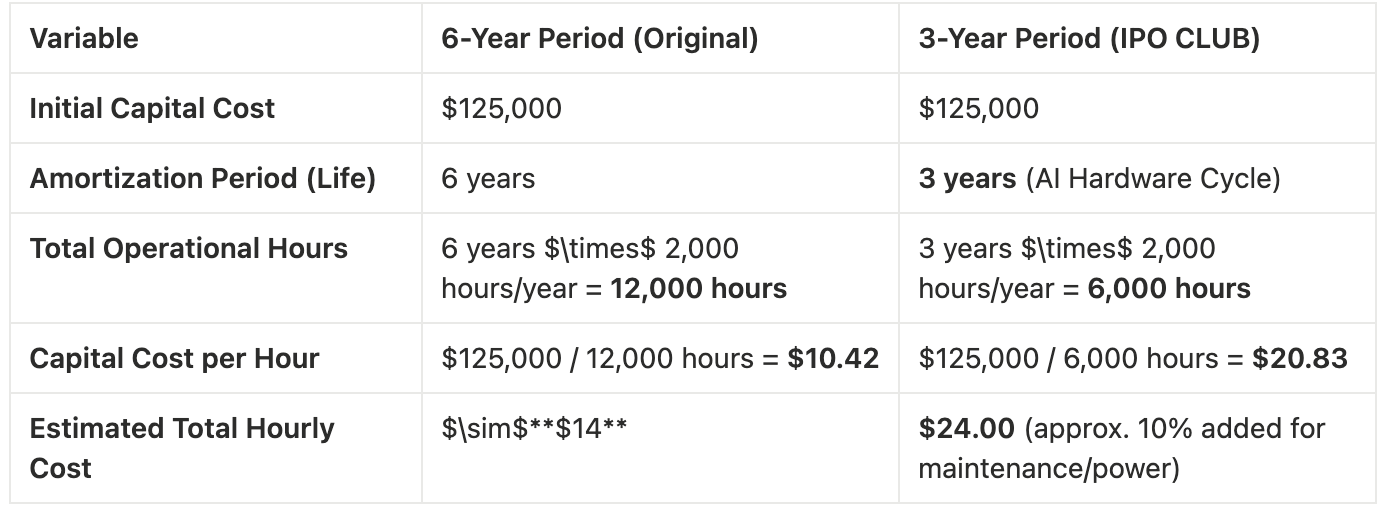

The statement that industrial humanoids currently cost an effective manufacturing wage of $14 per hour and have a six-year payback period is based on the outdated depreciation model of a non-intelligent industrial robot.

The IPO CLUB argues that the high cost of embedded AI compute, sensors, and power management is subject to a rapid obsolescence cycle. Therefore, the true economic depreciation window for first-generation humanoids must be calculated over a three-year period, not six years.(Source: IPO CLUB Research. We cover the robotics market for America 2030)

7.1 Current Cost Calculation (2025)

The statement provides an average price today of $100,000–$150,000. We will use the $125,000 midpoint for the initial capital cost:

Assumes 1 shift per day, 250 days/year, 8 hours/shift $\approx 2,000 \text{ hours/year}$ for the sake of comparative calculation.

7.2 Projected 2030 Cost Calculation

The statement targets a two-year payback by 2030 (based on a 6-year amortization). We will use a projected cost of $50,000 (a likely cost point for 2030 if the goal is a 20$ hourly wage at 3 years).

Using a three-year amortization window, the current effective hourly cost for a humanoid is approximately $24.00 per hour (assuming a $125,000 CapEx), which is above the U.S. entry-level labor rate. This revised figure underscores the magnitude of the hardware/AI cost problem. (Source: IPO CLUB Research)

This urgency reinforces the "Picks & Shovels" investment thesis: the rapid, three-year cycle necessitates continuous CapEx replacement. The real money will be made by component suppliers and RaaS providers who can deliver the step-change innovations necessary to pull the unit cost down to a level that makes the humanoid financially competitive even with the aggressive three-year depreciation schedule. The target cost point to achieve mass adoption remains beating the human labor rate, which requires both unit price reduction and the Software/RaaS model to bundle the continuous upgrades into a single, profitable subscription fee. (Source: IPO CLUB Research. We cover the robotics market for America 2030)

8. U.S. vs. China

China is the largest installer of industrial robots, surpassing Japan in 2013, accounting for half of the global total. (Source: CNBC, July 2024)

One of China’s advantages is cost, based on the availability of small to medium size shops that can manufacture almost custom made parts for the humanoids, like it has happened for the iPhone. (Source: Dan Wang, Breakneck)

China is a threat to the pick and shovel investment thesis, because chinese factory may, after having learned to produce standardized parts for their local humanoid manufactuers, potentially sell them at a cheap price globally.

National economics and security will prompt the U.S. to support its robotics industry, though we don’t know how yet. (Source: IPO CLUB Research)

9. Disclaimer

This research piece has been prepared by IPO Club LLC for informational and discussion purposes only and does not constitute an offer to sell or a solicitation of an offer to buy any securities or investment products. This material is not intended to be relied upon as a basis for making an investment decision and is not, and should not be assumed to be, complete.

The views and information expressed herein reflect the opinions of the authors as of the date of publication and are subject to change without notice. This document may contain forward-looking statements, which are inherently speculative and subject to risks and uncertainties that could cause actual outcomes to differ materially from those expressed or implied. IPO Club LLC does not guarantee the accuracy or completeness of the information contained herein and disclaims any liability for any loss arising from the use of this material.

This research is intended solely for accredited investors who satisfy the suitability standards outlined in the IPO Club Confidential Private Placement Memorandum. It does not constitute investment, legal, tax, or other advice, and prospective investors are urged to consult their own advisors.

No securities are being offered or sold pursuant to this research. Any such offer, if made, will be made only pursuant to definitive offering documents, including a Private Placement Memorandum, Subscription Agreement, and related documents, and will be made solely to persons who are “accredited investors” under Regulation D of the Securities Act of 1933, as amended.