IPO Returns: How Are The Latest Ten Tech IPOs faring in the Public Market

Overview

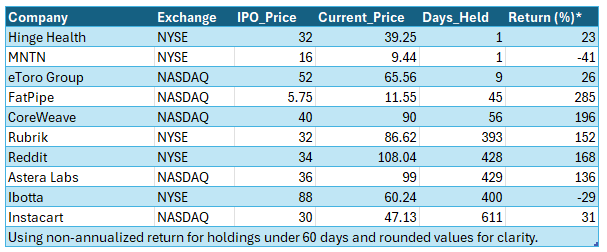

As 2025's IPO window cautiously reopens, secondary investors are evaluating early returns to gauge post-IPO market sentiment. Our snapshot of 10 recent tech IPOs shows sharp divergences in performance, with FatPipe (+285%) and CoreWeave (+196%) outperforming while names like Ibotta (-29%) and MNTN (-41%) have struggled. This post offers a data-driven look at the short-term results across a mix of enterprise, fintech, AI, and consumer tech players, highlighting opportunities and warning signs for secondary capital allocators. IPO CLUB was invested pre-IPO in Instacart and Rubrik.

1. Standout Performers: FatPipe & CoreWeave

FatPipe (NASDAQ: FATP):

IPO’d at $5.75, now trading at $11.55 after just 45 days, marking a +285% return. Known for its SD-WAN tech for enterprises, FatPipe capitalized on strong AI-driven infrastructure tailwinds and cost-efficiency messaging in a capex-sensitive environment.CoreWeave (NASDAQ: CORE):

Raised eyebrows with a +196% gain in 56 days. Backed by Nvidia and specializing in cloud GPU infrastructure, CoreWeave is perfectly timed for generative AI infrastructure spend—particularly among LLM and video rendering startups.

These companies demonstrate strong post-IPO appetite for picks-and-shovels AI infrastructure plays.

2. Steady Compounding Winners: Reddit, Rubrik, and Astera Labs

Reddit (NYSE: RDDT):

IPO’d at $34, now trades at $108.04, a +168% return over 428 days. Despite initial skepticism, Reddit monetized via ads and data licensing, fueled by LLM model training demand and a growing ecosystem of third-party apps.Rubrik (NYSE: RBRK):

Cloud data security platform Rubrik is up +152% over 393 days, riding the zero-trust security trend and winning major federal and enterprise contracts.Astera Labs (NASDAQ: ALAB):

Grew +136% over 429 days. As a provider of high-speed interconnects for data centers and AI workloads, Astera remains a critical enabler for Nvidia and AMD-driven AI scale-ups.

3. Struggles in Consumer Tech: Ibotta and MNTN

MNTN (NYSE):

Down -41% after just one day of trading. The adtech firm failed to excite the market despite its promise of performance-based CTV advertising. Profitability concerns and lackluster growth weighed on sentiment.Ibotta (NYSE: IBTA):

Down -29% over 400 days. While grocery cashback remains relevant, market saturation and limited international expansion prospects raised growth ceiling concerns.

These names underscore the challenge for consumer-oriented platforms in a market favoring enterprise and AI-heavy narratives.

4. Early Momentum: Hinge Health & eToro Group

Hinge Health (NYSE):

Up +23% on Day 1, with strong demand for its digital musculoskeletal therapy platform. As employer healthcare spend rises, Hinge's preventative model may gain enterprise traction.eToro Group (NASDAQ):

Up +26% in 9 days, benefiting from renewed crypto interest and retail investor reactivation amid Bitcoin’s 2025 rally. Future volatility remains, but momentum is real.

5. Longer-Term Play: Instacart

Instacart (NASDAQ: CART):

Modest +31% gain over 611 days, after a volatile start. It’s settling into a hybrid grocery logistics/ads platform narrative. Stability is here, but growth is muted compared to its pandemic-era expectations. Interesting to see how Fidji Simo can impact the OpenAI share price, since she heading there to lead applications (and advertising).

Implications for Secondary Market Investors

AI Infrastructure Is the Theme of 2025. Companies like CoreWeave, Astera Labs, and FatPipe are clear early beneficiaries.

The best way to capitalize on the AI infrastructure boom is by investing in the IPO CLUB II America 2030 Fund, a professionally managed vehicle designed to provide targeted exposure to the foundational technologies powering the next wave of artificial intelligence. This fund offers broad diversification across top-tier AI infrastructure companies, reducing single-stock risk while maximizing upside potential. Investors benefit from institutional-grade research, rigorous due diligence, and early access to late-stage, high-growth names before they hit the public markets. With thematic focus, active rebalancing, and a long-term horizon aligned with the AI buildout through the end of the decade, America 2030 is a strategic gateway for secondary capital to enter one of the most transformational trends of our time.

AI-Infrastructure companies already under coverage at America 2030:

What is IPO CLUB

We are a club of Investors with a barbell strategy: very early and late-stage investments. We leverage our experience to select investments in the world’s most promising companies.

Disclaimer

Private companies carry inherent risks and may not be suitable for all investors. The information provided in this article is for informational purposes only and should not be construed as investment advice. Always conduct thorough research and seek professional financial guidance before making investment decisions.