Instacart IPO Analysis

“Similar to Arm and the marketing automation company Klaviyo, Instacart is scheduled to go public in September. This move is among several notable companies exploring the market’s reception to IPOs. The environment for new stock listings has been relatively quiet over the past couple of years, largely because of Russia’s actions in Ukraine and a significant rise in interest rates.”

Background

Founded in 2012 by Apoorva Mehta, Instacart is an American company that operates as an Internet-based grocery delivery and pick-up service in the U.S. and Canada. Instacart has become one of the dominant players in the grocery delivery industry with a high-profile list of grocery store partners.

Market Position

1. Growth and Market Share

Instacart has shown significant growth since its inception, benefiting from the boom in online grocery shopping, especially against the COVID-19 pandemic. The pandemic catalyzed digital transformation in the grocery industry, with more consumers shifting to online shopping and home delivery.

2. Partnerships

Partnering with leading grocery chains such as Kroger, Costco, and Safeway has provided Instacart with a unique value proposition and a broad customer base. Also, the filing reveals that PepsiCo has agreed to purchase $175 million of the company’s stock in a private placement.

3. Competitive Landscape

While Instacart faces competition from companies like Amazon Fresh and Walmart's delivery service, its distinct advantage lies in its network of partnerships and its sole focus on grocery delivery.

Financial Health

Drawing insights from the recently filed S-1 by Instacart, we are now privy to the company's latest financial figures.

Revenues growth

For the six months ended June 30, Instacart's revenue was $1.48 billion, up 31% from the same period last year. Advertising and other revenue surged 24% to $406 million.

2. Profitability

It reported a net income of $242 million during the six months, compared to a $74 million loss a year earlier. According to the filing, Instacart has now been profitable for five straight quarters.

3. Unit Economics

Gross transaction value (GTV), the measure of the total value of each sale, increased to $28.8 billion in 2022 from $5.1 billion in 2019.

Challenges and Opportunities

1. Growth

“We believe the future of grocery won’t be about choosing between shopping online and in-store,” CEO Fidji Simo wrote in the prospectus. “Most of us are going to do both. So we want to create an omni-channel experience that brings the best online shopping experience to physical stores, and vice versa.”

2. Diversification

Instacart said it will continue to focus on incorporating artificial intelligence and machine learning features into the platform and expects the company to “rely on AIML solutions to help drive future growth in our business.” In May, Instacart said it was leaning into the generative AI boom with Ask Instacart, a search tool that aims to answer customers’ grocery shopping questions. Instacart’s move into AI has come largely through several acquisitions in the past two years. Those deals include the purchase of e-commerce startup Rosie, AI-powered pricing firm Eversight, AI shopping cart and checkout solutions provider Caper, and FoodStorm, a software startup specializing in self-serve kiosks for in-store customers.

The company also touted its use of machine learning to predict grocery availability for retailers and increase consumer sales. It said its algorithms predict availability every two hours for the “large majority” of its 1.4 billion grocery items and that more than 70% of customers purchased items through Instacart’s recommendation algorithm in the second quarter of 2023.

3. Regulatory Concerns

Gig economy companies, including Instacart, face regulatory challenges, especially concerning the classification of their workers. According to its website, Instacart shoppers and drivers deliver goods in over 5,500 cities from more than 40,000 grocers and other stores. The business took off during the COVID pandemic as consumers avoided public places. But profitability has always been a major challenge, as it is across much of the gig economy, because of the high costs associated with paying all those contractors.

Instacart said headcount peaked in the second quarter of 2022 and declined over the next two quarters, reducing our fixed operating cost base. At the end of June, the company had 3,486 full-time employees.

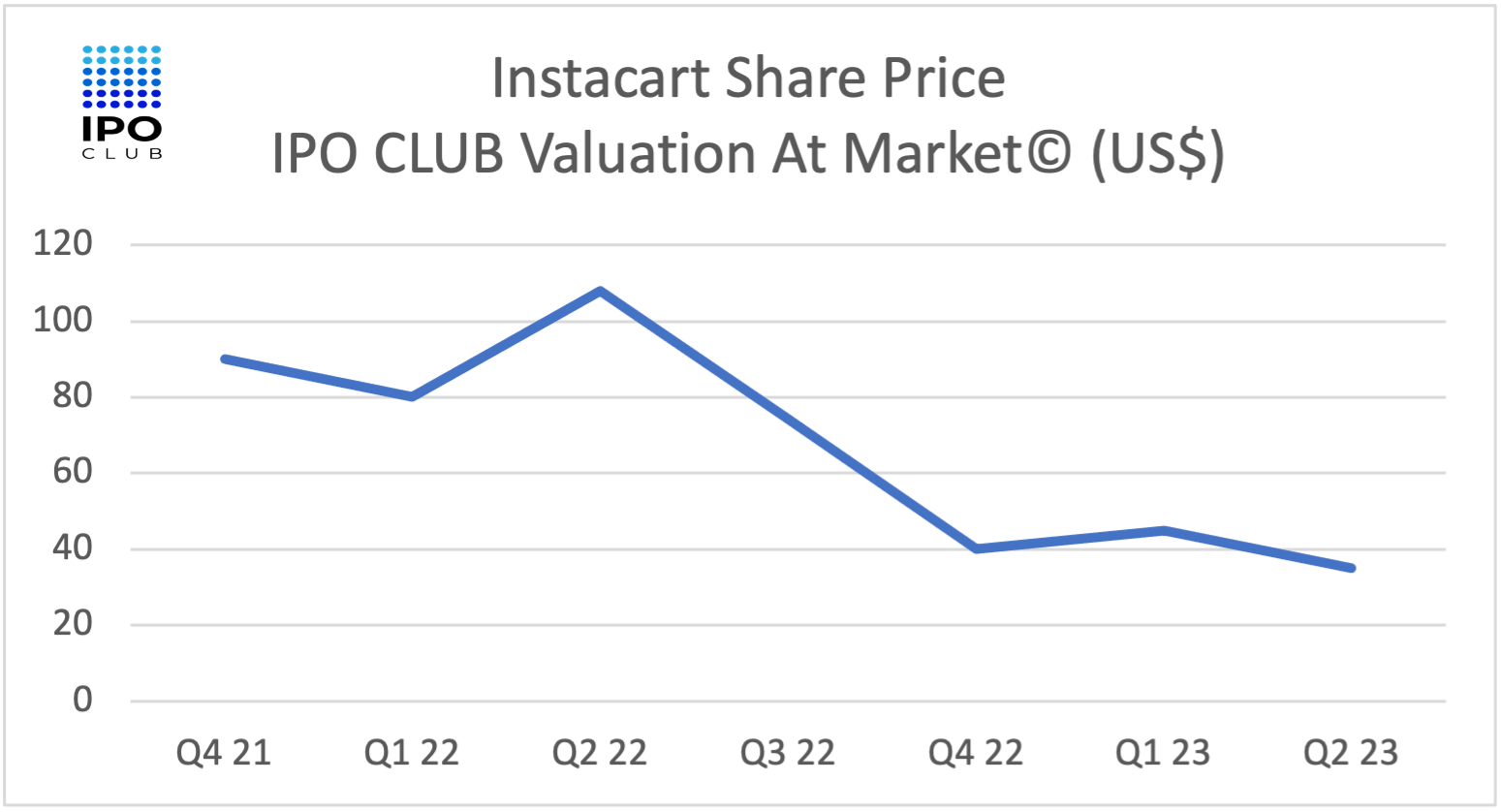

Instacart Valuation

In March of last year, Instacart slashed its valuation to $24 billion from $39 billion as public stocks sank. The valuation reportedly fell by another 50% by late 2022 to $12 billion.

Currently, or just before the S-1 filing, the valuation is comprised of an $8 billion bid and a $10 billion offer, or $27 and $32 in the market for the stock.

For more coverage about Instacart, subscribe to our club letter

Instacart's upcoming IPO is undoubtedly one of the most anticipated, given its significant market position in the online grocery delivery industry. Investors will be keenly watching its financial metrics, growth trajectory, and plans for future profitability. While the company has a promising position, it must weigh its strengths against the challenges of operating in a competitive and low-margin environment.

What is IPO CLUB

We are a club of Investors with a barbell strategy: very early and late-stage investments. We leverage our experience to select investments in the world’s most promising companies.

Disclaimer

Private companies carry inherent risks and may not be suitable for all investors. The information provided in this article is for informational purposes only and should not be construed as investment advice. Always conduct thorough research and seek professional financial guidance before making investment decisions.