Latest Trends on Pre IPO Companies

News on portfolio companies and sectors we cover

October Update on Live Investments, Covering the Previous 90 Days

October Update on Live Investments, Covering the Previous 90 Days

AI Meteoric Rise in Frontier Technologies

The global AI market is set to surge from $189 billion in 2023 to $4.8 trillion by 2033, driving growth equity investment and reshaping frontier technologies. AI’s market share will jump from 7% to 29%, outpacing IoT, blockchain, and electric vehicles. Discover key trends and growth equity opportunities in AI’s trillion-dollar future.

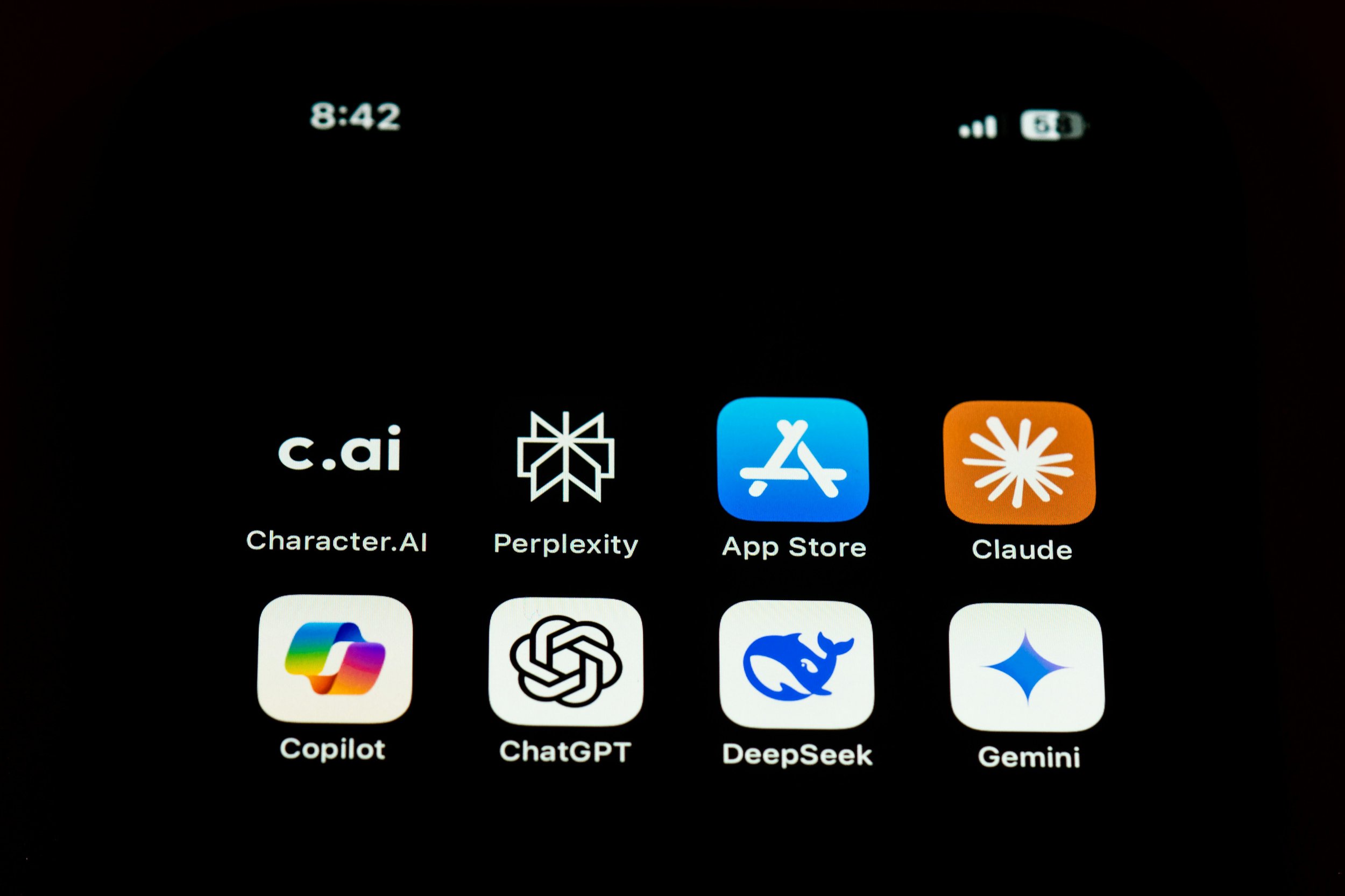

The AI Arms Race: How China tries to Overtake the U.S. by 2030

China is racing to surpass the U.S. in AI dominance by 2030, leveraging state subsidies, aggressive data collection, and alleged IP theft. With companies like DeepSeek and Huawei leading the charge, how can America maintain its edge?

The U.S.-China AI Race: An Ecosystem Problem, Not Just a Technology Gap

We discuss two key sectors of the America 2030 fund that are connected with China.

China’s rapid industrialization is not just about manufacturing dominance—it’s about building an entire ecosystem that supports AI, from infrastructure to energy. With six times the U.S.‘s electrical grid expansion in 2023 alone, China is laying the foundation to dominate AI. This isn’t just a technology race; it’s a systemic shift.

U.S. government exploration of blockchain technology

In January 2025, the Trump administration issued an executive order emphasizing support for digital assets and blockchain technology. The order promotes the development of lawful dollar-backed stablecoins and prohibits the establishment of Central Bank Digital Currencies (CBDCs) within the U.S. These developments show a transformation in capital formation, with digital assets becoming integral to next-generation investment portfolios. Investors are focusing on strategic positioning ahead of mass adoption, considering key trends and regulatory developments in pre-IPO digital asset investing.

2000 Years of Defense Spending

Explore 2000 years of defense spending trends, from ancient empires like the Song Dynasty and Roman Empire to modern post-WWII nations. This analysis reveals how military priorities have shaped economies and geopolitical strategies.

Betting on America Is the Winning Strategy for Investors

The U.S. stock market, driven by "animal spirits" and S&P 500 global exposure, remains the ultimate investment choice. Learn why historical data and expert insights, including Stanley Druckenmiller's comments, reinforce America's consistent market dominance.

#USMarkets #SP500 #Investing #StanleyDruckenmiller #AnimalSpirits #VanguardData #StockMarketPerformance #GlobalExposure #DollarStrength #JohnBogle #AmericanEconomy #InvestorProtections #StableRegulation #EmergingMarkets #MarketAnalysis

In Plain Sight, No Longer Invisible: Europe at a Crossroad

Europe's reliance on external powers for security, energy, and trade is unraveling, exposing vulnerabilities. IPO CLUB highlights investment opportunities in defense (Natilus) and energy (Newcleo) as critical to bridging the gap with global power blocs.

OpenAI's ChatGPT Pro Subscription Losses

The recent revelation by Sam Altman, CEO of OpenAI, that the company is currently losing money on its $200 per month ChatGPT Pro subscriptions is a stark reminder of the financial tightrope that innovation in AI often requires. This admission was made in a candid social media post where Altman described the situation as an "insane thing," highlighting how the usage of the Pro plan has exceeded expectations, leading to unexpectedly high operational costs.

Automation and Technology Transforming Modern Warfare: The Future of Defense

Exploring the dual-use potential of AI models like Grok, ChatGPT, and Gemini in defense: from real-time data analysis and intelligence gathering to training simulations, each AI offers unique capabilities that could enhance military operations if adapted with ethical safeguards.