Latest Trends on Pre IPO Companies

Follow the news on the most interesting Pre-IPO companies

Ripple builds new partnerships in Europe

Ripple builds new partnerships in Europe with Paris-based payment provider for online marketplaces Lemonway and Swedish money transfer provider Xbaht.

Epic Games Says Google Pushed Competitors Not To Launch App Stores

Epic Games, which makes the hit game Fortnite, has accused Google of more antitrust behavior, claiming the tech giant "paid off developers with the means, capability and desire" to lunch competing app stores.

OpenSea CFO joins exodus and leaves

OpenSea’s CFO Brian Roberts resigns position. The NFT trading platform has seen its sales volume decline rapidly. Several crypto top executives have left their positions in light of the recent bear market.

Private Company Secondaries Outperform Public Peers in September

ApeVue data show that private companies weathered September

Stocks of private companies far outpaced public equity peers last month, according to ApeVue, the first independent, daily pricing data service for unicorn stocks. Amid a weak year in public markets, the 50 most active private companies in the institutional market, including well known brands like Stripe, Impossible Foods and Klarna, lost 30.61% for investors up until October 1st.

Q3 22 Valuation At Market

The rules for Valuation at Market© are based on the PRE IPO CLUB LLC proprietary methodology: price inputs are derived from the 10 most active secondary brokers during the quarter, as well as publicly available information, such as federal filings (e.g., Form D), state filings (e.g., amendments to Certificates of Incorporation, Limited Offering Exemption Notices, Employee Plan Exemption Notices) and company disclosures (e.g., press releases, other public statements). The calculation model is based on actual or derived prices of preferred stock and common stock, which are validated by the Fund Manager. Corporate actions, such as bankruptcies, stock splits, reorganizations, mergers and acquisitions, and spinoffs are monitored on a daily basis. Index values are calculated for each calendar month, but distributed on a quarterly basis, before the last Day of each January, April, July and October.

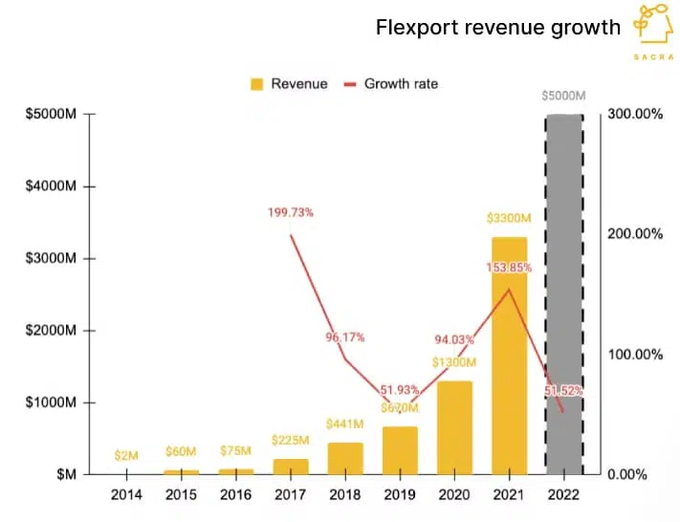

Flexport numbers look good for IPO

Flexport numbers are looking very good, above all versus its valuation that has taken a beating due to liquidations.

Kraken is going after smaller, retail crypto traders, says The “Talented Mr. Ripley.”

The Information has spoken to Kraken’s new CEO David Ripley, just after he took the helm, getting promoted from COO, following the 12 years reign of Jesse Powell.

Investing in Pre-IPO Stocks.

A Short Guide on How to Make Money in Late-Stage Private Deals

Valuation Volatility

In this short article we sum up how Volatility can help Venture Capital investment.

Family Offices and Private Deals

In this article we sum up our findings about the current role of Family Offices in the Private Deals.