Latest Trends on Pre IPO Companies

Follow the news on the most interesting Pre-IPO companies

Multiple on Invested Capital (or “MOIC”) in Venture Capital

Multiple On Invested Capital (or “MOIC”) allows investors to measure how much value an investment has generated. MOIC is a gross metric, meaning that it is calculated before fees and carry. It can be used to measure the performance of both realized and unrealized investments. It can be calculated at the deal or portfolio level.

Microsoft plans to invest $10 billion in creator of ChatGPT

Microsoft is set to invest $10 billion in OpenAI as part of a funding round that would value the company at $29 billion.

Microsoft will reportedly get a 75% share of OpenAI’s profits until it makes back the money on its investment, after which the company would assume a 49% stake in OpenAI.

A bet on ChatGPT could help Microsoft boost its efforts in web search, a market dominated by Google.

OpenAI will soon test a paid version of ChatGPT

OpenAI has shared a waitlist for a experimental ChatGPT Professional service that, for a fee, would effectively remove the limits on the popular chatbot.

OpenAI begins piloting ChatGPT Professional

OpenAI this week signaled it’ll soon begin charging for ChatGPT, its viral AI-powered chatbot that can write essays, emails, poems and even computer code.

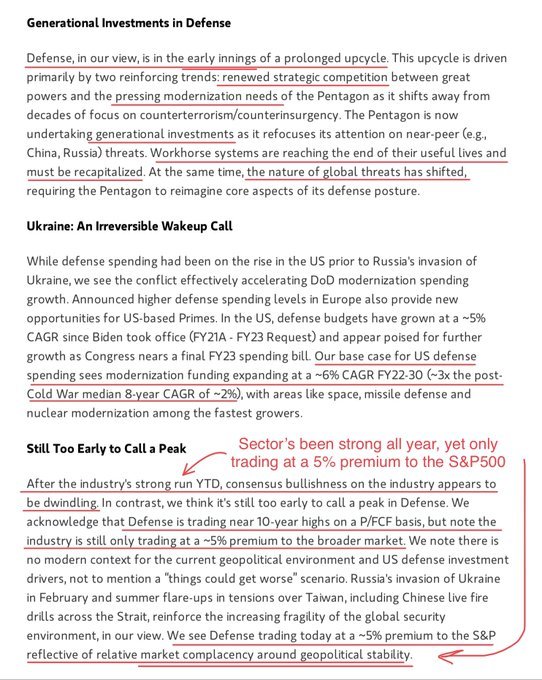

Defense stocks bull super cycle is here.

Morgan Stanley on the “early innings in the prolonged Defence upcycle”. Two key reasons: renewed strategic competition (away from two decades of fighting “terrorism”, to Russia/China), and a need to modernise workhorse systems that are reaching the end of their useful lives.

A quick look at 2023 exits

2022 was a rocky year for IPOs. In the US, the only market we care about, the number of IPOs fell by 76% and proceeds down 95%. And look at the Renaissance ETF IPOs, it's down more than 50% over the last year.

ANDURIL AUTONOMOUS SUB DOCKS IN SYDNEY

The stealthy extra-large autonomous undersea vehicle program (XL-AUV) being developed by Anduril Australia has been formally named the “Ghost Shark” by the Department of Defense in a ceremony in Sydney.

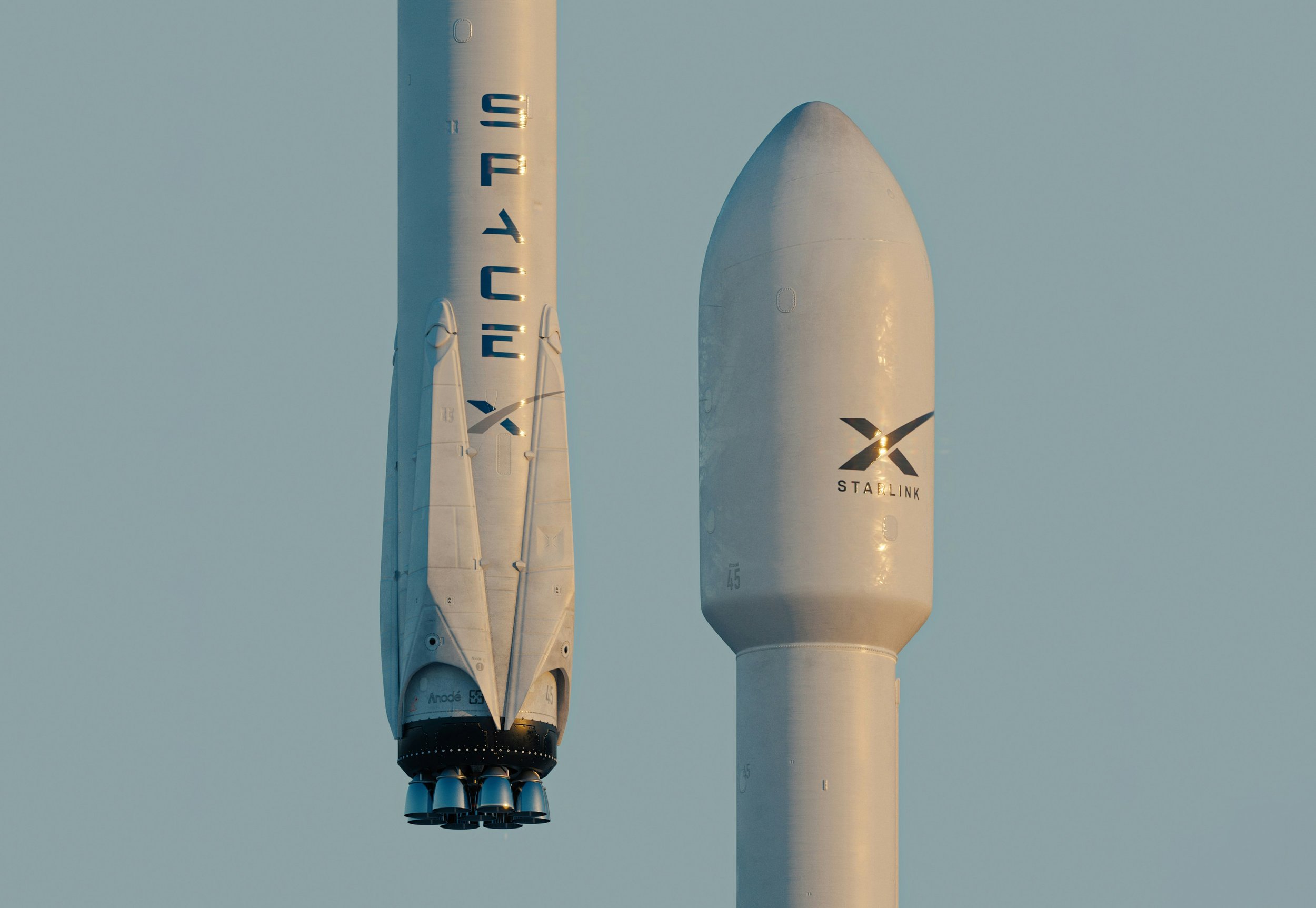

SpaceX Valued at $137 Billion in Latest Funding Round

Space Exploration Technologies Corp. is raising $750 million in new fundraising, which values the company at $137 billion.

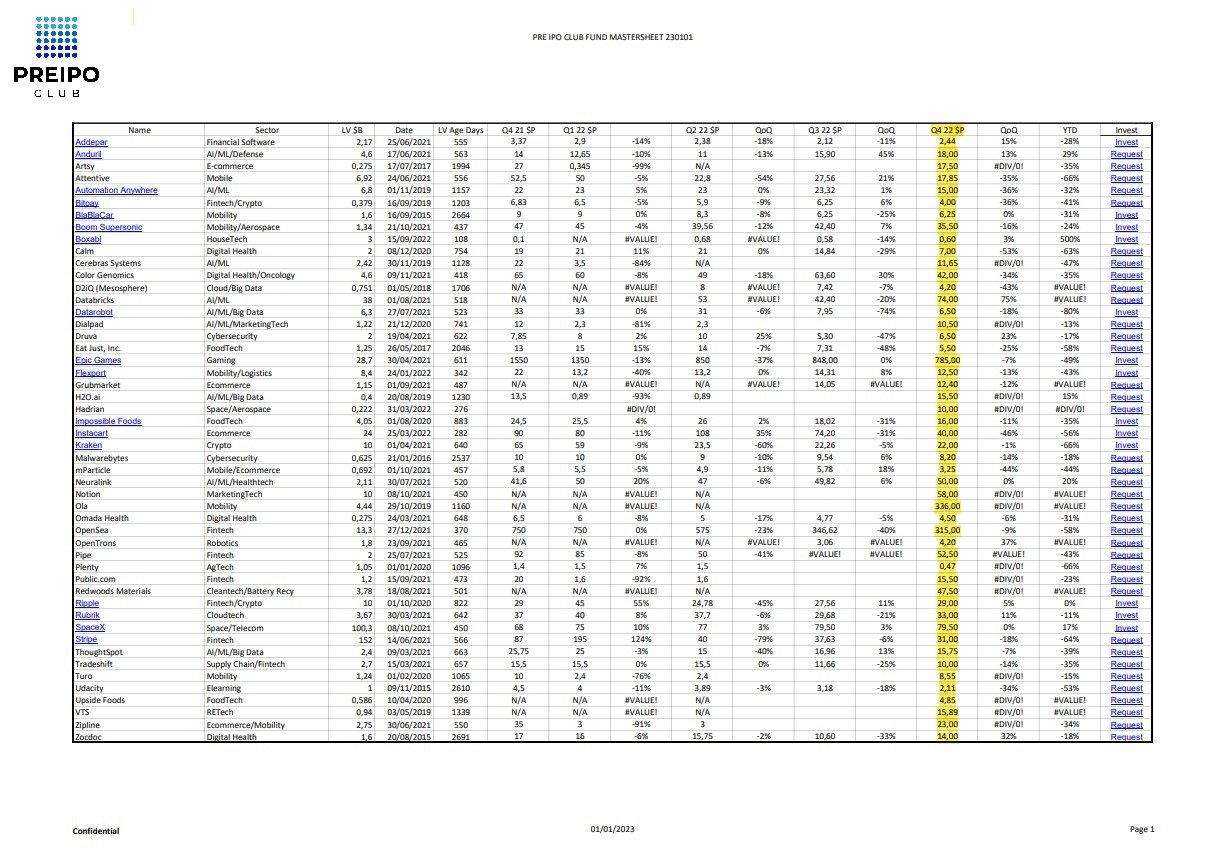

Q4 22 Valuation At Market

The rules for “Valuation at Market©” are based on the PRE IPO CLUB LLC proprietary methodology: price inputs are derived from the 10 most active secondary brokers during the quarter, as well as publicly available information, such as federal filings (e.g., Form D), state filings (e.g., amendments to certificates of incorporation, limited offering exemption notices, employee plan exemption notices), and company disclosures (e.g., press releases, other public statements). The calculation model is based on actual or derived prices of preferred stock and common stock, which are validated by the fund manager. Corporate actions, such as bankruptcies, stock splits, reorganizations, mergers and acquisitions, and spinoffs, are monitored on a daily basis. Index values are calculated for each calendar month, but distributed on a quarterly basis, before the last day of January, April, July, and October.

SpaceX sets a new record by reusing its F9 booster for the 15th launcH

SpaceX sets a new record by reusing its F9 booster for the 15th launch. It has been an honor to fund this project with so many talented company managers and employees, as well as one crazy CEO.