Latest Trends on Pre IPO Companies

Follow the news on the most interesting Pre-IPO companies

EPIC Games IPO: Analysis and Investor Insights

Epic Games is steering towards a 2026 IPO with robust growth strategies including significant partnerships and innovative content expansions. This analysis delves into Epic's preparation for its IPO, highlighting strategic collaborations with Disney and LEGO, and its impactful return to mobile gaming platforms, projecting a valuation near $57 billion.

#EpicGames #IPO #GamingIndustry #Fortnite #InvestmentOpportunity #MobileGaming #StrategicPartnerships #Disney #LEGO #InteractiveEntertainment #epic #fortnitecommunity #ps4 #gaming #entertainment #playstation #xbox #epicgamesstock #privateequity #VentureCapital #vc #PreIPO #IPO #investing #familyoffice #wealthmanagement #venture #gamer #gamingcommunity #onlinegaming #newgame

Dismissed Distributions?

Venture capital’s allure has always been rooted in its promise of outsized returns, derived from the successful incubation and maturation of groundbreaking startups. Yet, there's an emerging narrative that reveals a critical oversight in the venture capital saga: the Dismissed Distributions.

Investing in Boxabl: A tale of two cities.

Exploring the juxtaposition of Boxabl's financial and operational realms, this article mirrors the essence of Charles Dickens's "A Tale of Two Cities," revealing a stark contrast between the company's fiscal challenges and its progressive strides in innovation. Despite disappointing revenue figures and increased liabilities, Boxabl's commitment to enhancing production efficiency and expanding market reach forecasts a promising horizon, underpinned by strategic executive appointments and technological advancements.

ACE NEW YORK $5,000,000 Capital Campaign supported by IPO CLUB.

IPO CLUB proudly supports the Association of Community Employment Programs for the Homeless (ACE), a distinguished 501(c)(3) nonprofit organization committed to transforming lives in New York City. Since 1992, ACE has provided job training, education, and support services to the homeless, aiding their journey toward economic independence and societal reintegration.

Natilus innovates aviation with the Kona

Natilus is revolutionizing aviation with its blended-wing-body aircraft, the Kona, promising to slash emissions and operational costs. This groundbreaking design merges efficiency with sustainability, signaling a new era for the industry.

Venture Capital and Private Equity in 2023

Unveiling the 2023 dynamics of private equity and venture capital markets, this analysis delves into PE's resilience amidst global fundraising challenges and VC's strategic pivot in response to economic headwinds. Gain insights into the sectors' performances, trends, and investment shifts.

Kraken Unveils Qualified Custody Solution in the US

Discover Kraken's innovative step into the future of crypto with its state-of-the-art qualified custody solution, Kraken Custody. Engineered for institutional investors, this platform offers unmatched security and regulatory compliance, setting a new standard in the digital asset market. Dive into how Kraken Custody is revolutionizing institutional crypto investments and why it's the trusted choice for navigating the complexities of the crypto world.

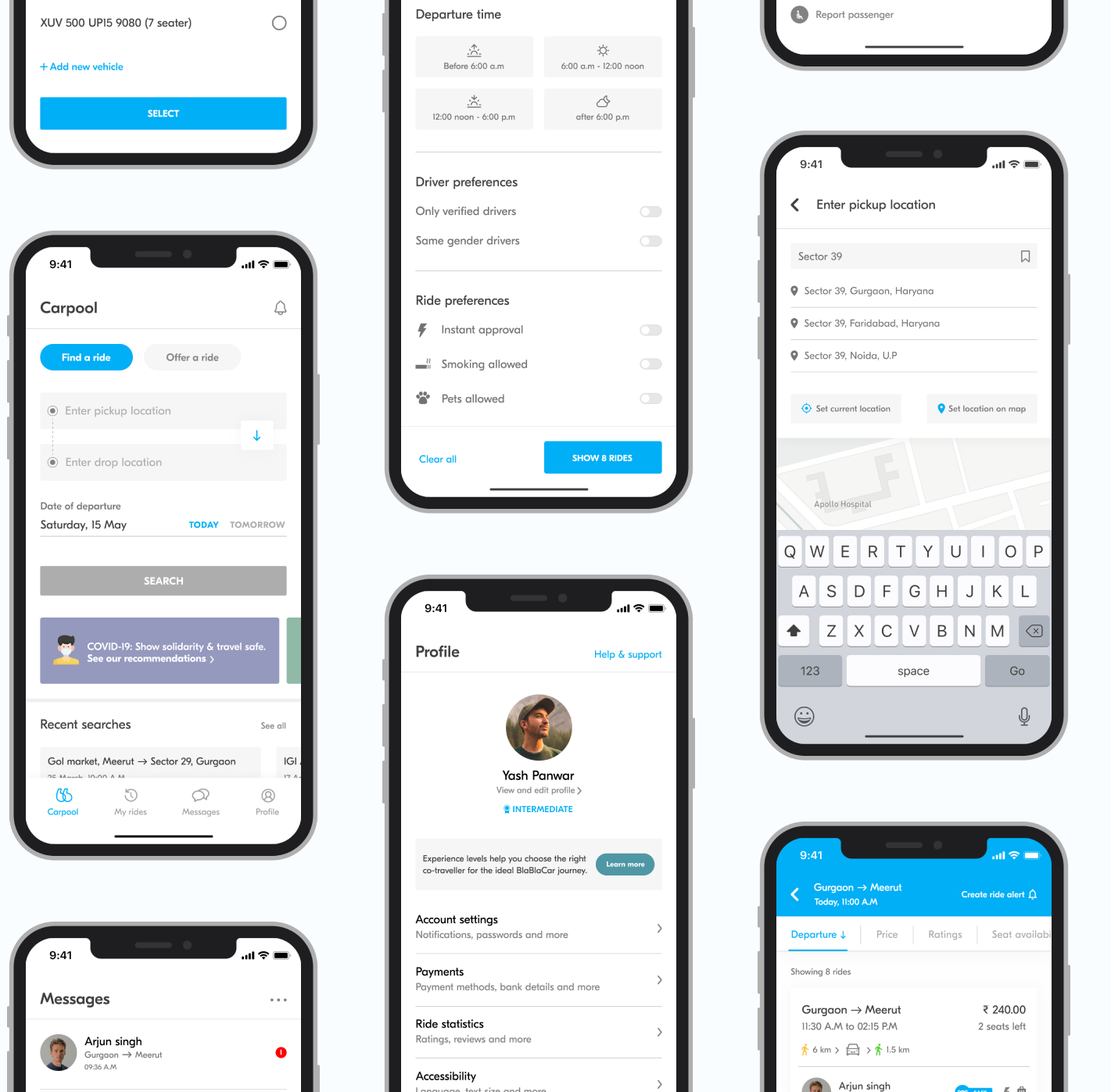

Blablacar secures $100 million credit line

BlaBlaCar secures a €100M credit facility, marking a strategic move for expansion and acquisitions. The company has led in shared mobility with profitability since April 2022 and plans to add train tickets.

Stripe's valuation increased to $65 billion

Stripe's valuation has increased to $65 billion in a recent employee stock sale deal, marking a 30% rise from its valuation in the previous year. This increase contrasts with its $95 billion peak in 2021. The agreement involved buying over $1 billion of shares from current and former employees, with notable participation from investors like Sequoia Capital and Goldman Sachs's growth equity fund. This move, seen as a liquidity provision for employees, postpones the anticipated Stripe IPO, possibly until after 2024.

The Future of Air Freight with Innovative Autonomous Aircraft

Natilus is transforming air freight by introducing a new category of blended wing body autonomous aircraft, aimed at doubling cargo capacity while halving costs. This groundbreaking approach merges the efficiency and safety of air travel with enhanced volume and reduced expenses, potentially expanding the air cargo market to a $470 billion opportunity. Natilus' designs promise fresher, more affordable goods by optimizing transport costs and emissions. Their pilotless aircraft, compatible with current airports, represents a significant leap in logistics, offering a viable solution to the pilot shortage and increasing the safety of operations.