Latest Trends on Pre IPO Companies

Follow the news on the most interesting Pre-IPO companies

Think Outside the Boxes: Rethinking the VC Playbook for AI Investment

Most VC firms invest in the same well-trodden paths of the AI value chain, from applications to hardware. But IPO CLUB sees opportunity in the overlooked fundamentals — electricity, data, communication infrastructure, and more. Learn why thinking outside the boxes drives better returns.

Trump’s Policies Impact on selected US growth companies

Donald's Honeymoon.

With Donald Trump’s election as President of the United States, there is significant anticipation about how his proposed policies—spanning #deregulation, #tax#reforms, and international #trade—might reshape certain industries and the #leading#growth#startups in #America.

We have divided selected portfolio companies into three groups: Strongly Positive, Positive and Somewhat Positive.

Record $6 Billion Weekly Inflow into Crypto Funds

Crypto funds have recorded a historic $6 billion weekly inflow, according to BofA Global Research. This milestone reflects growing institutional interest in the crypto space, signaling confidence in IPO CLUB’s portfolio companies Ripple and Kraken.

xAI new $5billion equity round

Following Tesla’s post-election success, investor interest in Elon Musk’s ventures has surged, fueling demand for xAI’s $5 billion round at a $40 billion pre-money valuation. This round highlights xAI's remarkable advancements, including a supercomputer with 100,000 Nvidia H100 GPUs and upgraded AI capabilities integrated with the X platform.

US tech wins the elections

Donald Trump’s recent re-election promises a favorable climate for U.S. late-stage tech startups, with policies on deregulation, tax incentives, reshoring, and emerging technologies driving potential growth. Enhanced government partnerships, particularly in AI and aerospace, are expected to bolster opportunities for venture-backed companies poised for expansion.

Key Geopolitical Risks Driving Global Defense, Energy, and Security Investments

Geopolitical tensions are reshaping global defense, energy, and security sectors, with increased military budgets in Europe, regional conflicts in the Middle East, and rising defense spending in the Asia-Pacific. From cybersecurity threats to energy security challenges, these risks highlight critical investment opportunities across defense technology, renewable energy, and cybersecurity.

Newcleo Leads in Next-Gen Nuclear Fission with Top PitchBook Exit Predictor Score

Newcleo tops PitchBook’s list for next-gen nuclear fission with a leading Exit Predictor Opportunity Score, indicating strong IPO potential and high investor returns in sustainable nuclear energy.

#newcleo #PitchBook #nuclearfission #cleanenergy #IPO #investment #sustainability #Paris

xAI Gains Potential Strategic Partner in Nvidia as AI Ecosystem Expands

As Nvidia continues to shape the AI landscape with strategic investments, its rumored involvement in xAI signals a future where it isn’t just a hardware provider but a driver of innovation within the AI development ecosystem. The tech world will closely monitor this potential collaboration, as it could mark a significant milestone in how industry giants like Nvidia influence the trajectory of artificial intelligence.

#Nvidia #xAI #ElonMusk #AIInvestment #GrokChatbot #AIEcosystem #NvidiaChips #TechIndustry #StrategicInvestment #JensenHuang #AIAdvancements

Trading Ripple News: Digital Custody Guide, XRP ETF Filing, and New Stablecoin Launch

Ripple extends its influence in digital finance with initiatives in digital custody, an XRP ETF filing, and a new USD-pegged stablecoin, RLUSD. These moves reinforce its strategic position amid regulatory challenges and underscore its commitment to supporting banks and capturing market share in digital assets.

#Ripple #DigitalCustody #XRP #RippleETF #Stablecoin #RLUSD #DigitalFinance #CryptoRegulation #FinancialInstitutions #DigitalAssets

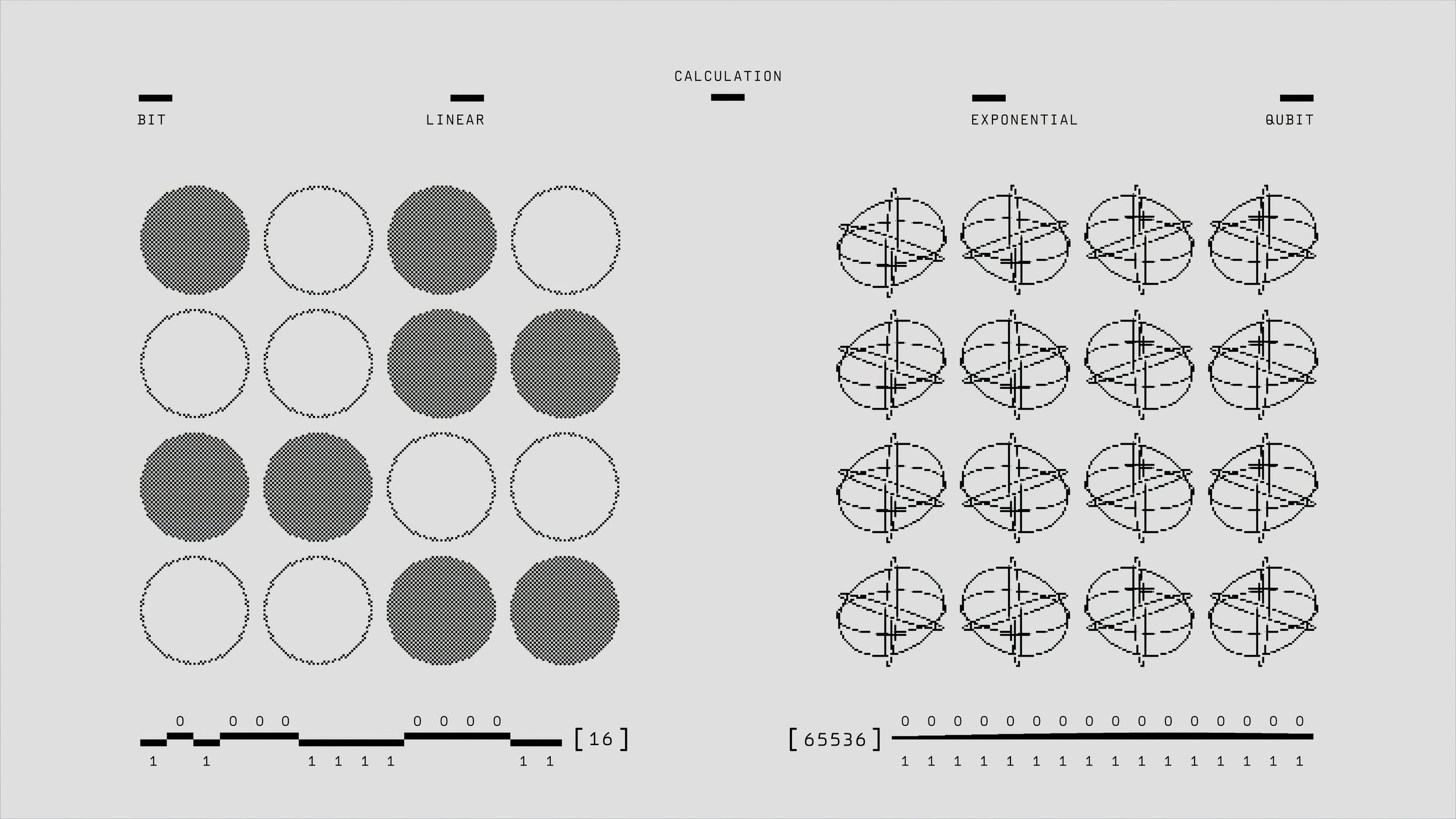

Is Quantum Computing Underfunded in the U.S.?

Quantum computing in the U.S. faces funding challenges relative to its potential, particularly in defense. With venture funding of only $1.2 billion in 2023 and public funding lagging behind other nations, quantum could benefit from increased strategic investment. Quantum’s impact on cryptography, secure communications, and defense logistics highlights the need for greater support in this critical sector.