Latest Trends on Pre IPO Companies

News on portfolio companies and sectors we cover

Crusoe Energy’s big AI Pivot

Crusoe Energy is making a bold pivot to AI infrastructure, developing a 4 million sq. ft. hyperscale data center campus in Texas and securing collaborations with OpenAI, Oracle, and Google. As AI overtakes energy as its primary revenue stream, Crusoe is emerging as a critical enabler of sustainable, high-performance compute.

Castelion: Hypersonic Defense Disruptor Gaining Speed in the Secondary VC Market

Castelion, a hypersonic weapons startup founded by ex-SpaceX engineers, raised $100M in January 2025 to mass-produce affordable long-range strike systems. Backed by Lightspeed, a16z, and others, the company is poised to reshape defense tech with rapid testing and scalable manufacturing.

Google’s $32B Wiz Acquisition Sparks Momentum in AI-Driven Cybersecurity

Google’s $32B acquisition of Wiz signals strong investor confidence in AI-driven cybersecurity, boosting valuations and M&A activity. This creates a positive climate for secondary market investors, especially in high-growth cybersecurity startups. America 2030’s pipeline includes top firms like Orca Security, Cybereason, and Dragos—positioned for potential exits. Explore pre-IPO opportunities now.

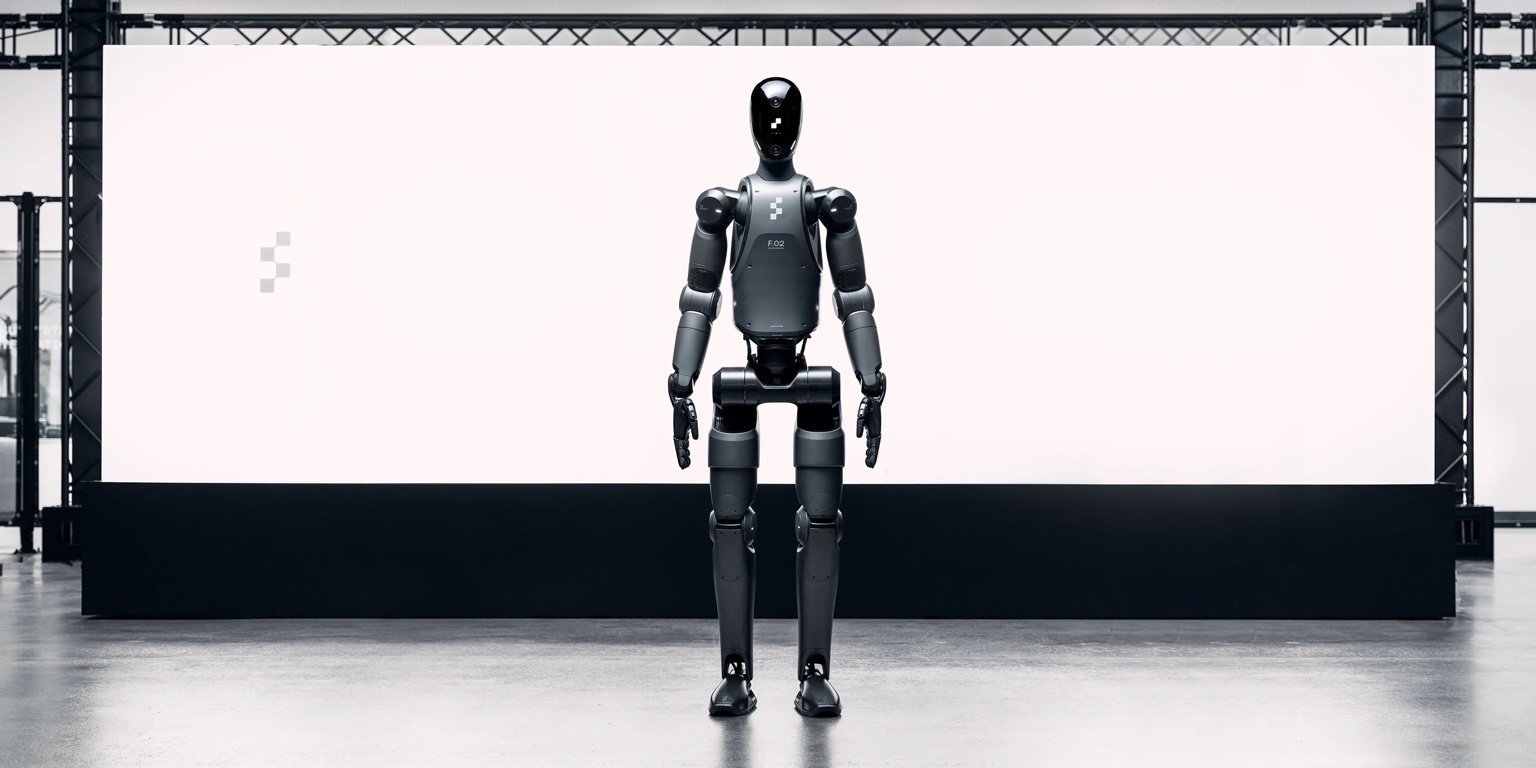

Figure AI’s $39.5 Billion Valuation: A Game-Changer in Humanoid Robotics?

Figure AI is reportedly raising $1.5 billion at a staggering $39.5 billion valuation—15x its February 2024 value. With commercial deals secured and production scaling, it now ranks among the world’s top robotics companies. Is this the future of AI-driven automation?

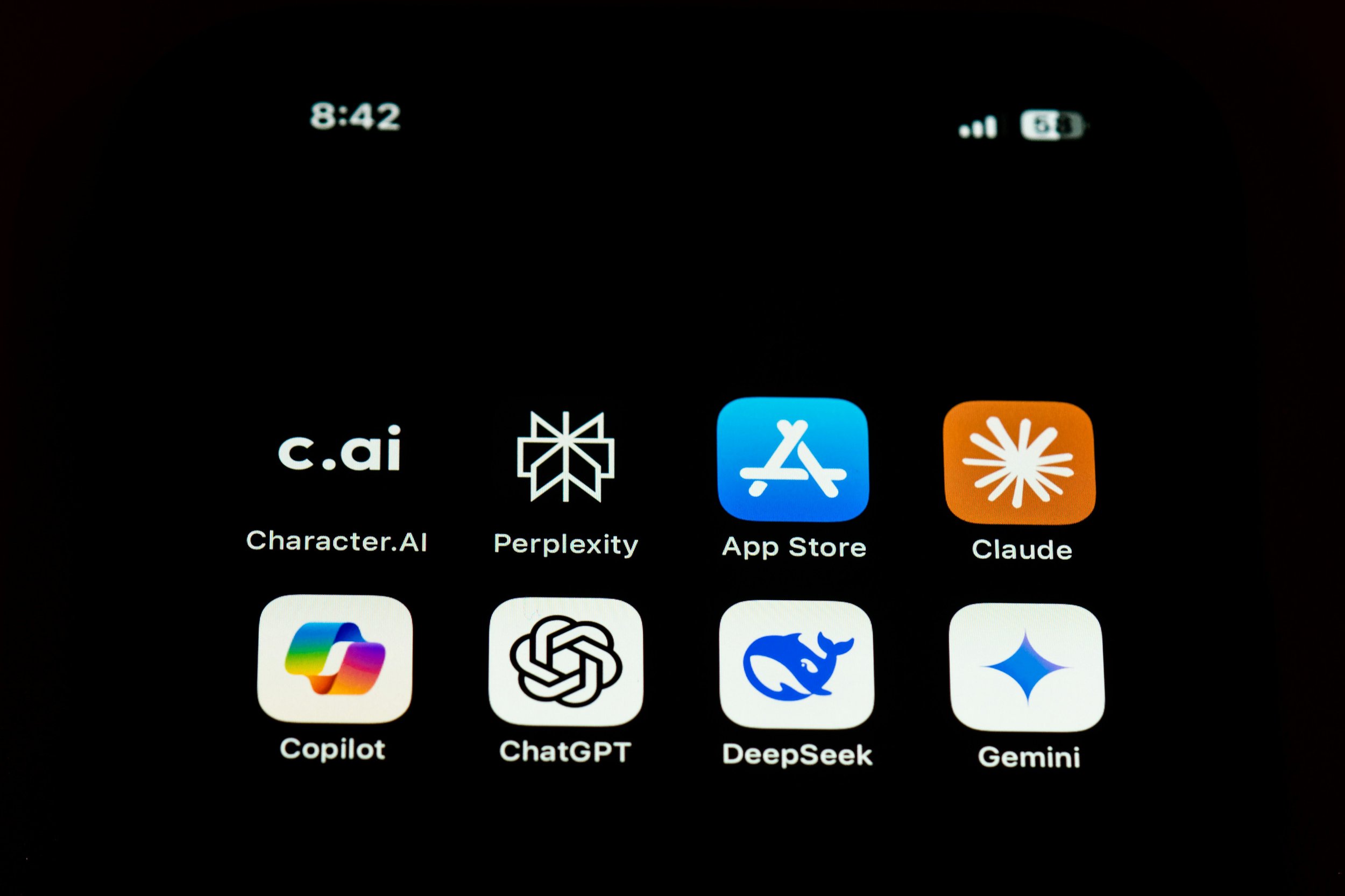

The AI Arms Race: How China tries to Overtake the U.S. by 2030

China is racing to surpass the U.S. in AI dominance by 2030, leveraging state subsidies, aggressive data collection, and alleged IP theft. With companies like DeepSeek and Huawei leading the charge, how can America maintain its edge?

The U.S.-China AI Race: An Ecosystem Problem, Not Just a Technology Gap

We discuss two key sectors of the America 2030 fund that are connected with China.

China’s rapid industrialization is not just about manufacturing dominance—it’s about building an entire ecosystem that supports AI, from infrastructure to energy. With six times the U.S.‘s electrical grid expansion in 2023 alone, China is laying the foundation to dominate AI. This isn’t just a technology race; it’s a systemic shift.

Huntress: Pioneering Cybersecurity for the Underserved SMB Market

Huntress, a cybersecurity leader for SMBs, has surpassed $100M ARR and raised $150M at a $1.5B+ valuation. With rapid growth, key acquisitions, and a potential 2025 IPO, Huntress is a prime candidate for secondary market interest. Discover its market position, funding history, and future outlook.

Kraken’s Market Resurgence: Secondary Activity and Growth Signals in 2025

Kraken is demonstrating a strong recovery, marked by a resurgence in secondary market trading, growing revenue, and strategic expansion efforts. While regulatory pressures persist, the exchange’s security-first approach and institutional focus position it well for sustained growth. For investors, Kraken remains a compelling pre-IPO opportunity with improving market sentiment.

Neuralink begins testing brain-controlled assistive robotics

Neuralink has launched its CONVOY study, testing its brain-computer interface (BCI) for controlling assistive robotic devices. The study’s first participant, Alex, who is paralyzed from the neck down, previously used Neuralink’s BCI to design graphics telepathically. Now, he will explore controlling a robotic arm, marking a major step in assistive tech.

Scalable Carbon Capture from Greenland

A breakthrough discovery in Greenland’s coastal waters has led to a revolutionary carbon capture technology. Ikkaton, co-founded by Dr. Erik Trampe, mimics natural mineralization processes to lock CO₂ in stable forms. With a growing global market for CO₂-negative calcium carbonate, this startup is set to redefine sustainable carbon management.