Anduril

Written by Edoardo Zarghetta

Anduril is in the pipeline of America 2030, IPO CLUB’s $50M, actively managed secondary fund focused on U.S. defense, energy, security, and AI.

Founded in 2017 (Source: Company founding announcement, June 2017), Anduril is headquartered in Irvine, California and employs ~700 people (Source: Company press release, Mar 2025). The company operates at the intersection of autonomous systems, AI-enabled warfare, and next-generation unmanned systems—core verticals within America 2030.

What is Anduril?

Anduril Industries is a U.S. defense-technology company developing autonomous systems, AI-powered military platforms, counter-UAS systems, advanced sensors, and next-generation battle-management software.

Founded by Palmer Luckey (Source: CNBC interview, Sept 2024), Anduril uses a Silicon-Valley engineering model—private capital, rapid iteration, and software-first R&D—to build capabilities that traditionally took defense primes years to deliver.

What Anduril Builds?

Unmanned Aerial Systems & Counter-UAS

Ghost – Autonomous ISR drone

(Source: Product launch briefing, Apr 2024)Altius – Tube-launched fixed-wing UAV

(Source: Area-I acquisition note, Mar 2023)Anvil – Autonomous interceptor drone

(Source: Counter-UAS program fact sheet, Oct 2024)

Sensors, Imaging & Surveillance

Iris – Advanced airborne IRST + targeting sensor

(Source: AIRS acquisition announcement, Jan 2025)Deployed multi-domain surveillance systems on U.S. and allied borders

(Source: DHS contract summary, Aug 2024)

Weapon Systems & Aerospace

Solid Rocket Motors – Expanding tactical propulsion capacity

(Source: DoD industrial base update, Feb 2025)Roadrunner & Roadrunner-M – Reusable autonomous interceptor

(Source: Roadrunner product disclosure, May 2024)

Software & Command Platforms

Lattice – AI-driven open-architecture operating system enabling sensor fusion, autonomous decision-making, and battle-networking across domains. (Source: Lattice software whitepaper, Dec 2023)

Global Operations

Presence in U.S., U.K., Australia, with expanding deployments across AUKUS partners and NATO allies

Strategic partnerships with cloud/AI providers for mission-critical compute. (Source: AUKUS industry partnership statement, Jul 2024)

M&A Strategy

Area-I (tube-launched UAVs) – Jan 2021

Blue Force Technologies (autonomous fighter drone R&D) – Sep 2023

AIRS (IR imaging hardware) – Jan 2025

(Sources: Company acquisition announcements)

Anduril is in the pipeline of America 2030, IPO CLUB’s $50M, actively managed secondary fund focused on U.S. defense, energy, security, and AI.

Market Position & Strategic Significance

Silicon-Valley R&D Model

Anduril builds full systems before contracts (“product-first”), bypassing slow cost-plus procurement cycles. (Source: Anduril strategy briefing, Apr 2024)

Speed, iteration, and private capital put it structurally ahead of legacy primes.

AI-Driven Defense Leadership

Leader in autonomous ISR, counter-UAS, AI battle-management, and software-defined weapon systems.

Positioned to capture a material share of the $38B AI-defense market by 2030. (Source: DoD FY2025–2030 Budget Projection, Feb 2025)

Manufacturing Scale

Arsenal-1 (Ohio) – $900M advanced manufacturing facility. (Source: State of Ohio industrial investment release, Nov 2024)

Designed for high-volume production of autonomous systems

Expected to create ~4,000 jobs by 2035. (Source: JobsOhio projection, Nov 2024)

Competitive Landscape

Competes with Lockheed Martin, Northrop Grumman, RTX

Advantage: software-native architecture, higher update velocity, vertically integrated autonomy stacks. (Source: Defense industry comparative analysis, Jul 2024)

Financials & Growth

Revenue

2023: $457M (Source: Forbes revenue estimate, Feb 2024)

2024: ~$1B (Source: PitchBook Anduril Profile, Aug 2024)

2026E: ~$2B (Source: Morgan Stanley defense-tech forecast, Jan 2025)

Valuation

$14B (Aug 2024) – Series F (Source: PitchBook, Aug 2024)

$28B (Feb 2025) – Series G, doubling valuation (Source: CB Insights, Feb 2025)

Secondary markets reflect rising demand for dual-use autonomy platforms

Capital Raises

2017: Seed

2019: Series B – $120M, $1B valuation

2020: Series C – $200M, $2B valuation

2021: Series D – $450M, $4.6B valuation

2024: Series F – $1.5B, $14B valuation

2025: Series G – $2.5B, $28B valuation

Anduril is in the pipeline of America 2030, IPO CLUB’s $50M, actively managed secondary fund focused on U.S. defense, energy, security, and AI.

Contract Momentum (Selected)

2024–2025 U.S. Awards

$99.6M – Next-Generation Command and Control (NGC2) ecosystem (Source: DoD Contract Announcement, Feb 2025)

$159M – Soldier Borne Mission Command program (Source: U.S. Army PEO Soldier contract notice, May 2025)

Expansion across multi-domain autonomy, ISR, and tactical communications

Potential Catalysts

Opportunity to replace elements of the IVAS program if ongoing reviews favor Anduril’s systems (Source: Congressional Budget Justification, Mar 2025)

Additional AUKUS procurement pathways in Australia and the U.K. (Source: U.K. MoD Industry Release, Sep 2024)

Anduril founder Palmer Luckey joins 'Closing Bell Overtime' to talk its latest news about the company.

Anduril IPO

Founder’s Position

Palmer Luckey has confirmed interest in a future IPO but will time the listing for optimal public-market conditions.

(Source: CNBC interview, Sept 2024)

IPO Timing Drivers

Revenue visibility

Long-term production contracts

Maturity of Lattice and multi-domain autonomy portfolio

Market appetite for dual-use defense AI

Clarity on major programs (e.g., IVAS, C2 modernization, AUKUS acceleration)

(Source: Goldman Sachs defense-tech IPO framework, Oct 2024)

Potential IPO Valuation

Analysts indicate:

Base case: $40–60B

(Source: Evercore ISI valuation model, Oct 2025)

Upside case: Up to $90B if major long-term programs are secured.

(Source: Internal America 2030 estimate, make your own research, not financial advice).

Anduril Investors

Major backers include:

Founders Fund

Andreessen Horowitz

General Catalyst

Sands Capital

Valor Equity Partners

D1 Capital

8VC

Lux Capital

Notable individual investor:

JD Vance, U.S. Vice President (invested prior to political career).

(Source: Reuters profile, Aug 2024)

Anduril Stock

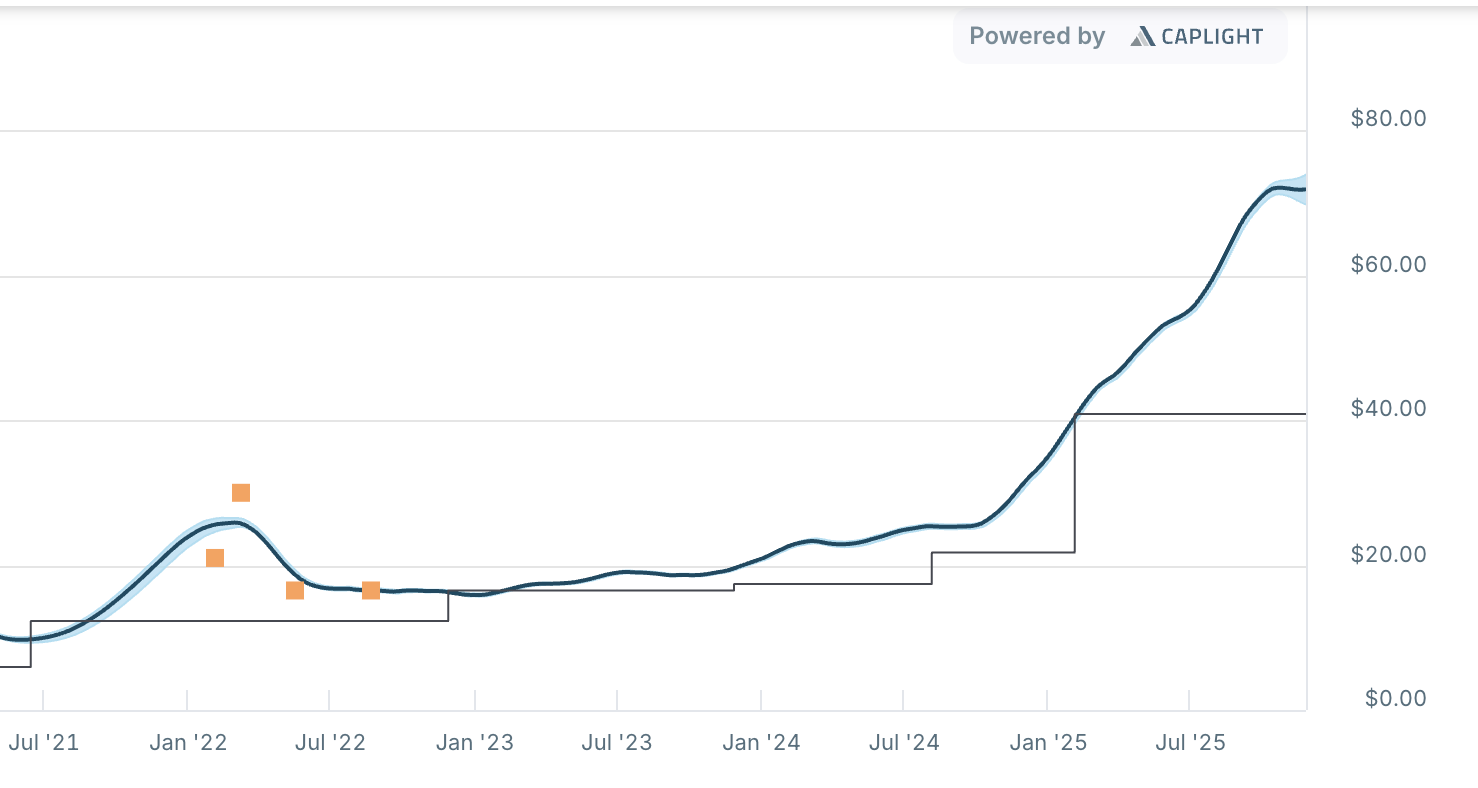

Anduril has captured the attention of investors as its secondary market share price soared to new highs in 2025, recently approaching $80 per share according to private market transactions. Following Anduril’s record-breaking $2.5 billion Series G funding round in June 2025, the company valuation exceeded $30 billion, reflecting remarkable year-over-year revenue growth and strong demand for its pre-IPO share. Sources (Caplight, IPO CLUB)

Is Anduril Public?

No. Anduril remains privately held by founders, employees, and institutional investors.

Shares trade only in limited secondary transactions.

How to Invest

IPO CLUB provides accredited investors with access to curated secondary allocations in companies like Anduril through:

Single-Name SPVs

For allocations or investment memos:

Request access → https://www.ipo.club/accredited

FAQ

When was Anduril founded?

2017.

What does Anduril specialize in?

Autonomous systems, AI-enabled military platforms, counter-UAS, sensors, and command-and-control software.

Is there an Anduril stock price?

No public stock price exists. The company is private.

When is the IPO?

No confirmed date.

What is Anduril’s valuation?

$28B (Feb 2025), based on the latest primary round.

How can investors gain exposure?

Through private secondary markets or IPO CLUB vehicles.

Anduril unveils Roadrunner & Roadrunner-M

Latest News (November 2025)

AIRS acquisition expands IR imaging capabilities

$99.6M NGC2 award strengthens C2 modernization pipeline

$159M Soldier Borne Mission Command contract secured

Growing relevance across autonomy, ISR, and networked warfare

America 2030 Integration

Anduril is part of the America 2030 investment pipeline—our actively managed, diversified secondary fund investing across:

Defense

AI infrastructure

Robotics

Energy

Dual-Use U.S. industrial base

Founder Shares remain open until December 30 under reduced fees.

Anduril and America 2030 latest news

Stay up-to-date with all the latest news about Anduril stock, the IPO, and investment opportunities. By clicking here, you'll access real-time updates and in-depth analysis from market experts, empowering you to make informed decisions about your investment journey. Whether you're a seasoned investor or just getting started, our platform is tailored to provide you with all the crucial information you need to navigate the thrilling world of the stock market and IPOs. Dive in and keep your finger on the pulse of the financial markets.

Follow us on LinkedIn

Sources (Consolidated List)

Financials & Valuation

PitchBook, Anduril Company Profile (Aug 2024)

CB Insights, Anduril Valuation Update (Feb 2025)

Forbes Defense-Tech Revenue Estimates (Feb 2024)

Morgan Stanley Defense & Aerospace Outlook (Jan 2025)

Evercore ISI Defense-Tech IPO Model (Oct 2025)

Contracts & Government Programs

U.S. Army PEO Soldier Contract Notice (May 2025)

DoD Contract Announcement (Feb 2025)

U.K. MoD Industry Release (Sep 2024)

DoD FY2025–2030 Budget Projection (Feb 2025)

Company Information

Company Founding Release (June 2017)

Company Press Releases (2023–2025)

AIRS Acquisition Announcement (Jan 2025)

Interviews & Media

CNBC Interview with Palmer Luckey (Sept 2024)

Reuters Profile on JD Vance & Early Investments (Aug 2024)

Industrial Base & Manufacturing

JobsOhio Arsenal-1 Economic Impact Report (Nov 2024)

Internal

America 2030 Valuation & IPO Scenarios (Nov 2025)

You can imagine America 2030 as a polished metal capsule sitting in the palm of your hand.

A compact, precision-engineered instrument.

Every piece designed to do exactly one thing: turn the next decade of American hard-tech into real, liquid returns.