China-US Shift: Who Builds What, and implications for Venture Investing.

Overview

China’s rise in global manufacturing and tech, combined with its retreat from investing in U.S. Treasuries signals a rebalancing of power. This macro shift has deep implications for venture investing, supporting critical infrastructure, defense and energy startups.

1. The Economic Bargain That Was

For over three decades, the U.S.-China economic relationship functioned like a well-oiled machine:

China manufactured low-cost goods, which helped the U.S. keep inflation low and corporate margins high.

In return, China recycled its trade surplus into U.S. Treasuries, suppressing U.S. borrowing costs.

This allowed the U.S. to run persistent current account deficits while still enjoying cheap financing—a dynamic economists dubbed the “exorbitant privilege” of the U.S. dollar.

Between 2000 and 2012, China’s holdings of U.S. Treasuries grew from under $100 billion to over $1.3 trillion, making it the largest foreign holder. This helped fund everything from U.S. wars to tech startups indirectly via stable interest rates and frothy valuations.

2. The Quiet Dismantling of That Bargain

Over the past decade, China has shifted strategy.

a. Declining Treasury Holdings

According to U.S. Treasury data, China’s holdings peaked in 2013 at $1.32 trillion, but have declined to around $767 billion as of early 2024 — a drop of over 40% in a decade.

This is not just a passive shift. It’s strategic:

De-risking from U.S. exposure amidst trade tensions.

Reallocating reserves into gold, strategic assets, Belt and Road infrastructure, and other sovereign bonds.

A broader de-dollarization trend, echoed by BRICS+ initiatives.

b. Rising Manufacturing Sophistication

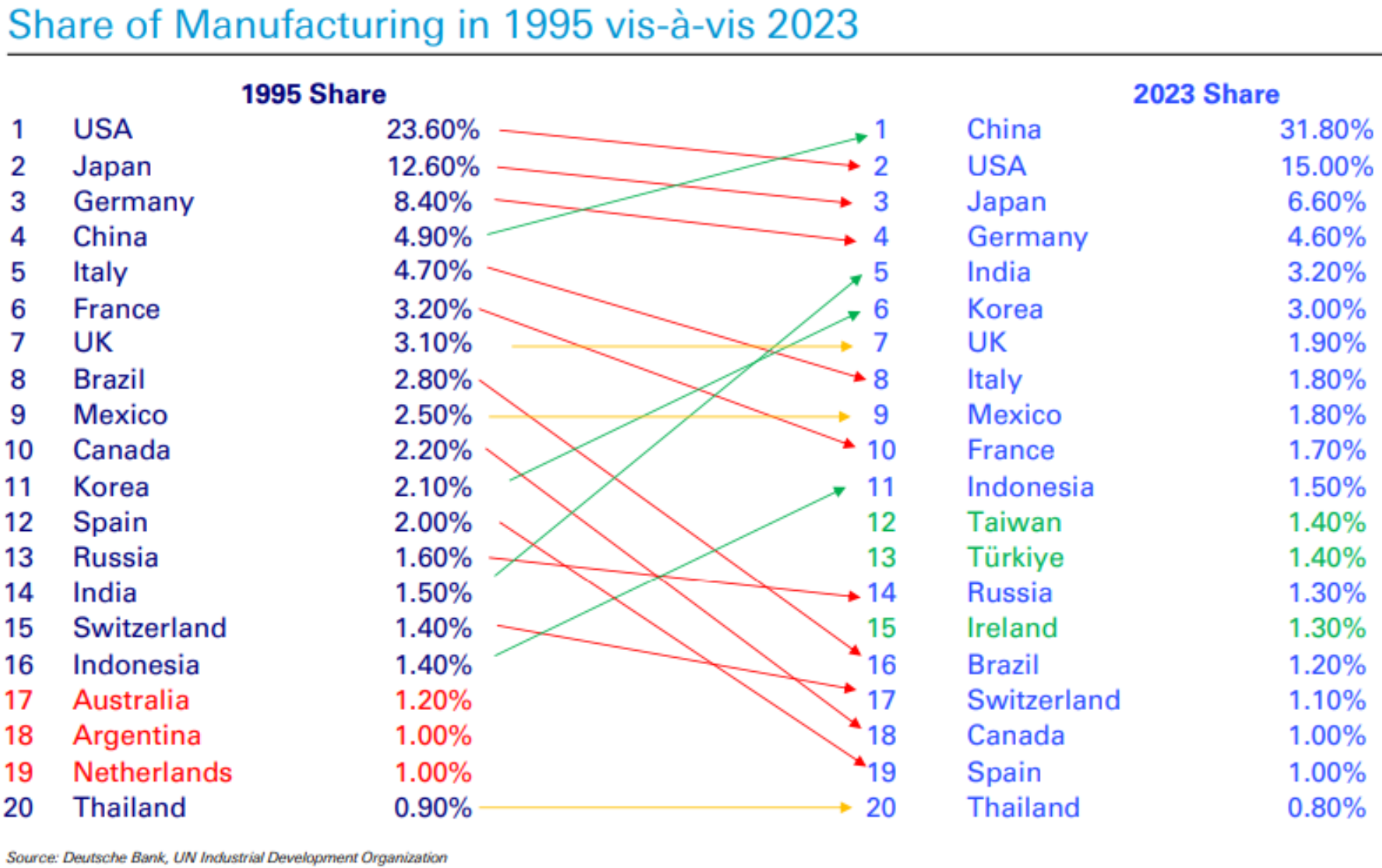

China now accounts for over 31% of global manufacturing output (World Bank, 2023), up from 20% a decade ago and under 10% in the early 2000s.

Chinese companies are no longer just low-cost assemblers:

Huawei, BYD, and DJI lead globally in telecom, EVs, and drones.

China is building export dominance in solar panels, electric vehicles, machine tools, and military drones—all areas once dominated by Western players.

In military tech, China’s export of drones to Pakistan during the India-Pakistan border skirmish in 2023 marked a watershed: non-Western parity in battlefield tech.

3. Implications for Venture Capital and Secondary Markets

a. Liquidity Tightening

China’s pullback from Treasuries means less demand for U.S. debt, pushing up yields. Higher risk-free rates:

Raise discount rates for private tech valuations.

Create tighter liquidity conditions for VCs and growth equity.

Slow the velocity of capital deployment.

b. Geopolitical Premium on Dual-Use Tech

As China rises in semiconductors, aerospace, and AI, Western investors are funneling capital into dual-use tech (civil-military), reshoring supply chains, and defense startups.

Examples:

Anduril, Shield AI, and Epirus have seen strong secondary demand, partly due to this macro backdrop.

Various U.S. companies are beneficiaries of U.S. CHIPS Act subsidies in response to China’s fab dominance, including tech startups, though private recipients are harder to track than publicly traded companies. In this space we like Lightmatter and PsiQuantum.

c. Multipolar Risk Hedging

LPs and secondaries are increasingly factoring in:

China risk exposure in startup cap tables.

Geo-sensitive exits (e.g., CFIUS blocking ByteDance acquisitions).

Demand for “clean cap tables” without PRC LPs or founders for sensitive tech.

4. The Future: A Multipolar Capital Order

The world is moving toward a potential West vs. China standoff in the next 6 years. We believe that the investment thesis of America 2030 helps preparing for winning such confrontation, should it happen.

Key signals to watch:

Yuan internationalization, though still limited, is gaining traction in energy trade.

Expansion of BRICS reserve mechanisms and CBDC pilots (China’s e-CNY is the most advanced).

Dollar liquidity risk during emerging market sell-offs.

What is IPO CLUB

We are a club of Investors with a barbell strategy: very early and late-stage investments. We leverage our experience to select investments in the world’s most promising companies.

Disclaimer

Private companies carry inherent risks and may not be suitable for all investors. The information provided in this article is for informational purposes only and should not be construed as investment advice. Always conduct thorough research and seek professional financial guidance before making investment decisions.