Impossible Metals

This company is in the pipeline of America 2030, IPO CLUB’s short-term, actively managed secondary fund focused on U.S. defense, energy, security, and AI.

Updated in January 2026

Headquarter: San Jose, California, USA

Year Founded: 2020

Leadership: Oliver Gunasekara

Industry Sectors: Climate technology; Robotics; Deep-sea mining; Critical minerals extraction

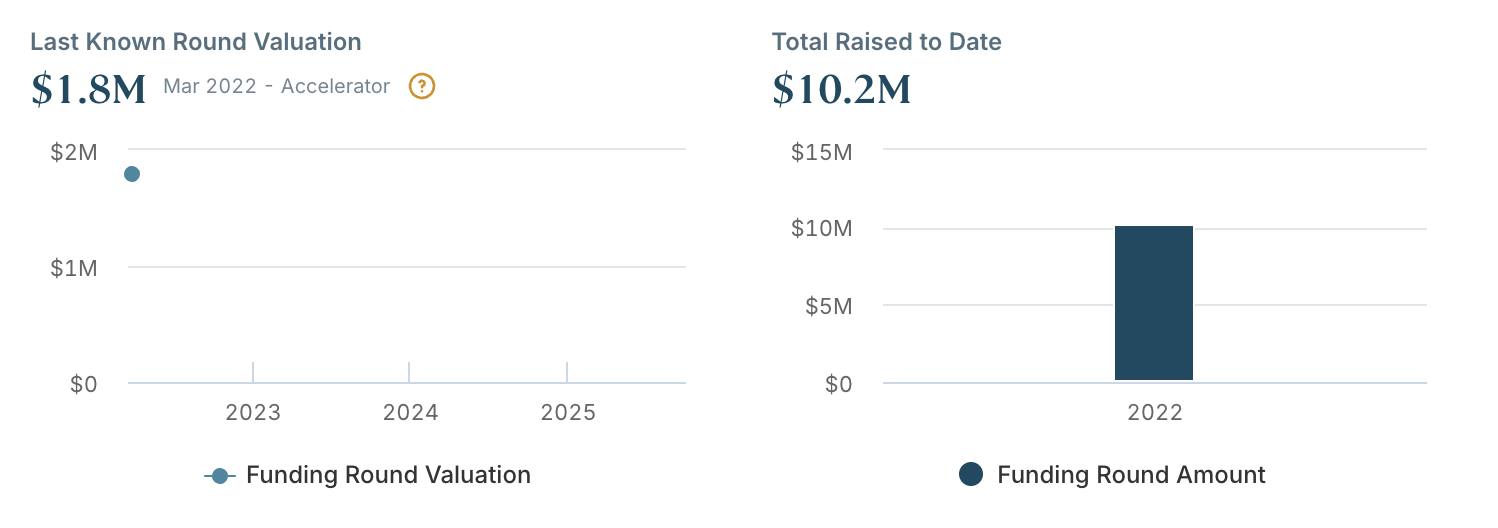

Funding Round: $15M Seed

Valuation: n/a

Is Impossible Metals A Public Company? No, it is privately held

What is Impossible Metals?

Impossible Metals is a U.S.-based deep-sea minerals technology company focused on enabling environmentally responsible access to critical battery and clean-energy metals from the ocean floor. Founded to address the growing supply constraints of nickel, cobalt, copper, and manganese, the company’s mission is to dramatically reduce the ecological impact traditionally associated with seabed mining by using precision, robotic collection methods rather than large-scale dredging. According to its website, Impossible Metals positions itself as a sustainability-first alternative to conventional terrestrial and marine mining approaches.

Technology & Products

Impossible Metals is developing an autonomous underwater robotic system designed to selectively harvest polymetallic nodules from the seabed while avoiding sensitive marine life. Instead of scraping or vacuuming the seafloor, the system uses computer vision, AI-driven object recognition, and robotic manipulation to identify individual nodules and collect them one by one, leaving surrounding sediment and organisms largely undisturbed. The company emphasizes a no-tailings, no-toxic-chemicals approach, with onboard sensing and real-time decision-making intended to minimize plume generation and habitat disruption compared with traditional seabed mining technologies.

Market Opportunity

Impossible Metals targets the rapidly expanding market for critical minerals required for electric vehicle batteries, grid-scale energy storage, and renewable energy infrastructure. As global demand for battery metals accelerates and land-based mining faces permitting delays, geopolitical risk, and environmental opposition, the company positions seabed nodules as a potentially high-grade, concentrated resource with fewer social and environmental trade-offs. The company’s approach is aimed at serving battery manufacturers, automakers, and clean-energy supply chains seeking secure, scalable, and lower-impact sources of essential raw materials.

Competitive Landscape

Impossible Metals operates within the emerging deep-sea minerals sector, alongside companies pursuing polymetallic nodule collection through more traditional mechanical harvesting systems. Its key differentiation, as stated on its website, is its selective, robotic harvesting model, which contrasts with bulk seafloor collection methods that have drawn criticism from environmental groups and regulators. By prioritizing precision robotics, AI-enabled perception, and reduced seabed disturbance, Impossible Metals positions itself as a technology-driven alternative for stakeholders concerned about the environmental footprint and regulatory risk of conventional seabed mining approaches.

How To Buy Impossible Metals Stock?

Impossible Metals is currently a private company and is not publicly traded on major stock exchanges like the NASDAQ or NYSE. This means you can buy shares through a pre-IPO platform or brokerage like IPO CLUB by becoming a FREE MEMBER.

This company is in the pipeline of America 2030, IPO CLUB’s short-term, actively managed secondary fund focused on U.S. defense, energy, security, and AI.

Impossible Metals and America 2030 Latest News

Stay up-to-date with all the latest news pertaining to this company’s stock, IPO, and investment opportunity. By clicking here, you'll gain access to real-time updates and in-depth analysis from market experts, empowering you to make informed decisions about your investment journey. Whether you're a seasoned investor or just getting started, our platform is tailored to provide you with all the crucial information you need to navigate the thrilling world of the stock market and IPOs. Dive in and keep your finger on the pulse of the financial markets.

The article summarizes each company’s jurisdiction, reactor technology, fuel type, development stage, and most recently disclosed valuation, based on publicly available information and industry disclosures as of 2024–2026.