Buy SpaceX Stock?

The Investment Case Behind a Rocket on the Launch Pad. And this time it’s not about Starlink.

A rocket stands on the launch pad, engines quiet, countdown paused somewhere in the middle.

That’s SpaceX’s valuation today.

Loaded with fuel.

Cleared for ascent.

But waiting for the next ignition sequence.

And that pause is exactly what makes the picture so interesting.

For more coverage about Spacex stock, subscribe to our club letter.

SpaceX’s private valuation has stayed effectively flat since July, a fact we observe directly in the secondary market as actual shareholders.

This stability stands in sharp contrast to AI names, whose valuations have exploded upward in 2025.

The market is behaving as if AI is the only frontier technology worth bidding up.

But rockets tell a different story.

SpaceX has executed more than 129 launches in 2025, maintaining the highest launch cadence in history.

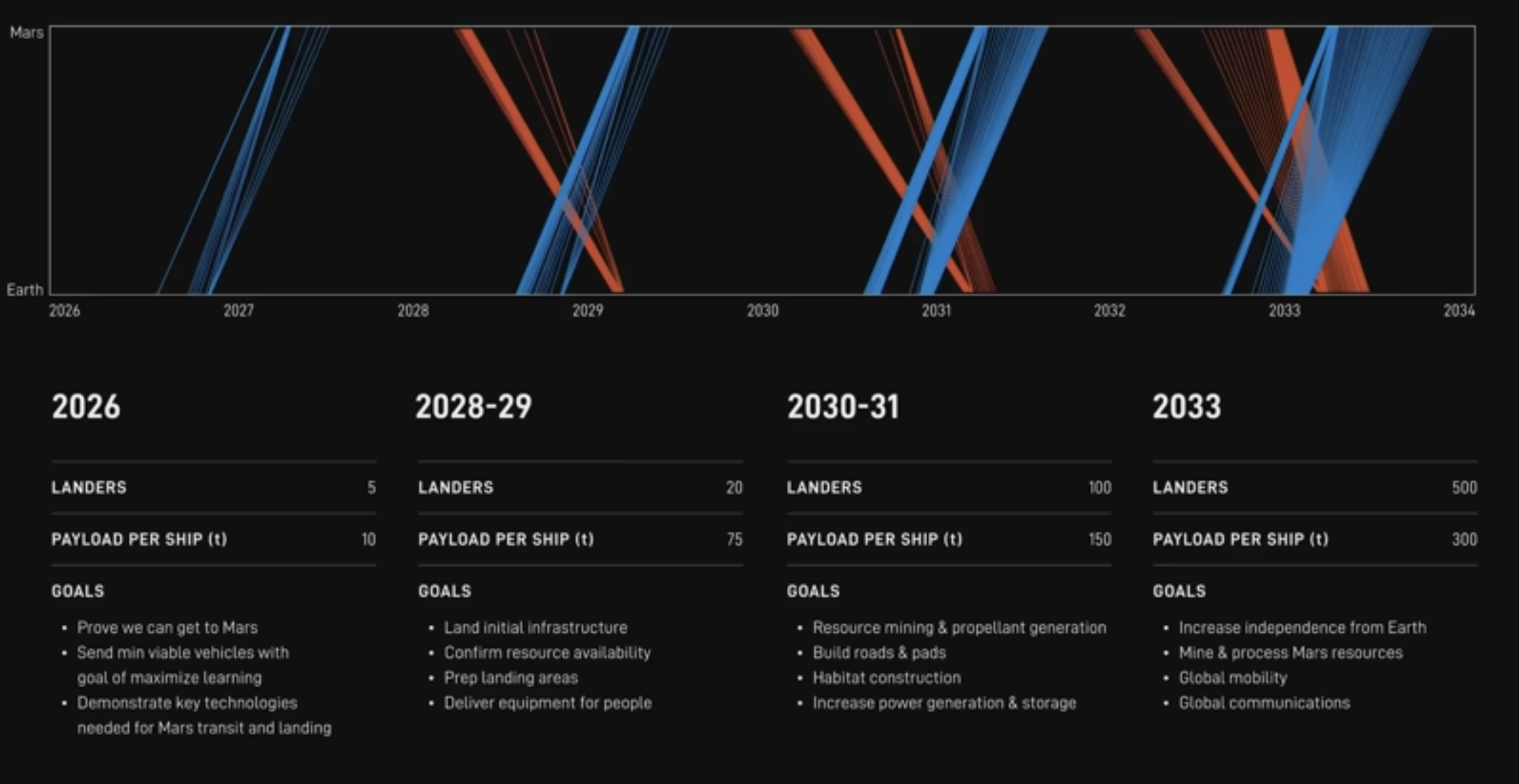

Its Starship program continues to progress with test flights essential for NASA’s Artemis missions and Musk’s Mars objectives.

Government work remains robust, with $5.9 billion in Pentagon launch contracts securing revenue visibility well into 2029.

This is an operating machine — not a speculative dream.

Yet, despite clear operational strength, the secondary market hasn’t pushed share prices higher, until the whispers of a new SpaceX stock tender, romoured today November 20, 2025.

The question is what lies ahead for SpaceX stock in 2026.

This is where the datacenter-in-space narrative gains importance.

Because SpaceX is not simply launching rockets —

it is quietly building the only infrastructure capable of hosting an orbital compute layer.

Starlink’s constellation.

Starship’s heavy-lift capability.

Global laser-linked satellites.

High-throughput interconnects.

All foundational components of in-space edge processing.

And IPO CLUB’s view is that this narrative may still be still underpriced.

Investors chasing AI multiples are ignoring the physical infrastructure that will eventually carry the most latency-sensitive workloads.

As AI models scale, the need for orbital processing grows — and SpaceX is the only private company with the integrated stack to deliver it.

This is why the valuation pause matters.

Because it creates relative value at a moment when the underlying fundamentals are accelerating.

Because it positions long-term investors ahead of a narrative shift.

Because it mirrors the early days of terrestrial cloud, when infrastructure was misunderstood before it became indispensable.

SpaceX’s funding rounds continue to attract deep capital.

Its government contracts lock in supply.

Its technological moat widens with every Starship milestone.

And secondary-market liquidity remains strong, even if pricing is steady.

Taken together, these signals create a profile rarely seen in frontier technology:

high execution, high demand, high infrastructure value, and temporarily stable pricing.

Which is why the image of the rocket on the pad is so fitting.

Not stagnant.

Not uncertain.

Simply preparing for the next stage of ascent.

And as we watch 2026 approach, the ignition point becomes clearer.

SpaceX remains a high-potential private investment through 2026, especially for those tracking the datacenter-in-space theme.

What is IPO CLUB

We are a club of Investors with a barbell strategy: very early and late-stage investments. We leverage our experience to select investments in the world’s most promising companies.

Sources

Disclaimer

Private companies carry inherent risks and may not be suitable for all investors. The information provided in this article is for informational purposes only and should not be construed as investment advice. Always conduct thorough research and seek professional financial guidance before making investment decisions.

The information provided in this article is for informational purposes only and should not be considered financial advice. Investing in any company, including SpaceX or Starlink stock, carries inherent risks, and individuals should conduct their own research and consult with a qualified financial advisor before making any investment decisions.