2025 Q4 Market Commentary

Courtesy of PM Insights, a portfolio company of IPO CLUB.

Large-scale AI fundraising dominated headlines in Q4, with late-stage rounds concentrated among hyperscalers and foundational model players. At the same time, a cooling effect spread across early- and mid-stage venture, particularly among infrastructure-oriented AI startups. Market sentiment reflected growing concerns around AI-driven data center economics, private credit exposure, and slowing enterprise adoption, which collectively dampened momentum for smaller private companies and impacted select public comparables.

Toward the end of the quarter, investor enthusiasm began shifting toward space-based data infrastructure as a potential solution to AI’s physical compute bottlenecks. While compelling, we remain cautious given the considerable technical challenges still to be overcome.

Another notable trend was the growing interest in humanoids. Even ahead of CES 2026, venture capital attention accelerated in this category. In many ways, interest in physical AI began to outpace Gen AI. In our coverage universe, Physical Intelligence raised at a healthy valuation increase, signaling strong early momentum in the sector.

Meanwhile, defense remained one of the strongest-performing sectors. Portfolio-relevant companies such as Chaos Industries and Castelion continued to gain traction and attract capital at higher valuations. A significant development this quarter was the publication of the U.S. National Security Strategy in November 2025, which further elevated investor focus on the sector.

Energy and grid technologies also saw strong year-end momentum. Notable financings within our coverage included:

Valar Atomics

Radiant Nuclear

Last Energy

In summary, while top-tier venture names such as OpenAI, xAI, Anthropic, Neuralink, and SpaceX continue to attract premium capital, the zero thermic line* — the threshold dividing startups that can raise from those that cannot — has moved higher.

A positive shift this quarter was the strengthening consensus that 2026 could be a robust year for IPOs and broader liquidity, supported by reports that SpaceX may list in H2 2026.

Late in the quarter, Groq announced that it has entered into a non-exclusive licensing agreement with Nvidia for its inference technology, valued at $20 billion. The deal helps requalify the narrative around this licensing arrangement for investors, following the disappointment left by the Scale AI transaction, and opens a new liquidity avenue for venture investors.

Lastly, IPO CLUB Fund I’s unaudited Q4 2025 performance — limited to investments overlapping with America 2030’s sector focus — showed preliminary appreciation, with an estimated TVPI of 4.9x gross and approximately 4.1x net. This is approximately 4.5 times higher than the Carta 2020 Vintage benchmark, based on available data. These figures are unaudited, net of management, administration, and transaction fees, subject to 20% carried interest, and subject to change following audit and year-end reconciliation.

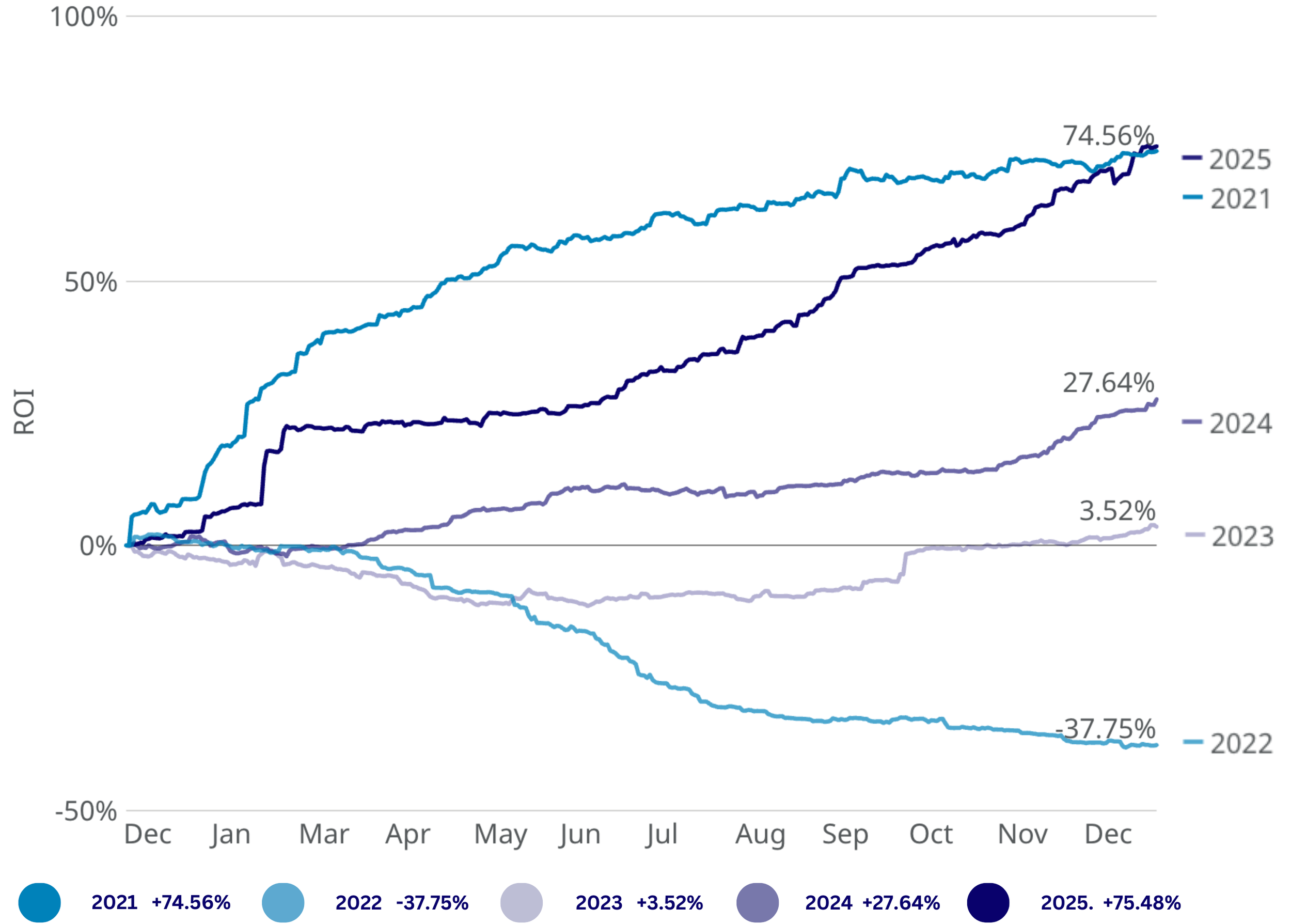

IPO CLUB Fund II America 2030 closed the year with a 25% gain since inception at the end of March 2025.These figures are net of management, administration, and transaction fees, but do not account for carried interest or potential audit adjustments. Final performance is subject to audit confirmation.

*The "zero thermic line" is our internal term for the threshold separating startups able to raise capital from those that struggle.

What is IPO CLUB

We are a club of Investors with a barbell strategy: very early and late-stage investments. We leverage our experience to select investments in the world’s most promising companies.

Disclaimer

Private companies carry inherent risks and may not be suitable for all investors. The information provided in this article is for informational purposes only and should not be construed as investment advice. Always conduct thorough research and seek professional financial guidance before making investment decisions.

The information provided in this article is for informational purposes only and should not be considered financial advice. Investing in any company, including SpaceX or Starlink stock, carries inherent risks, and individuals should conduct their own research and consult with a qualified financial advisor before making any investment decisions.