Scale

This company is in the pipeline of America 2030, IPO CLUB’s $50M, actively managed secondary fund focused on U.S. defense, energy, security, and AI.

Updated in January 2026

Headquarter: San Francisco, California, USA

Year Founded: 2016

Leadership: Alexandr Wang

Industry Sectors: Artificial intelligence; Data labeling & annotation; AI infrastructure; Machine learning operations

Funding Round: $1B Series F (2024)

Valuation: ~$13.8B

Is Scale A Public Company? No, it is currently private

What Is Scale AI?

Scale AI is a U.S.-based artificial intelligence infrastructure company headquartered in San Francisco, California, founded in 2016. The company’s mission is to accelerate the development and deployment of AI by providing the high-quality training data and data management infrastructure required to build reliable machine learning models. Scale positions itself as a foundational layer for AI development, serving enterprises and governments that need accurate, secure, and scalable data pipelines to power advanced AI systems.

Technology & Products

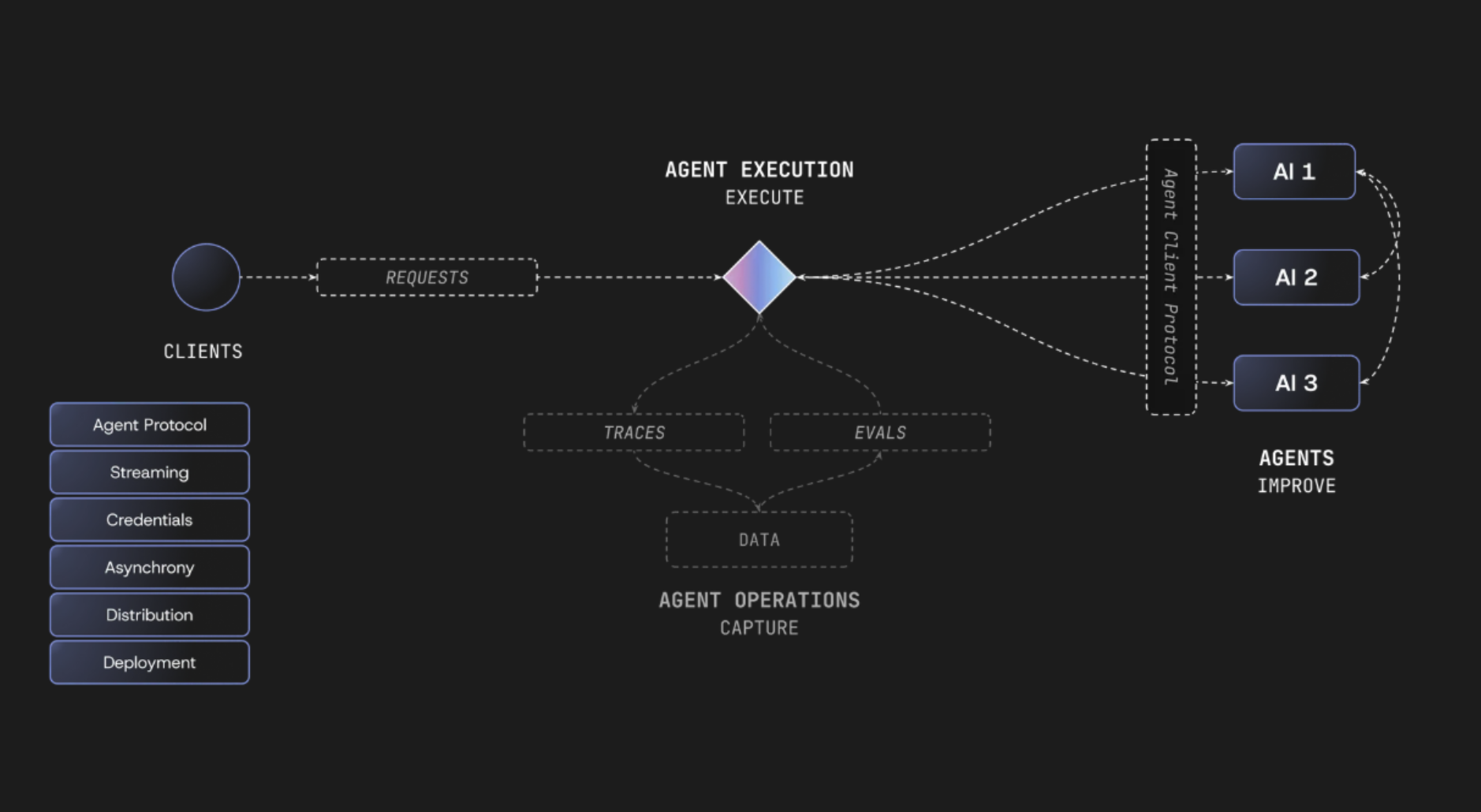

Scale’s offering centers on its data-centric AI platform, which includes a suite of products designed to manage the full lifecycle of AI data and model development. Its Scale Data Engine handles tasks such as data collection, annotation, curation, and quality assurance, using a combination of machine learning and human-in-the-loop processes to ensure high accuracy. Additionally, the Scale Generative AI Platform (SGP) enables teams to build, evaluate, and control agent-driven AI solutions that reason over enterprise data. The company also invests in research via initiatives like the Safety, Evaluation, and Alignment Lab, addressing model evaluation and alignment challenges.

Market Opportunity

Scale operates in the rapidly expanding AI and machine learning ecosystem, where demand for high-quality training data is a critical bottleneck for model performance. Organizations across sectors—including autonomous vehicles, robotics, enterprise software, and government—require reliable labeled data to power AI systems, positioning Scale as a foundational infrastructure provider. Its platform supports both traditional supervised learning and cutting-edge generative AI development, addressing a broad range of enterprise needs.

Competitive Landscape

Scale competes in the AI data infrastructure and annotation market, where its primary differentiator is the combination of automated tools and human expertise to deliver highly accurate datasets. Competitors include other AI data platforms and annotation services (e.g., Labelbox and similar providers), but Scale’s extensive tooling, enterprise integrations, and research investments set it apart. The company also benefits from collaboration with major technology firms and public sector entities. Notably, Meta Platforms acquired a 49% stake in Scale AI in 2025 in a multibillion-dollar deal, underscoring its strategic position in the AI value chain.

How To Buy Scale Stock?

Scale is currently a private company and is not publicly traded on major stock exchanges like the NASDAQ or NYSE. This means you can buy shares through a pre-IPO platform or brokerage like IPO CLUB.

Courtesy of Scale ai

This company is in the pipeline of America 2030, IPO CLUB’s $50M, actively managed secondary fund focused on U.S. defense, energy, security, and AI.

Scale and America 2030 Latest News

Stay up-to-date with all the latest news pertaining to this company’s stock, IPO, and investment opportunity. By clicking here, you'll gain access to real-time updates and in-depth analysis from market experts, empowering you to make informed decisions about your investment journey. Whether you're a seasoned investor or just getting started, our platform is tailored to provide you with all the crucial information you need to navigate the thrilling world of the stock market and IPOs. Dive in and keep your finger on the pulse of the financial markets.

You can imagine America 2030 as a polished metal capsule sitting in the palm of your hand.

A compact, precision-engineered instrument.

Every piece designed to do exactly one thing: turn the next decade of American hard-tech into real, liquid returns.