Energy Hub

We provide accredited investors with curated access to the Space tech ecosystem via two core formats:

Single-Name SPVs (Selective Access)

For investors who want direct exposure to companies like NewCleo and Redwood Materials, we occasionally offer deal-by-deal allocations through SPVs. These are invitation-only and capacity-limited.

Portfolio Companies

See what’s available: NewCleo, Redwood Materials, Impossible Metals, Aalo

America 2030

America 2030 Fund (Flagship Fund)

A diversified portfolio capturing late-stage U.S. companies across AI Infrastructure, defense, space and critical infrastructure. Designed for investors seeking exposure to national security trends without picking individual names.

See what’s available: Base Power, Bedrock Energy, Commonwealth Fusion, Energy Dome, Form Energy, Impossible Metals, Last Energy, Lilac Solutions, Radiant Nuclear, TAE Technologies, Terrapower, X-Energy

Maksim Sonin

Energy Expert

SMR Sector Outlook 2025: Key Drivers of Growth

The global small modular reactor (SMR) market is entering a phase of unprecedented growth, projected to double from US $6.9 billion in 2025 to US $13.8 billion by 2032. This acceleration is being driven by AI infrastructure’s surging energy demand, energy security imperatives, and decarbonization goals — with tech giants like Amazon, Google, Microsoft, and Meta committing multi-gigawatt nuclear capacity agreements through the 2030s.

Capital inflows into SMR developers have reached record levels in 2024–2025, with private funding rounds of US $700 million (X-Energy), US $225 million (Radiant), and €135 million (Newcleo), alongside large public-private partnerships. The sector is now positioned to become a primary clean-power backbone for data centers, defense, and industrial operations.

Emerging private market opportunities — Dominated by Last Energy, Radiant Industries, and Newcleo, with additional momentum from X-Energy, Kairos Power, TerraPower, and Oklo. Commercial pipelines include Last Energy’s 80+ reactor unit agreements worth over US $32 billion, Radiant’s DOE-backed microreactor program, and Newcleo’s €1 billion European build-out.

The evolving geopolitical landscape — U.S. DOE’s Advanced Reactor Demonstration Program, France’s Bpifrance SMR funding strategy, and the UK’s first commercial nuclear site licensing since 1978.

Flagship infrastructure projects — Amazon’s 1.9 GW nuclear PPA with Talen Energy, Google’s Kairos SMR program targeting 500 MW by 2030, Microsoft’s Three Mile Island restart, and Meta’s 1.1 GW Constellation Energy agreement.

👉 Download the 2025 SMR Market Brief

Includes top companies, sector outlook, and IPO Club’s allocation calendar, all in a 3-minute executive summary.

Join IPO CLUB to request memos for live SPVs and America 2030 Fund

SPV allocations close at the end of each month.

America 2030 allocations close at the end of the quarter.

Access 2025 Energy Allocations

NewCleo

SMR developer pioneering lead-cooled fast reactors that recycle nuclear waste

Redwood Materials

Battery recycling and materials company building a closed-loop supply chain for lithium-ion batteries

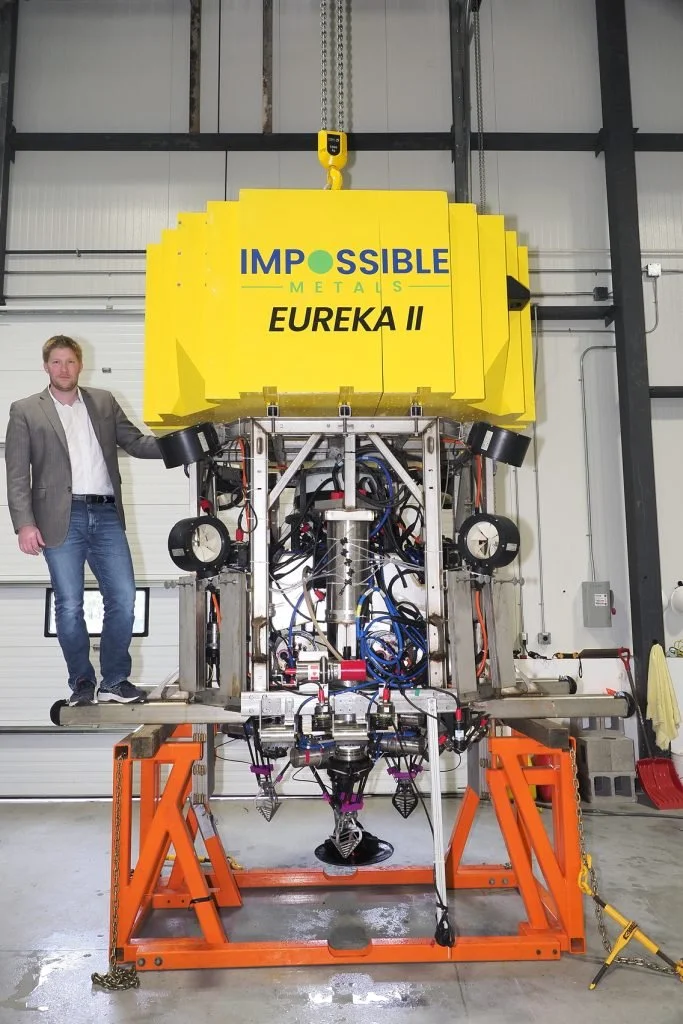

Impossible Metals

Deep-sea mining startup deploying autonomous underwater robotic vehicles to harvest battery‑grade metals

AMERICA 2030

One Fund, 30 Startups

Defense, Energy, Robotics, AI-Infra

Next allocation window closes soon. Secure your seat now