Archimede

This company is in the pipeline of America 2030, IPO CLUB’s short-term, actively managed secondary fund focused on U.S. defense, energy, security, and AI.

Updated in January 2026

Headquarter: Syracuse, Italy

Year Founded: 2024

Leadership: Stefano Buono

Industry Sectors: Nuclear energy; Advanced nuclear reactors; Lead-cooled fast reactor technology; Clean energy

Funding Round: n/a

Valuation: n/a

Is Archimede A Public Company? No, it is privately held

What Is Archimede?

Archimede Energia is an energy technology company focused on long-duration thermal energy storage, headquartered in Italy and originating from research conducted at the ENEA research center. The company is known for industrializing molten salt thermal storage technologies, with the mission of enabling decarbonization of industrial heat and power systems by storing renewable energy at scale and dispatching it when needed. Archimede positions itself as a key enabler of energy transition for sectors where electrification is difficult.

Technology & Products

Archimede’s core technology is based on molten salt thermal energy storage, using proprietary salt formulations and system designs capable of storing heat at very high temperatures for extended durations. The stored thermal energy can later be converted into electricity or delivered directly as industrial process heat, making the system suitable for both power generation and heavy industry. Archimede’s solutions are modular and designed for integration with renewable sources such as solar or surplus grid electricity, offering high efficiency, long asset life, and minimal degradation compared with electrochemical batteries.

Market Opportunity

Archimede operates in the growing long-duration energy storage (LDES) and industrial decarbonization market, driven by increasing renewable penetration and tightening emissions regulations. Energy-intensive industries—such as chemicals, metals, cement, and district heating—require reliable, high-temperature heat that intermittent renewables alone cannot provide. Archimede’s technology addresses this gap by enabling dispatchable, low-carbon energy, positioning the company to benefit from global investment in grid stability, clean industrial heat, and energy security.

Competitive Landscape

Archimede competes with other thermal and long-duration energy storage providers, as well as alternative technologies such as hydrogen and advanced battery systems. Its key differentiation lies in the maturity of molten salt technology, proven at utility and industrial scale, combined with the ability to deliver very high-temperature heat efficiently. While some competitors focus on electrical output only, Archimede emphasizes direct heat delivery and hybrid power applications, giving it an advantage in hard-to-abate sectors.

How To Buy Archimede Stock?

Archimede is currently a private company and is not publicly traded on major stock exchanges like the NASDAQ or NYSE. This means you can buy shares through a pre-IPO platform or brokerage like IPO CLUB.

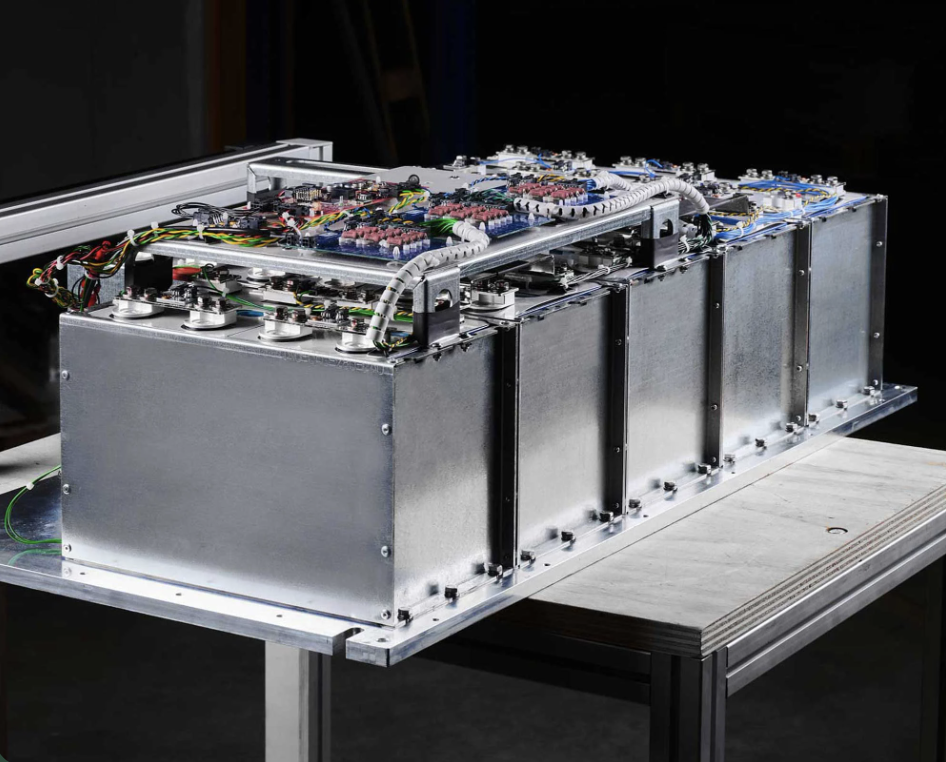

Courtesy of Archimede

This company is in the pipeline of America 2030, IPO CLUB’s short-term, actively managed secondary fund focused on U.S. defense, energy, security, and AI.

Archimede and America 2030 Latest News

Stay up-to-date with all the latest news pertaining to Archimede stock, the IPO, and investment opportunities. By clicking here, you'll gain access to real-time updates and in-depth analysis from market experts, empowering you to make informed decisions about your investment journey. Whether you're a seasoned investor or just getting started, our platform is tailored to provide you with all the crucial information you need to navigate the thrilling world of the stock market and IPOs. Dive in and keep your finger on the pulse of the financial markets.

You can imagine America 2030 as a polished metal capsule sitting in the palm of your hand.

A compact, precision-engineered instrument.

Every piece designed to do exactly one thing: turn the next decade of American hard-tech into real, liquid returns.