Shield AI vs. Anduril

Short-Term pre-IPO FUND: Investing in defense technology through America 2030 allows accredited investors to participate in the resurgence of U.S. national security innovation. Learn more.

What Shield AI Actually Does

Shield AI is a U.S. defense-technology company building autonomous AI systems designed to operate in the most dangerous, GPS-denied, and communications-contested environments.

In plain terms: They’re teaching machines to think, navigate, and fight without human control when humans can’t safely go.

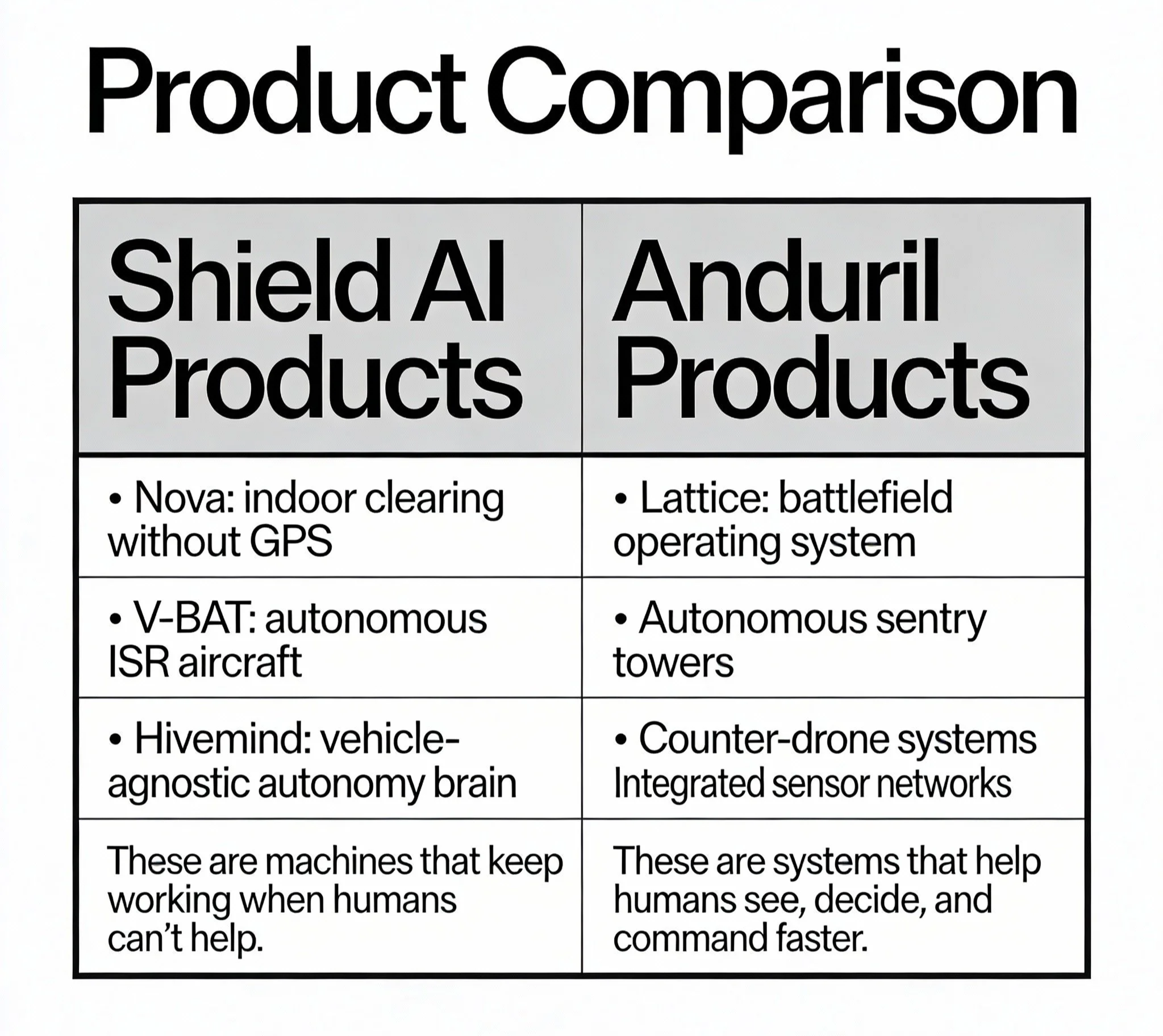

At the core of the company is Hivemind, its autonomy software stack.

Hivemind allows aircraft and other platforms to:

Navigate without GPS

Perceive and map unknown environments

Make mission decisions independently

Coordinate with other autonomous systems

This is not remote control. It’s onboard intelligence.

Key Products and Platforms

Hivemind Autonomy

The “brain.”

A hardware-agnostic AI system that can be deployed across different vehicles and missions.

Nova Drone

A small, indoor-capable drone used for room-clearing, tunnel inspection, and urban reconnaissance.

Already deployed by U.S. and allied forces.

V-BAT

A vertical takeoff and landing (VTOL) unmanned aircraft designed for longer-range missions from ships or austere locations.

Why Shield AI Matters

Modern warfare is changing.

Signals are jammed.

GPS is unreliable.

Human reaction time is too slow.

Therefore: Autonomy becomes a strategic necessity, not a nice-to-have.

Shield AI positions itself at the intersection of:

Artificial intelligence

National security

Real-world combat deployment

Few AI companies operate outside the lab. Shield AI does.

Customers and Credibility

Shield AI works with:

The U.S. Department of Defense

Allied militaries

Special operations units

This matters.

Defense adoption is slow, conservative, and unforgiving. Deployment signals trust.

The Bigger Picture

Shield AI isn’t just a drone company.

It’s an AI infrastructure company for defense, aiming to make autonomy as foundational to military operations as GPS once was.

If autonomy is the future of conflict, Shield AI wants to be the operating system.

Shield AI vs. Anduril

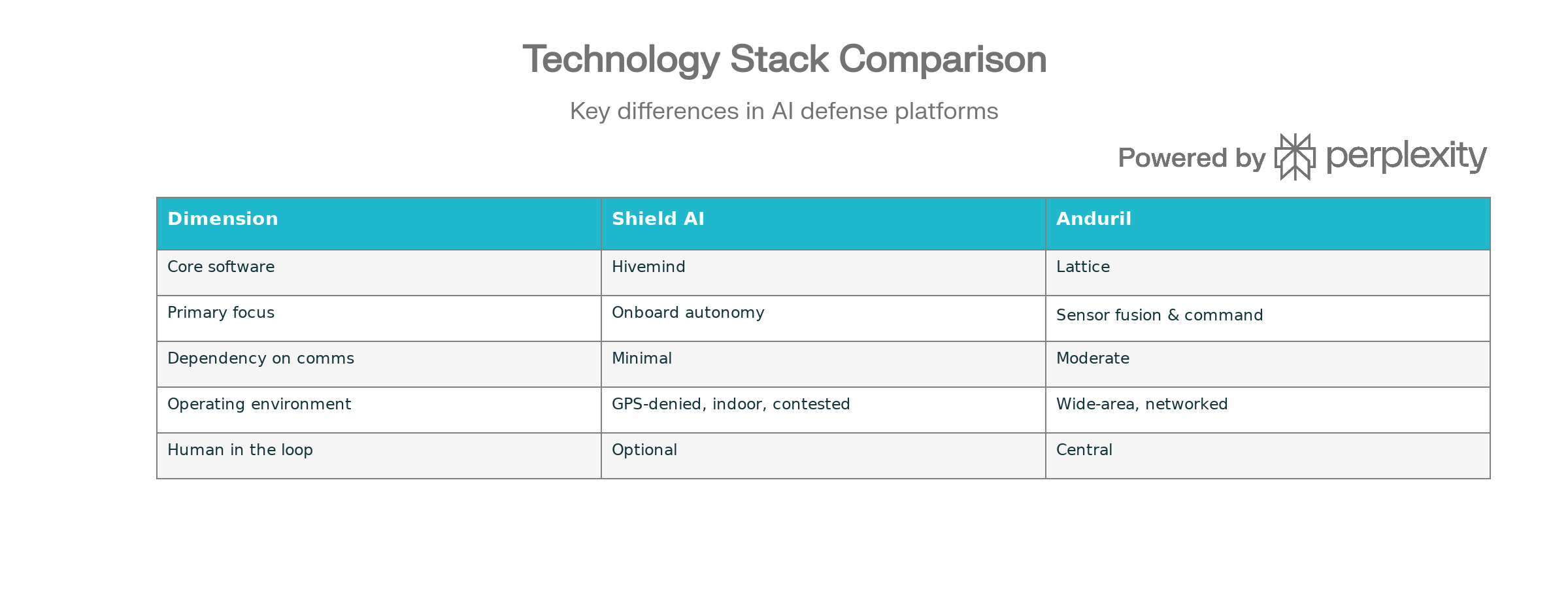

Shield AI builds the brain inside autonomous machines while Anduril builds the nervous system around the battlefield. Same war, different layers of the stack.

Core Philosophy

Shield AI: Autonomy at the Edge

Shield AI is obsessed with one problem.

What happens when humans are cut off?

No GPS.

No comms.

No joystick.

Therefore, the machine must:

Perceive

Decide

Act

On its own.

Autonomy is not a feature. It is the product.

Anduril: Decision Advantage at Scale

Anduril starts elsewhere.

The battlefield is flooded with sensors.

Humans can’t process it all.

Therefore, software must:

Fuse data

Highlight threats

Recommend actions

Coordinate responses

Anduril’s goal is command dominance, not vehicle independence.

Go-To-Market Strategy Comparison

Shield AI

Shield AI’s go-to-market strategy begins with elite operational units, where tolerance for experimental capability is higher and mission urgency outweighs procurement inertia.

Proves full autonomy in high-risk, denied, and GPS-contested environments

Focuses on extreme edge cases to validate reliability under combat stress

Expands horizontally across platforms once autonomy credibility is established (air, ground, maritime)

Strategic logic:

If autonomy works in the hardest environments, it becomes mission-critical and difficult to replace.

Anduril

Anduril’s strategy is built around integrated systems deployment at scale, bundling hardware platforms with proprietary software.

Sells platforms + software as a unified system

Targets replacement of legacy defense contractors

Scales vertically across bases, borders, and operational theaters

Strategic logic:

By owning the full stack and deployment footprint, Anduril positions itself as the default next-generation defense contractor.

Courtesy of Shield AI

Introducing X-BAT, the world’s first AI-piloted VTOL fighter jet. With vertical takeoff and landing, long range, and full autonomy, X-BAT delivers combat power anywhere, anytime. This is the future of Airpower.

Shield AI stock vs. Anduril stock — Private-Market Comparison

In the pre-IPO universe, “stock” refers to private valuations and fundraising performance, not publicly traded shares. Both companies are privately held but represent powerhouse valuations in the defense tech sector.

Shield AI’s valuation at $12B (current talks of round, February 2026) places it as one of the largest autonomous systems startups in defense but significantly below Anduril’s scale.

Anduril’s valuation at $60B (current talks of round, February 2026) more than 5x Shield AI’s, reflecting its broader platform strategy and deeper venture capital backing.

These figures are private values reported by funding rounds and reflect investor expectations rather than market prices.

Revenue & Contract Signals

Anduril reportedly reached ~$1 billion in revenue as of 2024, with contract value estimates in the low billions, supporting its premium valuation.

Public data on Shield AI revenue are less consistently reported, but one third-party estimate places 2024 revenue near $267 million, aligned with expanding contracts and international deployments.

Revenue differences help explain relative private valuations: Anduril’s broader platform suite and larger backlog implies greater near-term monetization potential, while Shield AI’s focus on autonomy software and mission execution suggests longer gestation toward recurring revenue.

Investor Profiles & Strategic Backing

Shield AI’s investor mix includes strategic defense partners like L3Harris and Hanwha, signaling industry alignment and potential integration pathways with existing primes.

Anduril’s backers include heavyweight VC firms (Founders Fund, a16z, General Catalyst), providing deep capital for scaling hardware and systems integration.

Risks from an Investment Perspective

Shield AI

Autonomy technology must prove reliability against military-grade edge cases before commanding premium multiples.

Smaller relative scale and narrower product set contribute to valuation dispersion among investors.

Anduril

Larger enterprise footprint increases complexity and execution risk, but also diversifies revenue streams.

A more mature contract pipeline and higher revenue base attract broader investor capital.

Implications for Pre-IPO Investors

From a private-market lens:

Anduril’s wider scale and revenue traction support its significantly higher private valuation, suggesting stronger near-term liquidity prospects if/when it approaches public markets.

Shield AI’s autonomy focus anchors its long-term strategic value, but its current valuation reflects both growth potential and execution risk tied to proving autonomous systems at scale.

This comparative view is neutral and summarizes private valuation, revenue indications, and investor signals — not investment advice.

(All numbers sourced from public funding reporting and private-market analyses.)

Competitive Reality (Critical Distinction)

Despite surface-level comparisons, Shield AI and Anduril are not direct competitors today.

They operate at different layers of the defense stack and are, in practice, complementary.

Anduril can:

Detect threats

Fuse sensor data

Assign missions and tasks

Shield AI can:

Execute those missions

Navigate denied environments

Operate autonomously without human intervention

Analogy:

Android OS vs. cellular network infrastructure.

Different layers. Same operational outcome.

Strategic Risk Profiles

Shield AI — Risk Profile

Autonomy is technically non-linear

Edge cases are frequent and unforgiving

Failure modes are often binary (works or doesn’t)

Upside:

If autonomy is proven at scale, Shield AI becomes structurally irreplaceable within the kill chain.

Anduril — Risk Profile

Systems integration complexity across domains

Exposure to defense procurement politics

High capital intensity for hardware manufacturing and deployment

Upside:

If scaling succeeds, Anduril becomes the default systems integrator for Western defense, analogous to a next-generation prime contractor.

Investing in defense technology through America 2030 allows accredited investors to participate in the resurgence of U.S. national security innovation. Learn more.

What is IPO CLUB

We are a club of Investors with a barbell strategy: very early and late-stage investments. We leverage our experience to select investments in the world’s most promising companies.

Sources

U.S. Department of Defense — Autonomy and Artificial Intelligence Strategy

Source: U.S. Department of Defense, February 2023Defense Innovation Unit (DIU) — Autonomy Portfolio & Operational AI Programs

Source: Defense Innovation Unit, 2022–2024Reuters — Coverage of Shield AI funding, contracts, and autonomous systems deployments

Source: Reuters, 2021–2024Reuters — Coverage of Anduril product launches, contracts, and valuation milestones

Source: Reuters, 2019–2024U.S. Air Force & U.S. Navy Program Offices — Autonomous systems testing, edge-environment operations, and ISR modernization

Source: U.S. Air Force / U.S. Navy, 2020–2024Center for Strategic and International Studies (CSIS) — AI, Autonomy, and the Future of Defense

Source: CSIS, 2021–2024Congressional Research Service (CRS) — Defense Primer: Artificial Intelligence and Autonomy

Source: Congressional Research Service, 2022–2024Financial Times — Defense technology modernization, contractor displacement, and Silicon Valley defense entrants

Source: Financial Times, 2020–2024NATO Allied Command Transformation — Autonomous Systems and Multi-Domain Operations

Source: NATO ACT, 2021–2023Company Primary Materials — Product documentation, public demonstrations, and official statements

Source: Shield AI; Anduril Industries, 2020–2024

Disclaimer

Private companies carry inherent risks and may not be suitable for all investors. The information provided in this article is for informational purposes only and should not be construed as investment advice. Always conduct thorough research and seek professional financial guidance before making investment decisions.