Gun-Based C-UAS: Leaders, Technologies, and Opportunities

Executive Summary

Drone threats across air, land, and sea—especially Group 1–3 multirotors, FPV kamikaze drones, and loitering munitions—demand layered counter-UAS defense. Gun-based airburst systems like Rheinmetall AHEAD and RapidFire offer low-cost, scalable protection. Ukraine’s battlefield accelerates C-UAS innovation now shaping NATO doctrine.

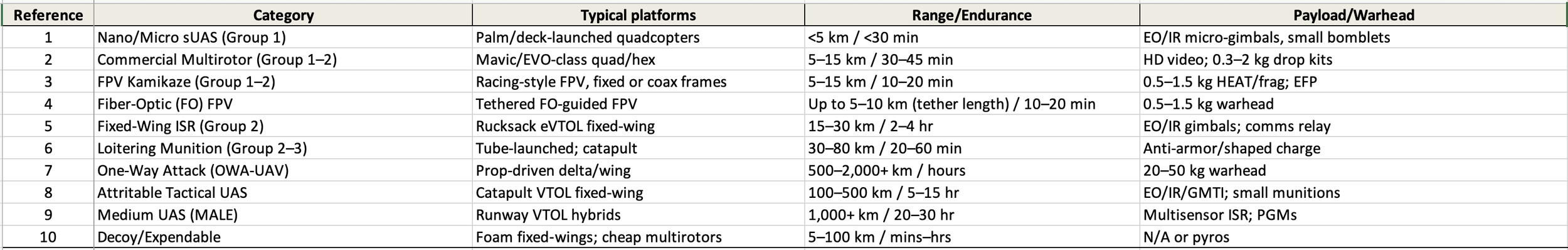

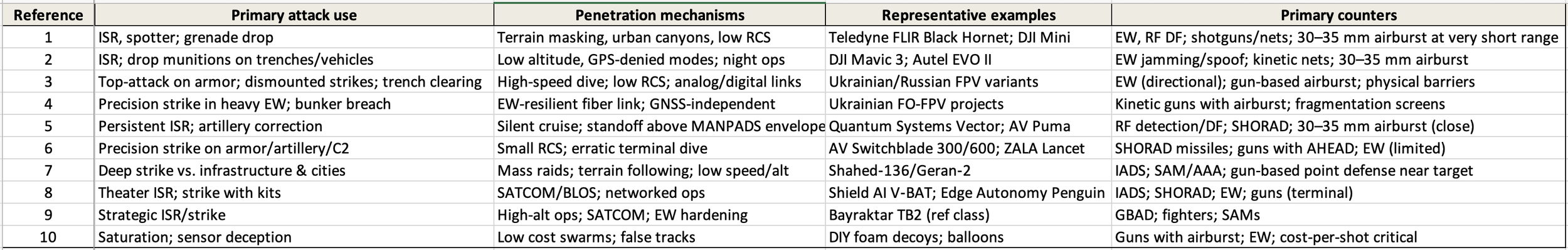

Drone threats span Group 1–5 systems and multiple domains (air/sea/land); the most acute near-term risks to maneuver forces and civilians are Group 1–3 multirotors, FPV kamikaze drones (including fiber-optic variants), small fixed-wing ISR, and loitering munitions.

Effective defense requires a layered C-UAS approach combining sensing (radar/RF/EO-IR) and multiple effectors (EW, airburst guns, interceptors, missiles, HPM/HEL). The U.S. Army’s ATP 3-01.81 doctrine and CRS outline this layered paradigm.

Gun-based C-UAS with programmable airburst (30–35 mm) delivers favorable cost-per-shot and deep magazines against swarming sUAS; Rheinmetall’s AHEAD and Thales/KND S RapidFire exemplify the state of the art.

Ukraine is the global crucible for rapid iteration in drones and counter-drone tech (FPV, fiber-optic FPV, EW, mobile C-UAS), with lessons diffusing to NATO programs.

Threat Landscape (What a gun system must stop)

Group 1–2 commercial multirotors (Mavic/EVO class): ISR, precision drops (0.3–2 kg); low/RCS, terrain masking, night operations. Ubiquitous on the battlefield.

FPV kamikaze drones: High-speed, all-angles-of-attack on vehicles/dismounts; extremely low cost; analog/digital C2; accelerating innovation in Ukraine.

Fiber-optic (FO) FPV: Tethered control over fiber resists EW/jamming; used for precise strikes in heavily contested EW.

Fixed-wing rucksack ISR (Group 2): 2–4 h endurance for artillery correction/comms relay. Examples include Quantum-Systems Vector, AV Puma.

Loitering munitions (Group 2–3): Precision anti-armor/anti-artillery systems (AeroVironment Switchblade family; Russian ZALA Lancet). Terminal high-angle dive profiles are challenging for point defense. Existing turret systems (like Sentradel) lack elevation above ~80 degrees.

One-way attack (OWA-UAV): Long-range prop-driven systems (Shahed-131/136/Geran-2) used for deep strike, often in mass raids that saturate air defenses and threaten civilian infrastructure. Jet powered drones like Geran 3 - 600 km/h and cruising altitude >9000 m = unreachable for anti-aircraft guns.

Attritable tactical VTOL fixed-wing: Longer-range ISR/strike (e.g., Shield AI V-BAT; Edge Autonomy Penguin).

Cross-domain drones: USVs (e.g., Magura class) for maritime strikes; UGVs as IED carriers—less relevant to gun C-UAS but part of layered defense planning.

Implication for gun C-UAS: Highest payoff is defeat of Group 1/2 FPV/multirotors and terminal windows of Group 2 loitering munitions within 300–3,000 m—where programmable airburst and precise cueing matter most.

Market Outlook and Investment Implications

The robotics sector presents compelling investment opportunities driven by:

Growth Catalysts:

Labor shortages across developed economies driving automation adoption

AI integration enabling more sophisticated robotic capabilities

Declining hardware costs improving ROI for commercial deployments

Expanding applications beyond manufacturing into services and consumer markets

Investment Considerations:

Private humanoid robotics companies offer highest growth potential but carry execution risk

Established industrial robotics companies provide stable exposure with steady growth

AI-powered robotics represents the fastest-growing segment with premium valuations

Strategic partnerships with major corporations validate commercial viability

The convergence of AI, advanced actuators, and sophisticated control systems has created a transformative moment for robotics. Companies like Apptronik and Figure AI are positioning themselves to capture significant market share as humanoid robots transition from research laboratories to commercial deployment across multiple industries.

For more coverage about Defense, subscribe to our club letter.

How drones penetrate to attack convoys, soldiers, civilians

Low, slow, small (LSS) signature evades conventional air surveillance; clutter and terrain masking complicate detection.

Top-attack FPV dives at 100+ km/h exploit short reaction times and weak roof armor.

Massed OWA-UAV raids generate saturation, forcing high-end SAMs to expend costly interceptors; affordable guns at defended sites improve economics.

EW adaptation (FO-FPV; pre-programmed routes; inertial dead-reckoning) reduces jamming effectiveness; kinetic fallback (airburst) is essential.

Market Segmentation

Drone Threat Segmentation (air/sea/land, missions, counters)

Gun-Based C-UAS: Technology Benchmarks and Fit

Programmable airburst (30–35 mm): AHEAD (35 mm) projects a tungsten sub-projectile cloud programmed to burst in front of the target; optimized for small, fast aerial threats. Thales/KND S RapidFire (40 mm cased-telescoped) provides VSHORAD close-in defense for air/surface targets.

Representative systems:

Rheinmetall Skyranger 30/35 & Skynex: Integrated sensors, 30×173 mm or 35 mm revolver guns, AHEAD ammunition; multiple European orders (incl. Denmark).

Thales RapidFire (Land/Naval): 40 mm CT cannon; qualified 2025; designed for small UAS/USV defense.

Programmatic context: U.S. ATP 3-01.81 (Aug 2023) and CRS (Mar 2025) emphasize layered C-UAS with kinetic guns as a cost-effective inner layer alongside EW and interceptors.

Ukraine: Global Center of Gravity for Drone/C-UAS Innovation

FPV & LOE: Ukraine’s front lines iterate FPV tactics (including FO-FPV) and counter-FPV measures at unprecedented speed; this informs NATO CONOPS and procurement.

Systems in combat rotation: AV Switchblade, Quantum-Systems Vector, Edge Autonomy Penguin, Teledyne FLIR R70; extensive EW/counter-drone deployments (e.g., Kvertus).

Ecosystem: BRAVE1/“Test in Ukraine” initiatives accelerate fielding and partner trials for international companies.

Company Landscape (manufacturers linked; US/EU startups emphasized)

Publicly listed (selected)

AeroVironment (US) — small UAS & loitering munitions; Switchblade 300/600, Puma.

Parrot (FR) — ANAFI USA/AI series (defense/public safety).

Teledyne FLIR (US) — SkyRanger R70, R80D, Black Hornet.

QinetiQ (UK) — Obsidian C-UAS radar/EO integration.

Leonardo (IT/UK) — Falcon Shield C-UAS suite.

Rheinmetall (DE) — Skyranger/Skynex gun-based air defense with AHEAD.

HENSOLDT (DE) — Elysion/Xpeller C-UAS (sensors & effectors).

DroneShield (AU) — RF sensing/jamming (global footprint). (Non-EU but allied).

Private leaders & startups (US/Europe focus)

** Shield AI (US) — V-BAT VTOL fixed-wing; Hivemind autonomy; SATCOM options.

** Skydio (US) — X10/X10D autonomous sUAS (DoD/public safety).

** Anduril (US) — Roadrunner reusable VTOL interceptor; Ghost/ALTIUS family.

Quantum-Systems (DE) — Vector/Scorpion ISR eVTOL fixed-wing; widely fielded in Ukraine.

Teal Drones / Red Cat (US) — Teal 2 Group-1 ISR.

Edge Autonomy (US/LV) — Penguin C Mk2 & VTOL long-endurance ISR.

Parrot (FR) — ANAFI USA/AI (enterprise/defense).

Dedrone by Axon (US/DE) — RF detection/C2; mobile “OTM” and handheld DedroneDefender.

Fortem Technologies (US) — SkyDome system and DroneHunter interceptor.

Echodyne (US) — MESA radars for C-UAS cueing/FC.

OpenWorks Engineering (UK) — SkyWall net capture systems.

MARSS (UK/MC) — NiDAR C2 with integrated countermeasures.

HENSOLDT (DE) — Elysion/Xpeller sensor-led C-UAS suites.

** Epirus (US) — Leonidas high-power microwave (HPM) C-UAS.

Leonardo DRS (US) — mobile C-UAS/SHORAD components.

UkrSpecSystems (UA) — PD-2, SHARK UAS; front-line fielding.

Kvertus (UA) — anti-drone rifles and vehicle EW kits.

**These companies are in the pipeline of America 2030, IPO CLUB’s $50M, actively managed secondary fund focused on U.S. defense, energy, security, and AI.

Read also AI Meteoric Raise in Frontier Technologies.

View IPO CLUB America 2030 Defense Fund

What is IPO CLUB

We are a club of Investors with a barbell strategy: very early and late-stage investments. We leverage our experience to select investments in the world’s most promising companies.

Disclaimer

Private companies carry inherent risks and may not be suitable for all investors. The information provided in this article is for informational purposes only and should not be construed as investment advice. Always conduct thorough research and seek professional financial guidance before making investment decisions.