Latest Trends on Pre IPO Companies

News on portfolio companies and sectors we cover

Robotics Companies: Market Leaders, Emerging Technologies, and Investment Opportunities

Robotics Companies are experiencing unprecedented growth, with the market projected to reach $178.63 billion by 2030, representing a 12.17% CAGR. The sector is being driven by AI integration, labor shortages, and technological breakthroughs in humanoid and autonomous robotics. This report examines key market segments, leading companies, and emerging private players positioned to capture significant market share.

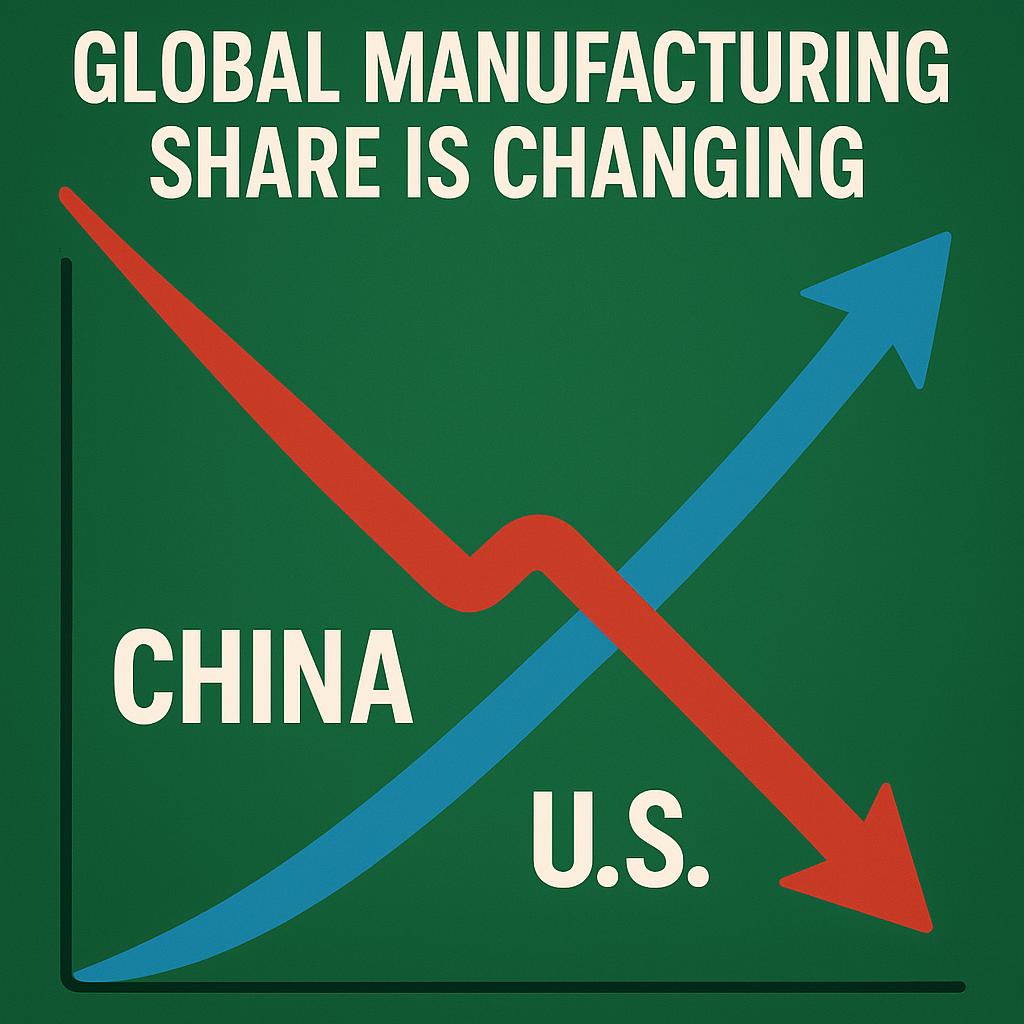

China-US Shift: Who Builds What, and implications for Venture Investing.

China’s retreat from U.S. Treasuries, combined with its rise in global manufacturing and tech, signals a rebalancing of power. This macro shift has deep implications for venture investing, supporting critical infrastructure, energy and defense.

Shield AI’s Path to a $24 Billion Valuation

To justify a $24B valuation, Shield AI must achieve $1.2–$3B in revenue with 25–40% EBITDA margins by 2028. We examine defense vs. tech multiples, peer benchmarks like Anduril and Palantir, and outline strategic levers for scaling Hivemind and reducing public market risks.

Where Defense, Energy, Cyber and AI-Infra Sectors Converge

Discover why the next generation of transformative startups won’t fit neatly into a single sector. At America 2030 Fund, we invest where defense, AI, energy, and cybersecurity converge—unlocking the compounding value of dual-use technologies. Learn how companies like Crusoe and Shield AI exemplify this crossover strategy in hardtech.

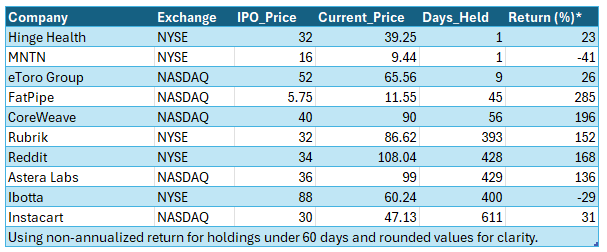

IPO Returns: How Are The Latest Ten Tech IPOs faring in the Public Market

FatPipe and CoreWeave deliver triple-digit gains post-IPO, capturing attention in early secondary markets. Meanwhile, Ibotta and MNTN show sharp losses. We analyze short-term IPO returns and identify emerging winners for secondary venture capital investors.

AI Infrastructure Startups: The Emerging Leaders Reshaping Compute, Data, and Robotics

Explore the top emerging startups in AI infrastructure, from fast inference chips to quantum computing. This snapshot reveals competitive clusters across five high-growth segments: hardware, cloud compute, data platforms, robotics, and quantum. Gain insight into which firms are defining the next wave of AI.

Self-Directed IRA and Venture Capital Funds: A Powerful Combination

As volatility challenges traditional 60/40 portfolios, SDIRA platforms like Alto are enabling individual investors to diversify retirement accounts into private equity, VC, and credit—once reserved for institutions. Here’s why secondary investors should pay attention.

Why Losses Hurt More Than Gains Feel Good, The Worry About Losing Money is Legit.

When it comes to money, human psychology plays a powerful role in shaping our decisions. One of the most well-documented phenomena in behavioral economics is loss aversion, which explains why the pain of losing money feels far worse than the pleasure of gaining an equivalent amount. This concept, first introduced by Amos Tversky and Daniel Kahneman through their groundbreaking prospect theory, has profound implications for how we make financial decisions.

18 Uprounds, 1 Listing, over $7 billion of fresh capital: Why AMERICA 2030’s Strategy Is Delivering Results

In just over a quarter into 2025, AMERICA 2030 has witnessed a remarkable confirmation of its investment thesis: 18 companies in our deal pipeline have already raised follow-on rounds at higher valuations, and Kodiak Robotics just announced a public listing via SPAC. This rapid validation highlights that we are picking the right companies at the right time—positioned at the intersection of defense, energy, security, and AI—at attractive secondary prices before broader capital catches up.

Boxabl 2024 Form 10-K Summary: A Crossroads Between Innovation and Execution

In 2024, Boxabl invested over $40 million to generate $3.4 million in revenue, selling 51 Casitas and making operational and regulatory advancements across several states. Key operational milestones include the certification of 83 installers, regulatory approvals in New Mexico, Nevada, and California, and continued R&D to expand the product line both up-market and down-market.