Shield AI’s Path to a $24 Billion Valuation

Investing in defense technology through America 2030 allows accredited investors to participate in the resurgence of U.S. national security innovation. Learn more.

We conducted a fun and academic exercise to envision what it would take for Shield AI to support a $24 billion market cap in the public market.

To justify a $24 billion public market valuation, Shield AI would need to demonstrate financial metrics aligned with both defense industry norms and high-growth tech company expectations. This analysis synthesizes data from defense sector multiples, comparable companies, and growth trajectories to outline required revenues, EBITDA, and profitability.

For more in-depth coverage, subscribe to our club letter.

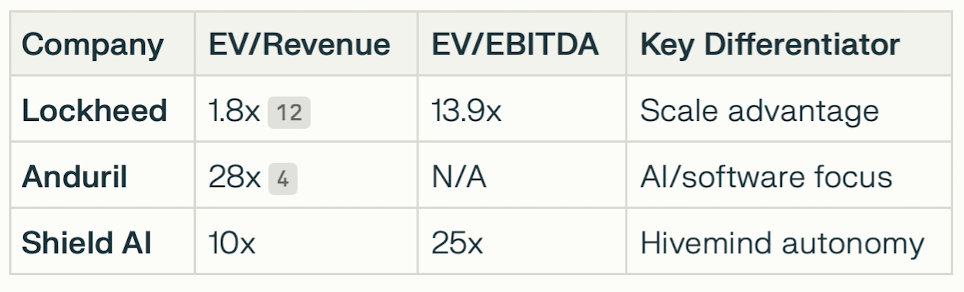

1. Valuation Framework: Defense vs. Tech Multiples

1.1 Industry Benchmark Multiples

Aerospace & Defense EV/EBITDA: 14–16x (sector median)

High-Growth Tech EV/Revenue: 10–28x (e.g., Anduril at 28x 2024 revenue)

Hybrid Defense-Tech Multiples: 20–25x EBITDA for AI/autonomy leaders

2. Scenario Analysis

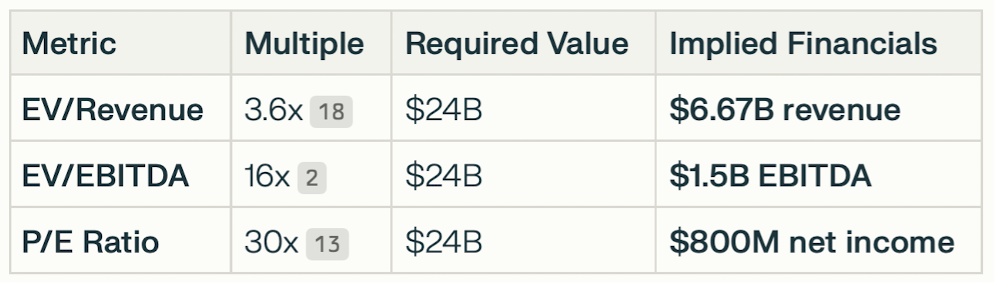

2.1 Base Case: Traditional Defense Contractor Multiples

Assumptions:

Gross margin: 40% (aligned with Anduril)

Net margin: 12% (above defense sector average of 8.7%)

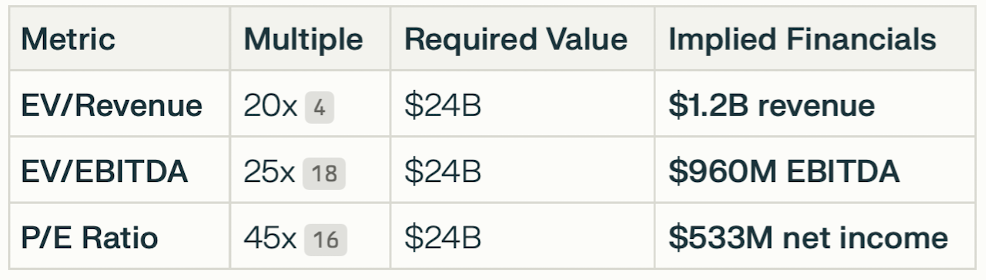

2.2 Growth Tech Premium Scenario

Assumptions:

Gross margin: 60% (software-centric model)

Net margin: 20% (AI-driven efficiency)

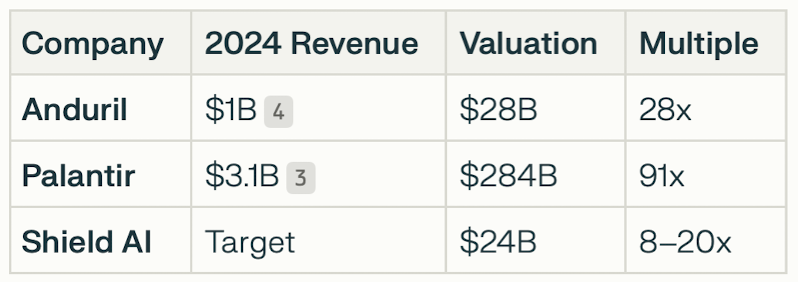

3. Traction Requirements vs. Peers

3.1 Revenue Growth Trajectory

To match Anduril’s 28x multiple, Shield AI would need $857M revenue ($24B ÷ 28).

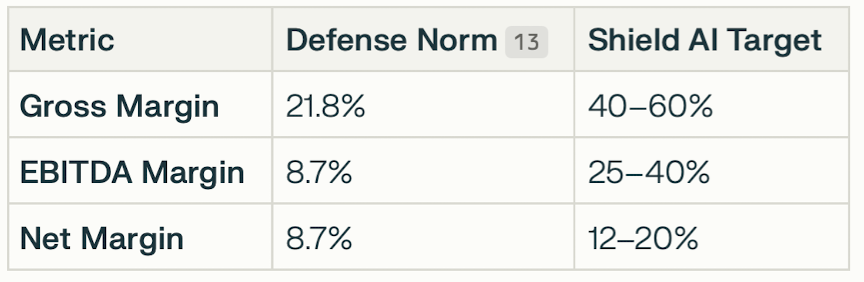

3.2 Profitability Thresholds

This company is in the pipeline of America 2030, IPO CLUB’s $50M, actively managed secondary fund focused on U.S. defense, energy, security, and AI.

4. Sector-Specific Risks & Adjustments

4.1 Contract Concentration Mitigation

DoD Dependency: 78% of Shield AI’s 2024 revenue comes from U.S. government contracts.

Diversification Target: Expand commercial/non-U.S. sales to 30% by 2027 (vs. 22% in 2024).

4.2 R&D vs. Profit Tradeoffs

Current R&D Spend: 22% of revenue (2024)

Public Market Expectation: Max 15% to maintain EBITDA margins >25%

5. Financial Projections for IPO Readiness

5.1 Minimum Viable Metrics for $24B Valuation

Growth Assumptions:

50% YoY revenue growth (vs. 64% in 2024)

EBITDA margin expansion from 25% to 35%

Net margin improving from 12% to 15%

6. Competitive Positioning Analysis

6.1 Multiples vs. Key Competitors

This company is in the pipeline of America 2030, IPO CLUB’s $50M, actively managed secondary fund focused on U.S. defense, energy, security, and AI.

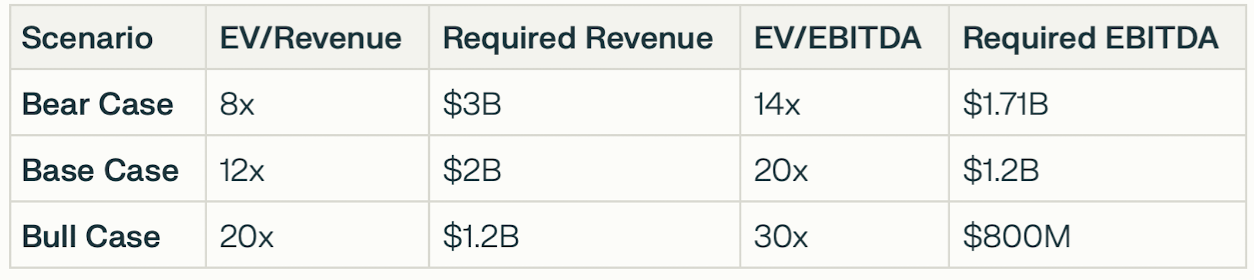

7. Sensitivity Analysis

7.1 Valuation at Various Multiples

8. Strategic Recommendations

Pre-IPO Margin Optimization: Reduce R&D/SG&A from 34% to 25% of revenue.

Commercial Expansion: Achieve $720M in non-defense revenue by 2027 (e.g., cargo drones).

Contract Backlog: Secure $4B+ in multi-year DoD contracts to de-risk revenue.

Conclusion: To justify a $24B valuation, Shield AI must deliver $1.2–$3B in revenue with 25–40% EBITDA margins within 2–3 years post-IPO, blending defense sector stability with tech-like growth premiums. Success hinges on scaling Hivemind’s adoption while diversifying beyond traditional military contracts.

Read also AI Meteoric Raise in Frontier Technologies.

Courtesy of CNBC

Multiple startups all the way to defense giants like Lockheed Martin are betting that a new generation of advanced drones will define the future of warfare. Shield AI gave CNBC an exclusive first look at the X-BAT, its new AI-powered fighter jet. The company has quickly become a rising force in defense technology, reaching a $5.3 billion valuation after raising $240 million in its latest funding round. Still, it’s competing against established defense primes like Lockheed Martin and Northrop Grumman — and has yet to turn a profit. Watch the video to see how Shield AI is trying to stand out in a crowded field.

Investing in defense technology through America 2030 allows accredited investors to participate in the resurgence of U.S. national security innovation. Learn more.

What is IPO CLUB

We are a club of Investors with a barbell strategy: very early and late-stage investments. We leverage our experience to select investments in the world’s most promising companies.

Sources

Shield AI, March 2025

Contrary Research, February 2025

Bloomberg Intelligence, 2025

PitchBook, 2025

Reuters, December 2024

SEC Filings, 2025

IPO CLUB Internal Analysis, 2025

Disclaimer

Private companies carry inherent risks and may not be suitable for all investors. The information provided in this article is for informational purposes only and should not be construed as investment advice. Always conduct thorough research and seek professional financial guidance before making investment decisions.