SambaNova

This company is in the pipeline of America 2030, IPO CLUB’s short-term, actively managed secondary fund focused on U.S. defense, energy, security, and AI.

Updated in January 2026

Headquarter: Palo Alto, California, USA

Year Founded: 2017

Leadership: Rodrigo Liang

Industry Sectors: Artificial intelligence; AI infrastructure; AI hardware & software integration; enterprise AI platforms

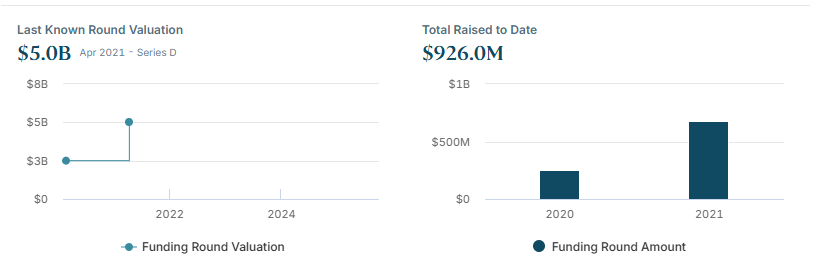

Funding Round: $676M Series D (Apr 13, 2021)

Valuation: $5B

Is SambaNova A Public Company? No, it is privately held

What is SambaNova?

SambaNova Systems is a U.S.-based artificial intelligence company headquartered in Palo Alto, California, founded in 2017 by industry veterans from Sun Microsystems and Oracle. The company’s mission is to enable organizations to deploy and scale generative AI and advanced analytics with greater efficiency, control, and performance, particularly for enterprise and government use cases. SambaNova focuses on solving the challenges of AI infrastructure complexity, high cost, and data governance by offering vertically integrated AI systems rather than fragmented hardware-software stacks.

Technology & Products

SambaNova’s core technology is built around its proprietary Reconfigurable Dataflow Architecture (RDA), which is implemented in its custom SN40L dataflow processors and supported by a full-stack software platform. Unlike traditional GPU-based architectures, RDA is designed to optimize data movement and computation simultaneously, delivering high performance and energy efficiency for large-scale AI workloads. The company offers SambaNova DataScale, an integrated AI system for training and inference, and SambaNova Suite, which enables enterprises to deploy generative AI models, including large language models, on-premises or in private cloud environments. This hardware-software approach is positioned to deliver predictable performance, lower total cost of ownership, and strong data security.

Market Opportunity

SambaNova targets the rapidly growing market for enterprise AI and generative AI infrastructure, serving sectors such as financial services, healthcare, energy, government, and national laboratories. As organizations increasingly seek alternatives to public cloud AI due to concerns around data privacy, regulatory compliance, and cost, demand is rising for on-prem and private AI platforms capable of supporting large models at scale. SambaNova’s focus on turnkey systems aligns with enterprises that want production-ready AI without managing complex multi-vendor stacks, positioning the company to benefit from sustained growth in enterprise adoption of generative AI.

Competitive Landscape

SambaNova competes with major AI hardware and platform providers, including GPU-centric ecosystems and other custom accelerator companies targeting large-scale AI workloads. While incumbents benefit from broad developer adoption, SambaNova differentiates itself through its dataflow-based architecture, full-stack vertical integration, and emphasis on enterprise-controlled deployments rather than cloud-only offerings. This positioning allows the company to compete on performance efficiency, security, and deployment flexibility, particularly for customers with sensitive data or mission-critical AI applications where predictability and control are paramount.

How To Buy SambaNova Stock?

SambaNova is currently a private company and is not publicly traded on major stock exchanges like the NASDAQ or NYSE. This means you can buy shares through a pre-IPO platform or brokerage like IPO CLUB by becoming a FREE MEMBER.

This company is in the pipeline of America 2030, IPO CLUB’s short-term, actively managed secondary fund focused on U.S. defense, energy, security, and AI.

SambaNova and America 2030 Latest News

Stay up-to-date with all the latest news pertaining to this company’s stock, IPO, and investment opportunity. By clicking here, you'll gain access to real-time updates and in-depth analysis from market experts, empowering you to make informed decisions about your investment journey. Whether you're a seasoned investor or just getting started, our platform is tailored to provide you with all the crucial information you need to navigate the thrilling world of the stock market and IPOs. Dive in and keep your finger on the pulse of the financial markets.

The article summarizes each company’s jurisdiction, reactor technology, fuel type, development stage, and most recently disclosed valuation, based on publicly available information and industry disclosures as of 2024–2026.