Firehawk Aerospace

This company is in the pipeline of America 2030, IPO CLUB’s short-term, actively managed secondary fund focused on U.S. defense, energy, security, and AI.

Updated in February 2026

Headquarter: Dallas, Texas, USA

Year Founded: 2019

Leadership: Will Edwards (CEO & Founder), Justin Karl (CTO), Bradley Schneider (CFO)

Industry Sectors: Hybrid and solid rocket engines for the defense industry.

Funding Round: $60M Series C, January 2025

Valuation: Not disclosed

Is Firehawk Aerospace A Public Company? No, it is privately held

What Is Firehawk Aerospace?

Firehawk is building a vertically integrated propulsion supplier focused on solid rocket motors and hybrid rocket engines, using additive manufacturing to shorten lead times and reduce the fragility of energetics production. The company is operating into a structurally constrained U.S./allied supply chain where demand for tactical munitions and missile propulsion has outpaced legacy capacity, creating an opening for new qualified suppliers with modern manufacturing footprints.

Technology & Products

Firehawk designs and manufactures propulsion for defense applications, emphasizing:

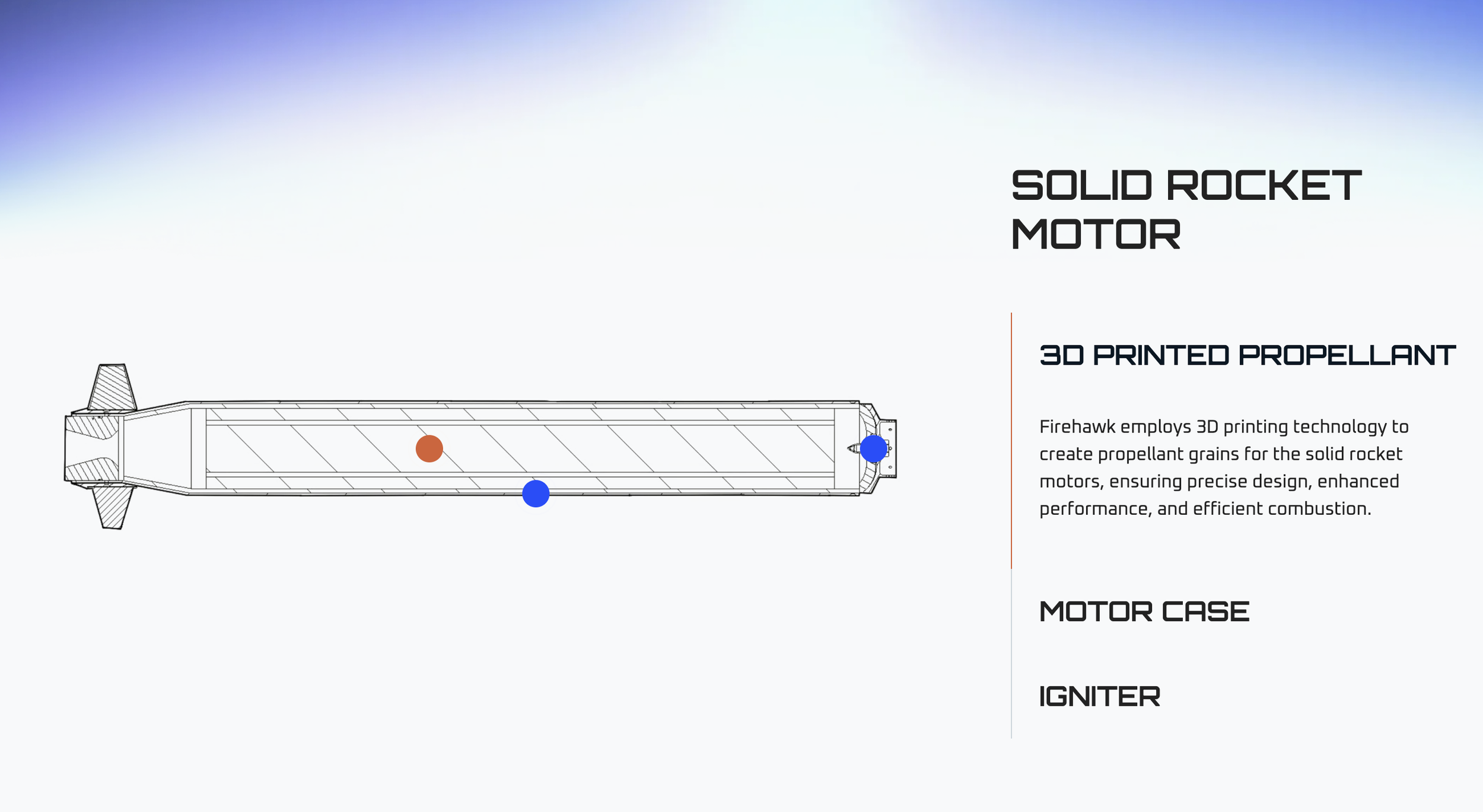

Solid rocket motors

(including tactical-class categories referenced by the company’s public milestones).

Hybrid rocket engines

that pair a solid fuel grain with a liquid/gaseous oxidizer to enable controllability relative to traditional solids.

Additively manufactured energetics / propellant grains, positioned as a way to accelerate iteration and production while enabling distributed or “mobile” production concepts.

Market Opportunity

Firehawk is exposed to the tactical missile/rocket propulsion and broader solid rocket motor ecosystem, where demand is being reinforced by:

Munition replenishment and “affordable mass” doctrines driving higher consumption and inventory goals.

Supply-chain concentration and capacity constraints in solid rocket motors, which policy makers and industry observers have highlighted as a bottleneck.

Competitive Landscape

Direct competition (solid rocket motors):

•Incumbents: Northrop Grumman and L3Harris are widely referenced as dominant U.S. SRM suppliers, with deep qualification history and entrenched program positions.

•New entrants: Anduril has publicly positioned itself as a new SRM supplier with a Mississippi facility and stated production ambitions, signaling that “new capacity” is not Firehawk’s opportunity alone.

How To Buy Firehawk Aerospace Stock?

Firehawk Aerospace is currently a private company and is not publicly traded on major stock exchanges like the NASDAQ or NYSE. This means you can buy shares through a pre-IPO platform or brokerage like IPO CLUB by becoming a FREE MEMBER.

This company is in the pipeline of America 2030, IPO CLUB’s short-term, actively managed secondary fund focused on U.S. defense, energy, security, and AI.

Firehawk Aerospace and America 2030 Latest News

Stay up-to-date with all the latest news pertaining to this company’s stock, IPO, and investment opportunity. By clicking here, you'll gain access to real-time updates and in-depth analysis from market experts, empowering you to make informed decisions about your investment journey. Whether you're a seasoned investor or just getting started, our platform is tailored to provide you with all the crucial information you need to navigate the thrilling world of the stock market and IPOs. Dive in and keep your finger on the pulse of the financial markets.

The article summarizes each company’s jurisdiction, reactor technology, fuel type, development stage, and most recently disclosed valuation, based on publicly available information and industry disclosures as of 2024–2026.